Tech Powers Gains, Small Caps Eye Breakout

Pristine Market Analysis & Watchlist

Hey Everyone,

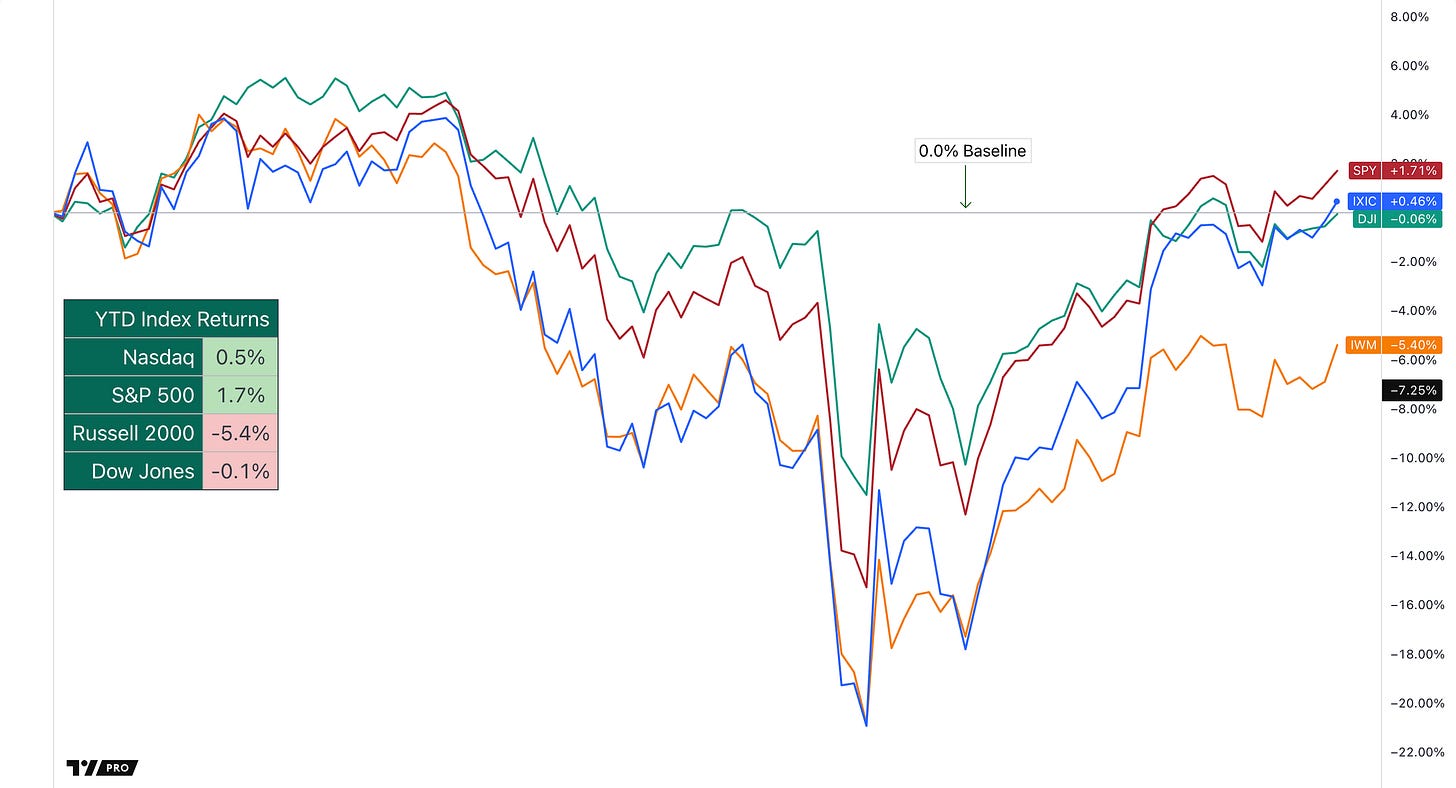

Big tech did most of the heavy lifting today, nudging the S&P 500 and Nasdaq higher. Small caps, tracked by the Russell 2000 (IWM), tried to shake off a rough year and is now flirting with a breakout after a long seven-month slump — yet still down over 5% for 2025. Overall, it was a cautiously optimistic day, with traders watching to see if small caps can finally join the rally.

-John (sitting in for Andrew this week).

Andrew is on his honeymoon and will return 6/6!

Market Update 📊

Standout Market Performers - June 3, 2025

Oil Moves Higher: Light Crude Oil Futures climbed 1.3%, marking the biggest move among equity alternatives.

Small Caps Shine: The Russell 2000 (IWM) led today with a 1.6% gain, outpacing large caps and signaling renewed interest in small-cap stocks.

Innovation Stocks Rally: The ARK Innovation ETF (ARKK) also posted a notable 1.4% jump, reflecting investor appetite for growth and tech-driven names.

Overall, small caps and tech stocks were the day’s clear winners, while international equities and gold struggled.👇

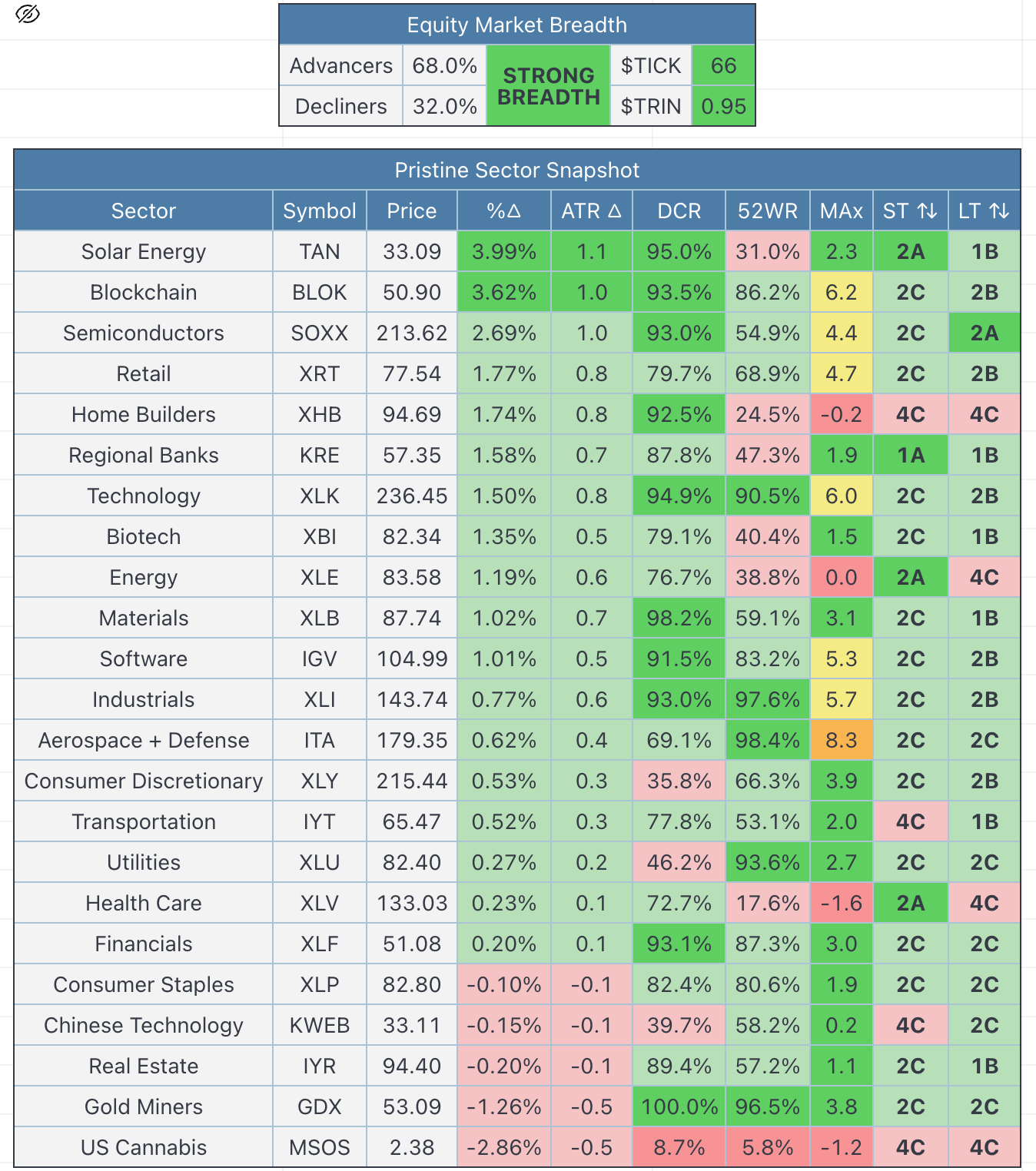

Strong Breadth today! Solar led, with the TAN jumping 3.9%! Overall, most sectors finished in the green, reflecting broad market strength and strong participation from growth and cyclical stocks. 👇

Index Performance June 📈

Portfolio progress is highly dependent on the market environment

Russell 2000 (IWM) leading the indexes, up 1.9%! 👇

Nasdaq joins the S&P 500, both are now up on the year! 👇

News & Econ Data🌎

Tariff Talks Keep Markets on Edge

Investors are anxiously awaiting updates on U.S. trade negotiations, as ongoing tariff disputes with China and other major partners continue to create uncertainty and keep market sentiment in flux.

OECD Slashes U.S. and Global Growth Outlook

The Organization for Economic Cooperation and Development cut its forecasts for both U.S. and global economic growth, citing the negative impact of tariffs and persistent policy uncertainty.

Tech Stocks Lead Early June Gains

Despite trade tensions, the S&P 500 and Nasdaq started June with modest gains, powered by strong performances from tech and chip stocks.

U.S. Dollar and Treasury Prices Rise Amid Caution

With trade talks in limbo and growth forecasts dimming, investors have sought safety in the U.S. dollar and Treasuries, both of which have seen increased demand.

Global Markets Mixed as Investors Watch U.S. Policy Moves

European and Asian markets showed mixed results, reflecting global caution as investors worldwide monitor U.S. policy decisions and their ripple effects.

US Investing Championship Record🏆

USIC 2025 YTD (4/30): +33.0% | USIC 2024: +254.0% | USIC 2023: +103.5%