🌪️ Trade Wars, CPI & Earnings Season

Pristine Weekend Watchlist

Hi Team,

Welcome to this week's edition of the Pristine Capital Weekend Watchlist! 👋

In this research note, we’ll cover the following topics in preparation for the upcoming trading week:

Sector relative strength analysis across multiple timeframes

Macro Analysis

Three A+ Trade Setups

And much more! Let's get started! 👇

ANNOUNCEMENT: Our Pristine Tradingview Indicators are coming soon! Stay tuned for early adopter pricing!

Sector/Style Factor Relative Strength Analysis

A key part of our technical process is tracking momentum across style factors and sectors on multiple timeframes. Our goal is to follow the flow of capital and spot trend changes early

Style Factor YTD Performance

The growth and momentum style factors led the bull market in 2023 & 2024, and are now leading to the downside in 2025 👇

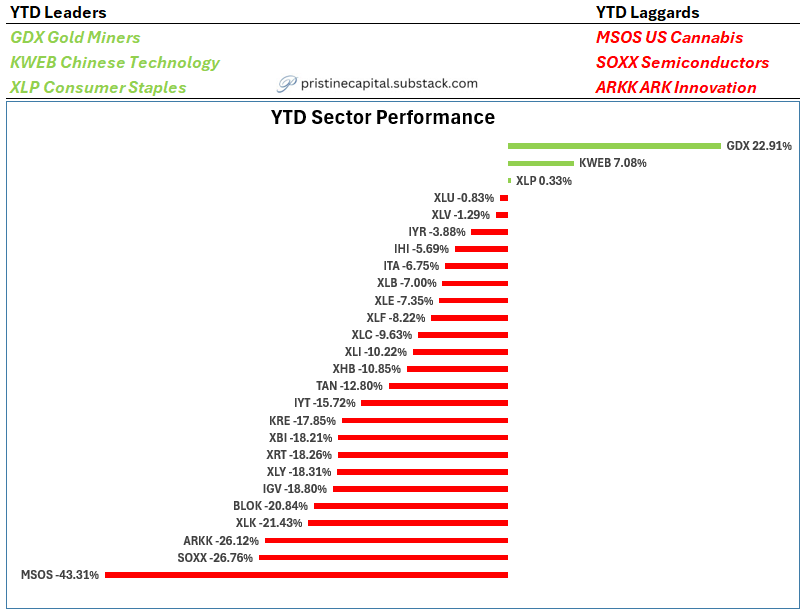

YTD Sector Performance

GDX gold miners are the clear leadership group in a sea of red! 👇

QTD Sector Performance

This is what a black swan event looks like. We are witnessing history unfold 👇

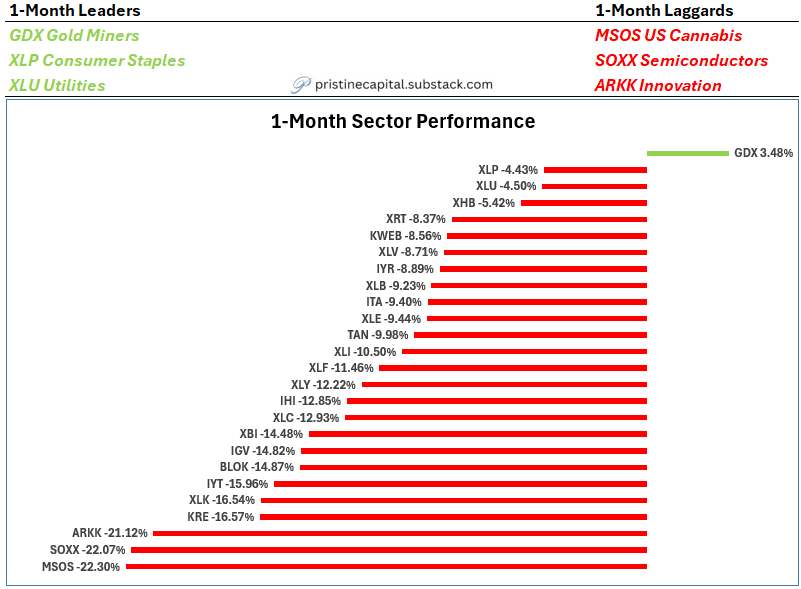

1-Month Sector Performance

SOXX semiconductors hit hard 👇

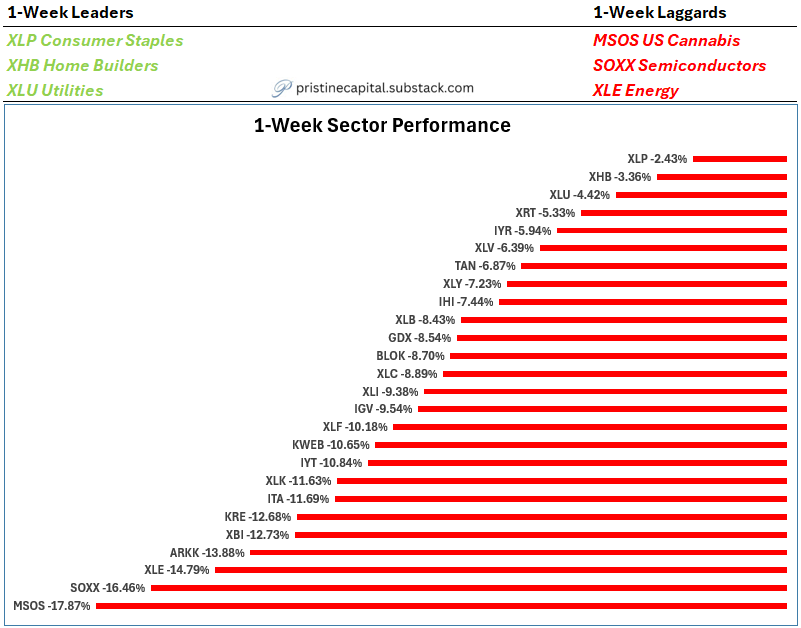

1-Week Sector Performance

Even the defensive groups were hit last week! 👇