🌪️ Waiting for the Fat Pitch

Pristine Weekend Watchlist 9.29.24

Hi Team,

Welcome to this week's edition of the Pristine Capital Weekend Watchlist! 👋

In this research note, we’ll cover the following topics in preparation for the upcoming trading week:

Sector relative strength analysis across multiple timeframes

Macro Analysis

Three A+ Trade Setups

And much more! Let's get started! 👇

If you’ve been enjoying our free content, and are committed to putting in the work to make 2024 your best trading year yet, consider upgrading your membership and becoming a premium subscriber.

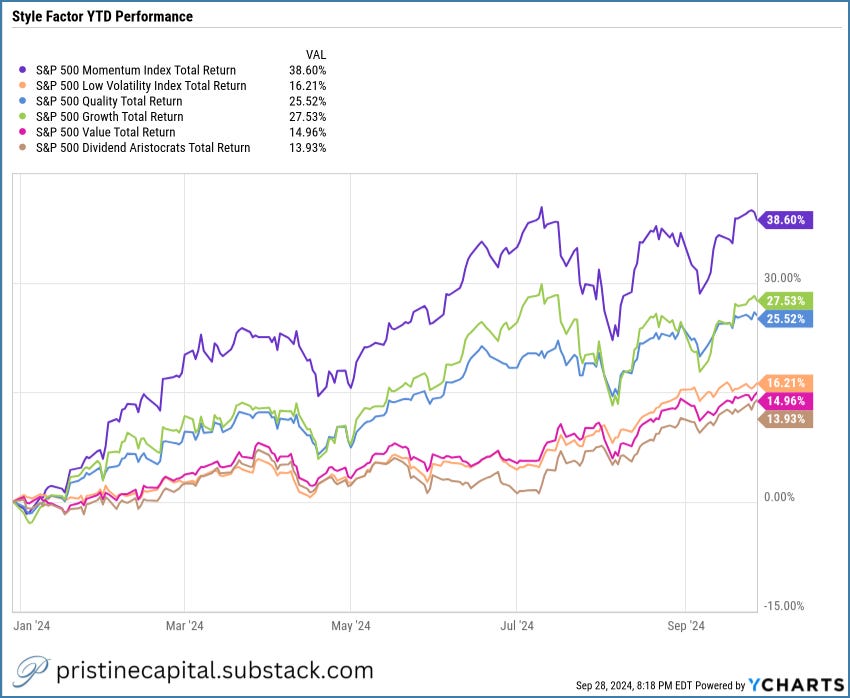

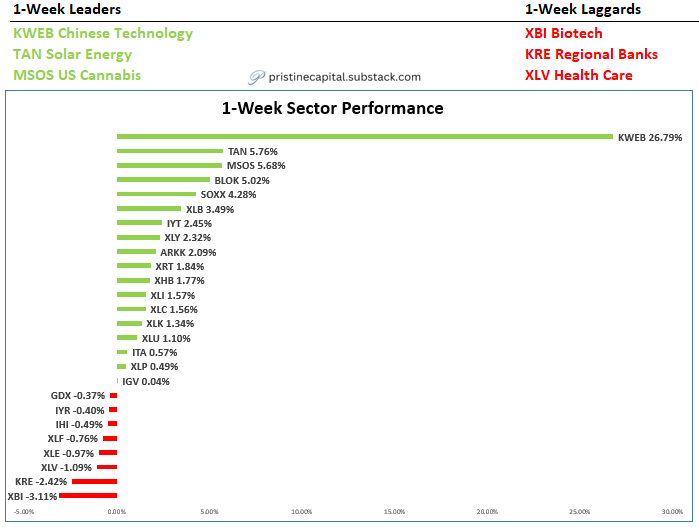

Sector/Style Factor Relative Strength Analysis

The momentum style factor is approaching it’s YTD high

Growth, Value, and Dividend style factors began to outperform in Q3 👇

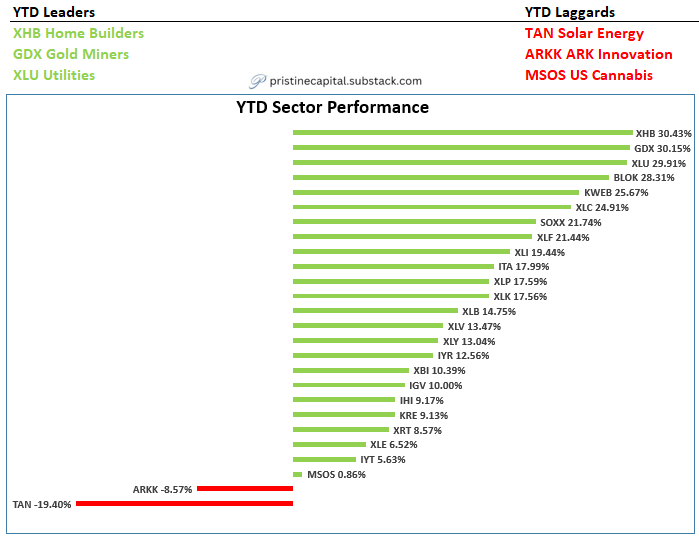

Who would have thought XHB homebuilders, GDX gold miners, and XLU utilities would be the YTD leaders? These groups barely get media attention👇

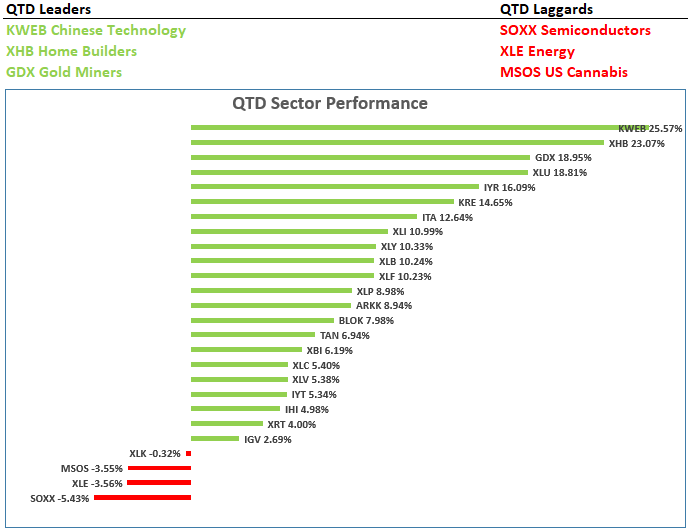

KWEB China stocks were the Q3 leader! We’ve been overweight KWEB all quarter via a core position in BABA calls and common shares that we’ve traded in and out of throughout the year👇

MSOS cannabis is a new core position for us, and it was a big Q3 underperformer

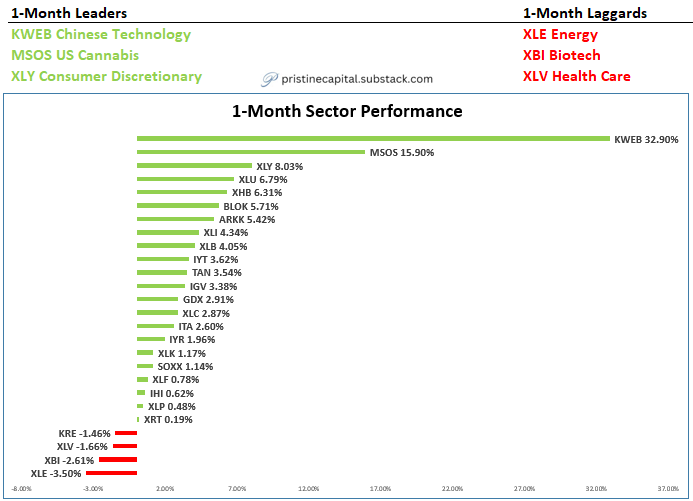

XHB Homebuilders and XLU utilities won big this past month

MSOS cannabis got hit when news broke than cannabis rescheduling would be moved to Dec 2nd👇

KWEB China names came alive on the 1-week timeframe. We’ve been overweight this group via long positions in BABA 👇