⚔️Trading Through a Trade War

Pristine Weekend Watchlist 10.12.25

Welcome to this week's edition of the Pristine Capital Weekend Watchlist! 👋

In this note, we’ll cover the following topics to prep for the upcoming trading week:

🦾 Sector relative strength analysis across multiple timeframes

🌎Macro Analysis

📈Three A+ Trade Setups

And much more! Let's get started! 👇

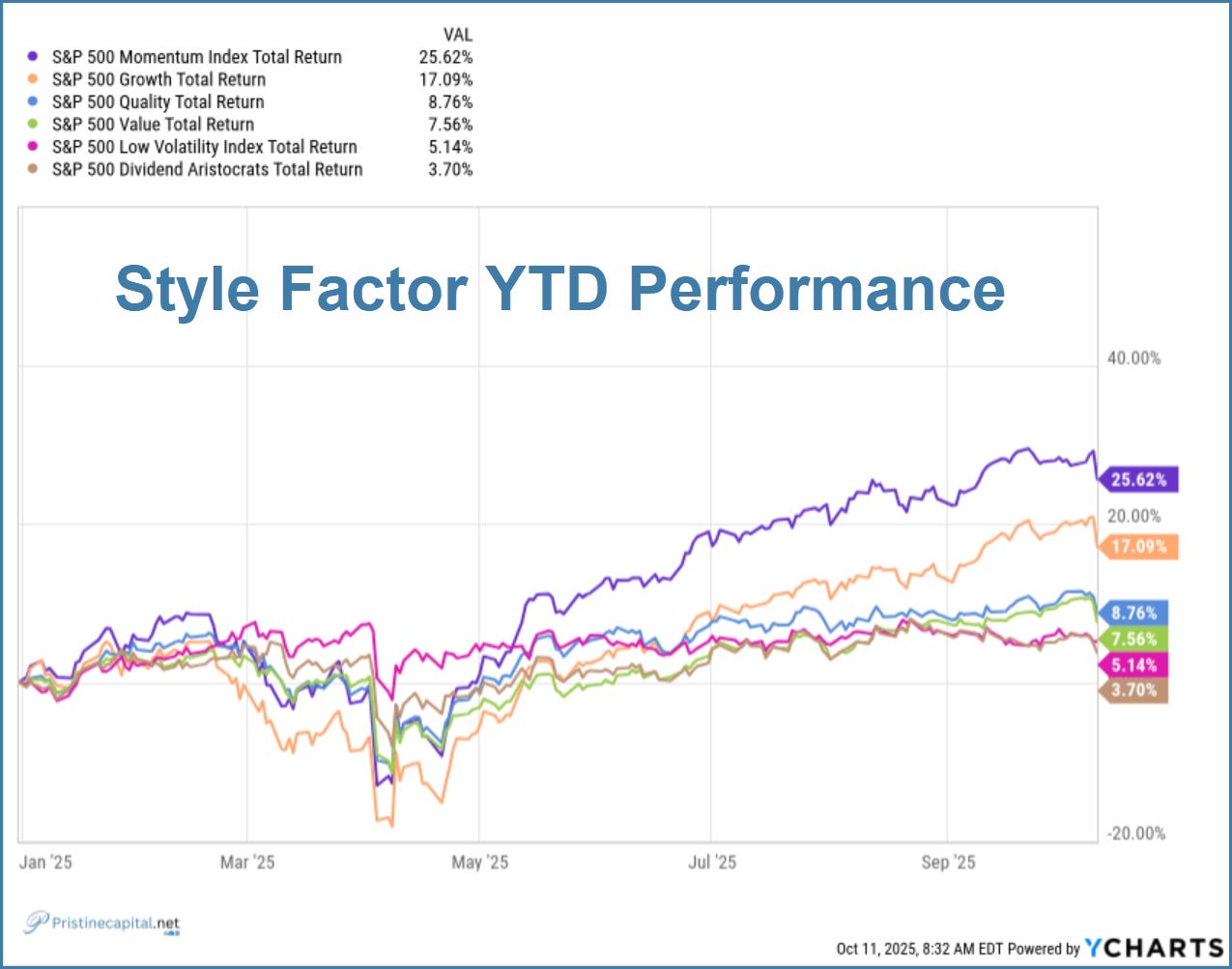

Sector/Style Factor Relative Strength Analysis

A key part of our technical process is tracking momentum across style factors and sectors on multiple timeframes. Our goal is to follow the flow of capital and spot trend changes early

Style Factor YTD Performance

Despite Friday’s pullback, the momentum & growth style factors are still putting up excellent YTD performances👇

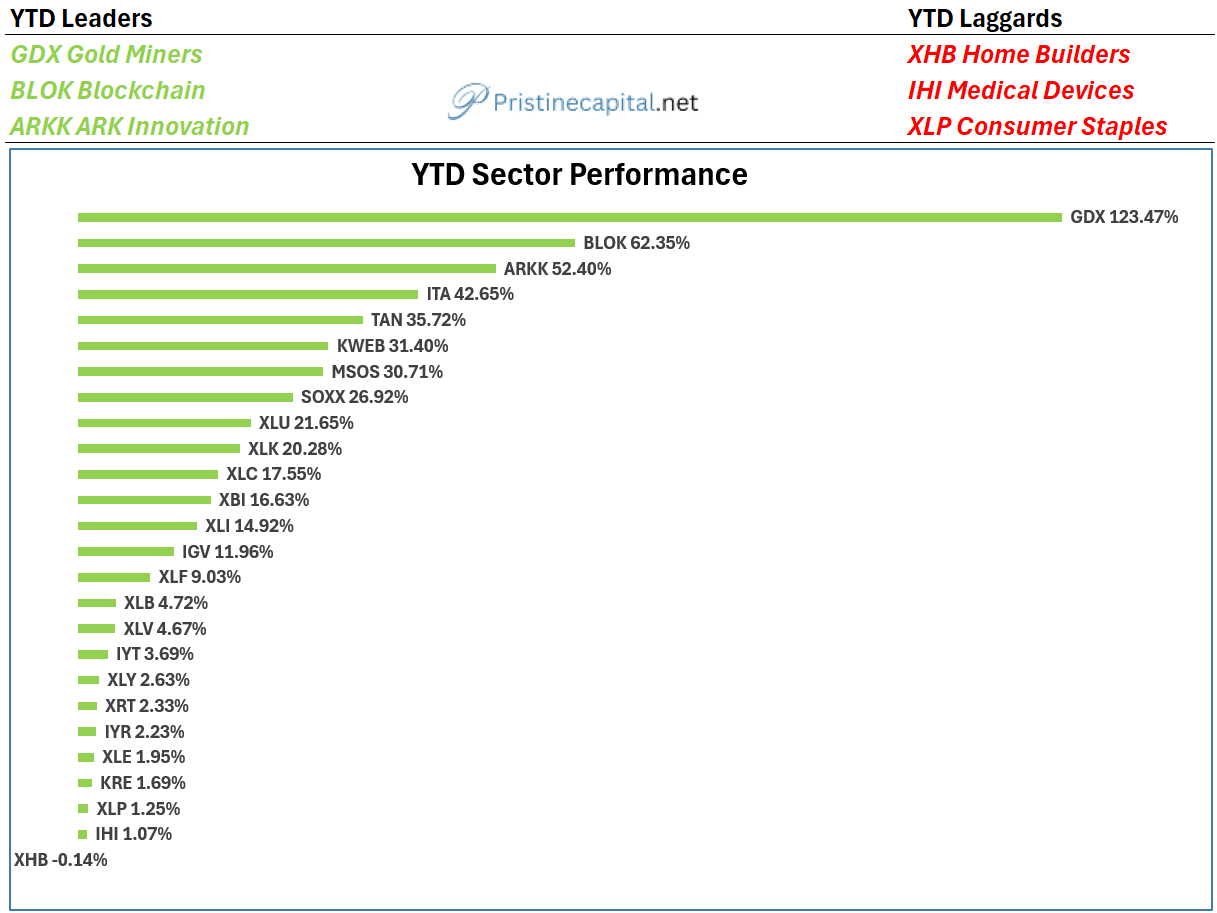

YTD Sector Performance

GDX gold miners reign supreme in an era of monetary debasement 👇

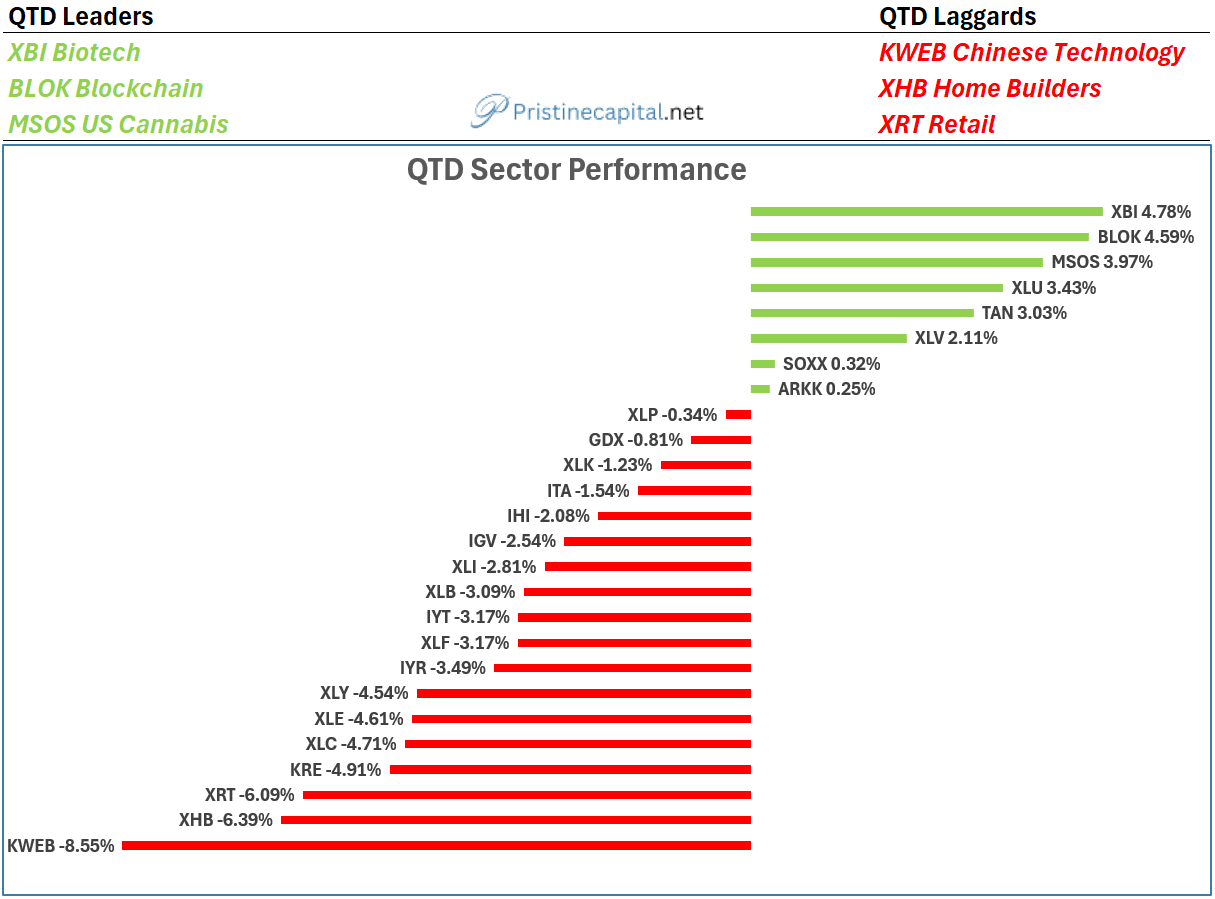

QTD Sector Performance

KWEB China tech lagging due to trade tensions👇

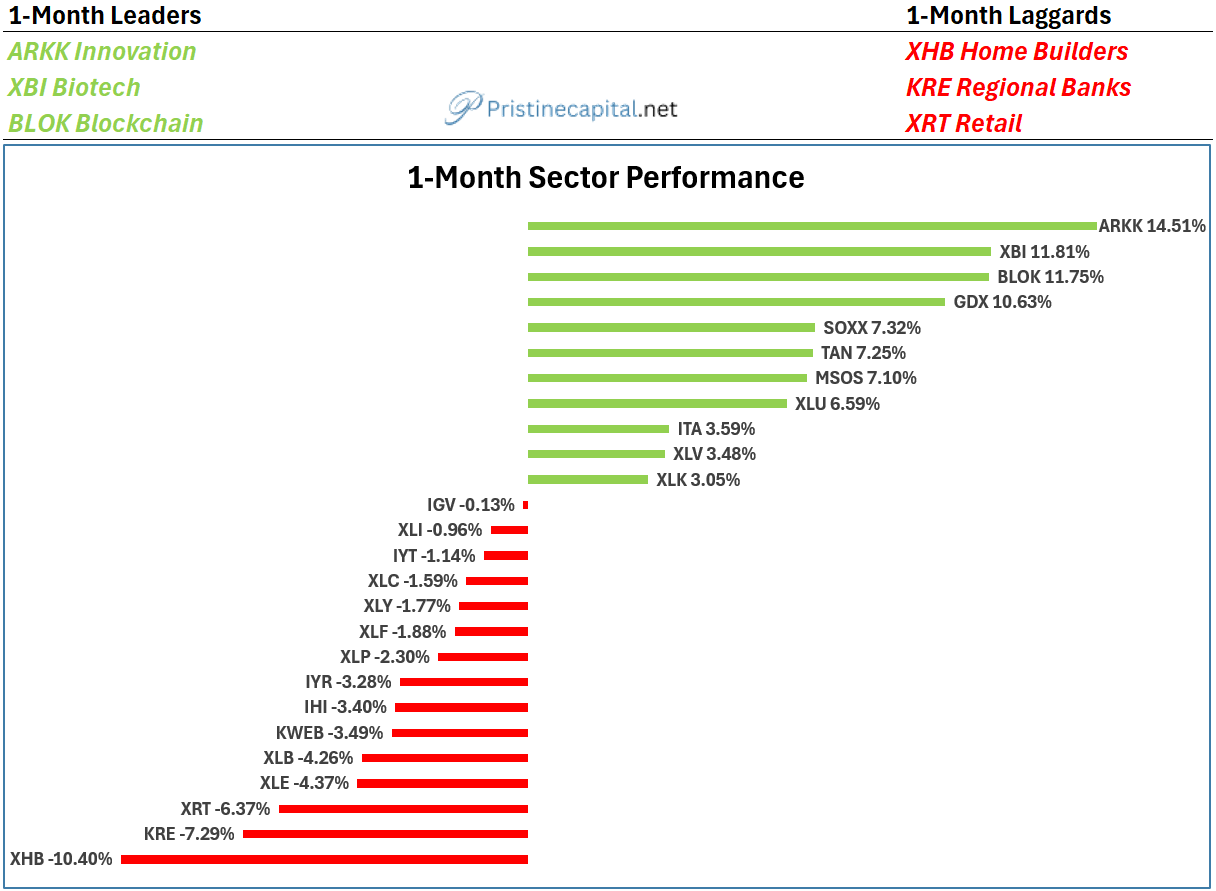

1-Month Sector Performance

ARKK innovation leading in a tape of haves and have nots👇

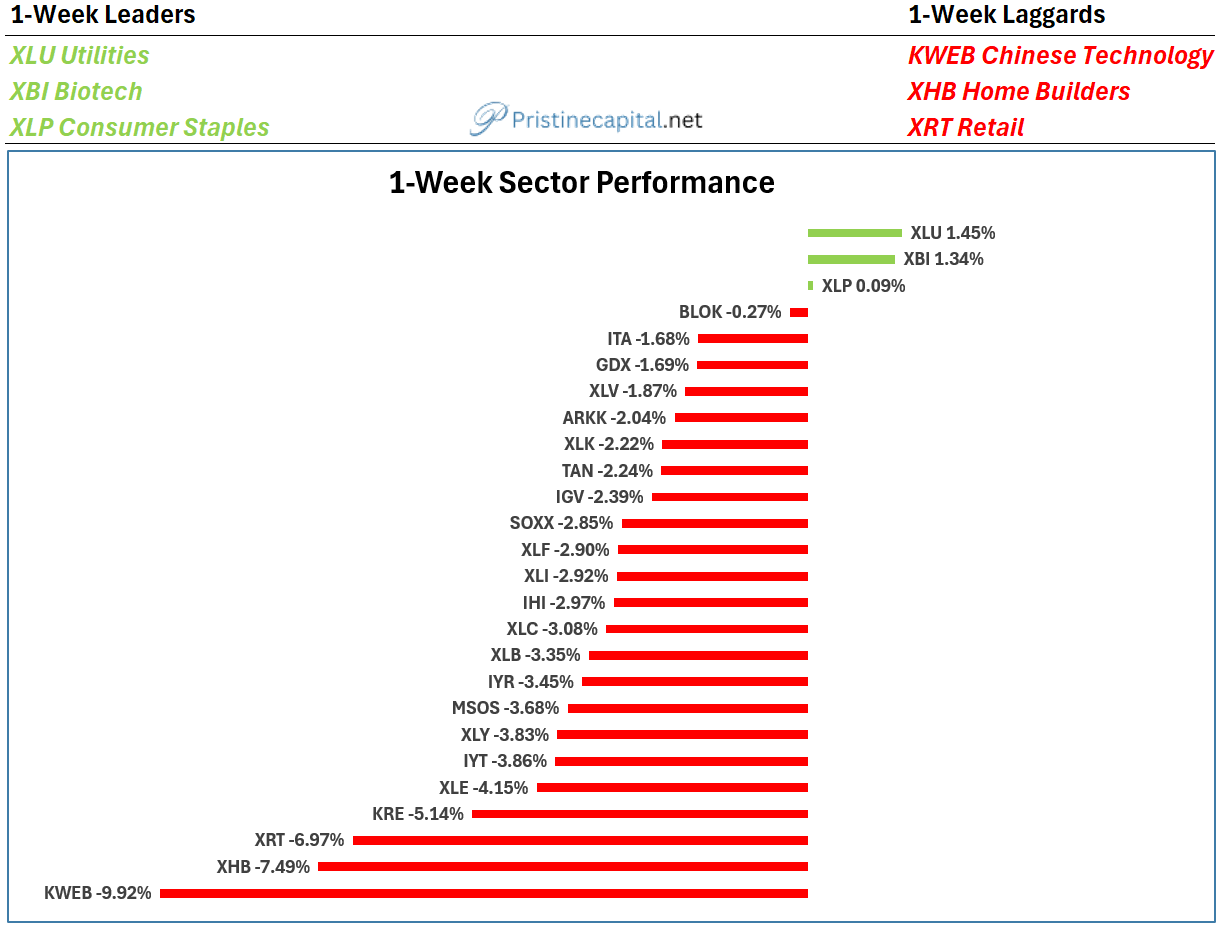

1-Week Sector Performance

The market is sniffing out weakness in the XHB homebuilders👇

Key Ideas/ Macro Backdrop🗝️