📈 The Final Stretch of Q1

Pristine Weekend Watchlist

Hi Team,

Welcome to this week's edition of the Pristine Capital Weekend Watchlist! 👋

In this research note, we’ll cover the following topics in preparation for the upcoming trading week:

Sector relative strength analysis across multiple timeframes

Macro Analysis

Three A+ Trade Setups

And much more! Let's get started! 👇

ANNOUNCEMENT: Our Pristine Tradingview Indicators are coming soon! Stay tuned for early adopter pricing👇

Sector/Style Factor Relative Strength Analysis

A key part of our technical process is tracking momentum across style factors and sectors on multiple timeframes. Our goal is to follow the flow of capital and spot trend changes early

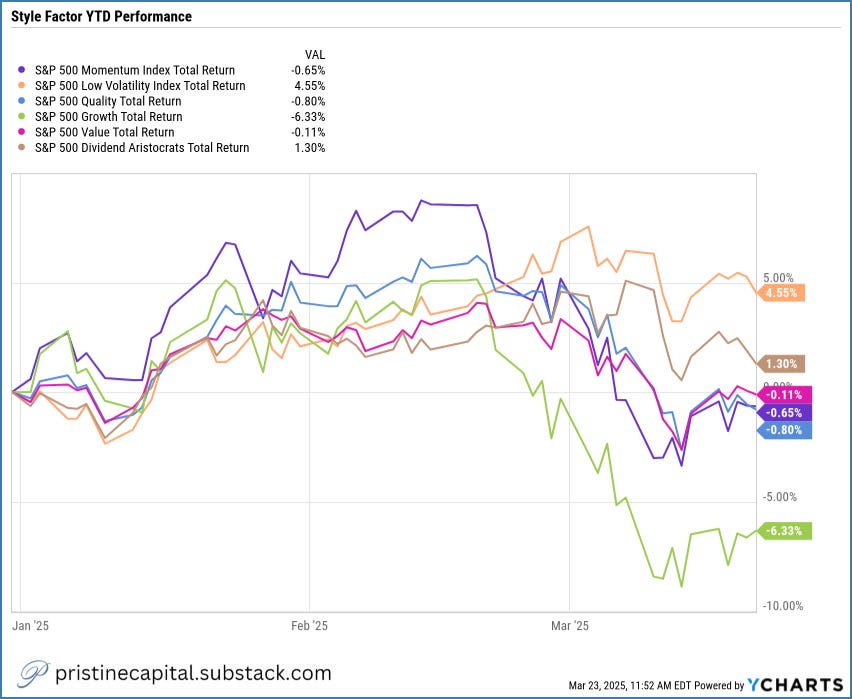

Style Factor YTD Performance

Low Volatility & Dividend Aristocrats are the only green YTD style factors

Note to self: When you are seeing initial signs of equities softening, it makes sense to reduce the beta of portfolio holdings and shift into value/defensive stocks as an intermediary step before going to cash or short equities 👇

YTD Sector Performance

Rotation out of US assets and into China/international 👇

QTD Sector Performance

Identical to YTD given we are in Q1 👇

1-Month Sector Performance

This is about as risk-off as it gets 👇

1-Week Sector Performance

Much more constructive than the higher time frames! 👇