🌪️ The Eye of the Seasonal Storm

Pristine Weekend Watchlist 9.22.24

Hi Team,

Welcome to this week's edition of the Pristine Capital Weekend Watchlist! 👋

In this research note, we’ll cover the following topics in preparation for the upcoming trading week:

Sector relative strength analysis across multiple timeframes

Macro Analysis

Three A+ Trade Setups

And much more! Let's get started! 👇

If you’ve been enjoying our free content, and are committed to putting in the work to make 2024 your best trading year yet, consider upgrading your membership and becoming a premium subscriber.

Sector/Style Factor Relative Strength Analysis

The momentum style factor is approaching it’s YTD high 👇

GDX Gold Miners, XLU utilities, and XHB homebuilders are the YTD leaders. When we look back on 2024, we will remember that this was the year to position in groups that benefit from LOWER interest rates 👇

SOXX semiconductors transitioned from an outperformer to an underperformer on 6/30 👇

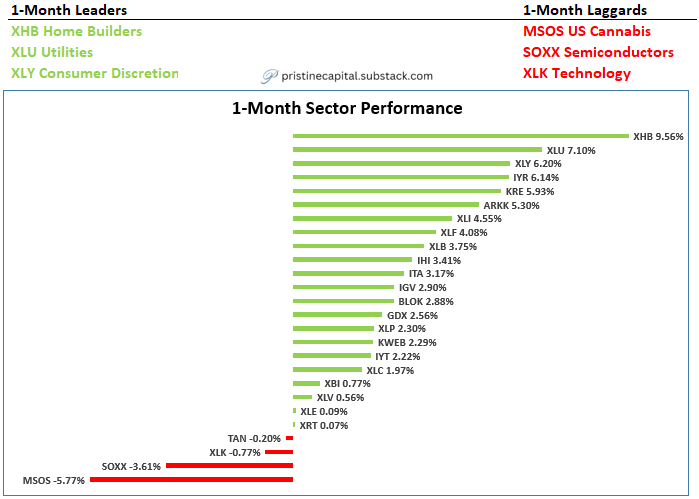

Massive reallocation to XHB homebuilders on the 1-month timeframe as investors apparently prepare for lower interest rates👇

KWEB China names came alive on the 1-week timeframe. We’ve been overweight this group via long positions in BABA 👇