📈Small Cap Breakout?

Pristine Market Analysis & Watchlist 7.22.25

Team,

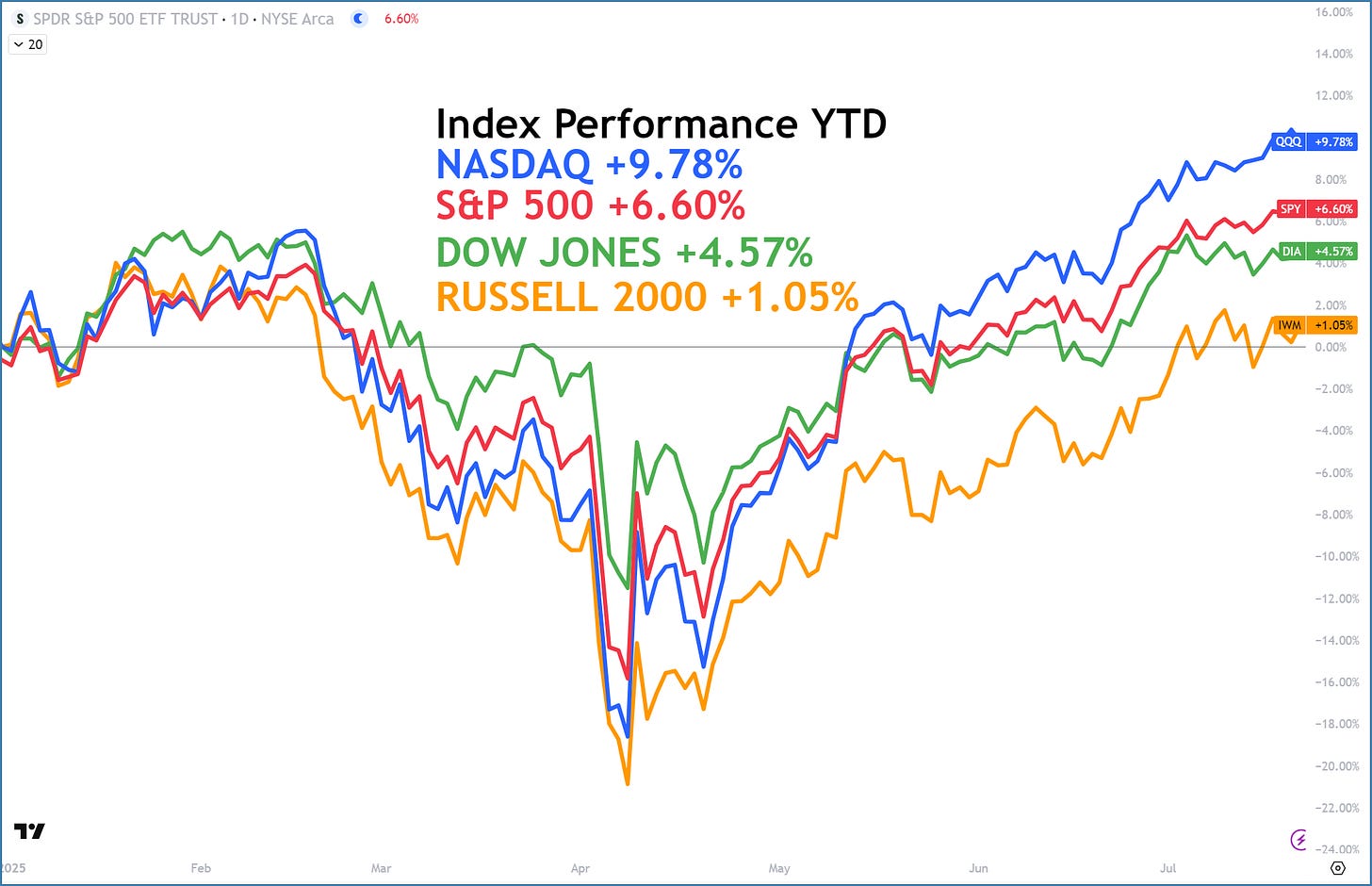

The S&P 500 is +6.60% YTD, which is a much slower pace of ascent than what we saw at this time in 2024 and 2023.

Remember, we only need 2-4 good trades to put up an excellent trading year! HAGE🍻

-Andrew

Market Update 📊

AI leaders NVDA ORCL PLTR pulled back on news that the Stargate $500BB infrastructure project is progressing at a slower rate than expected👇

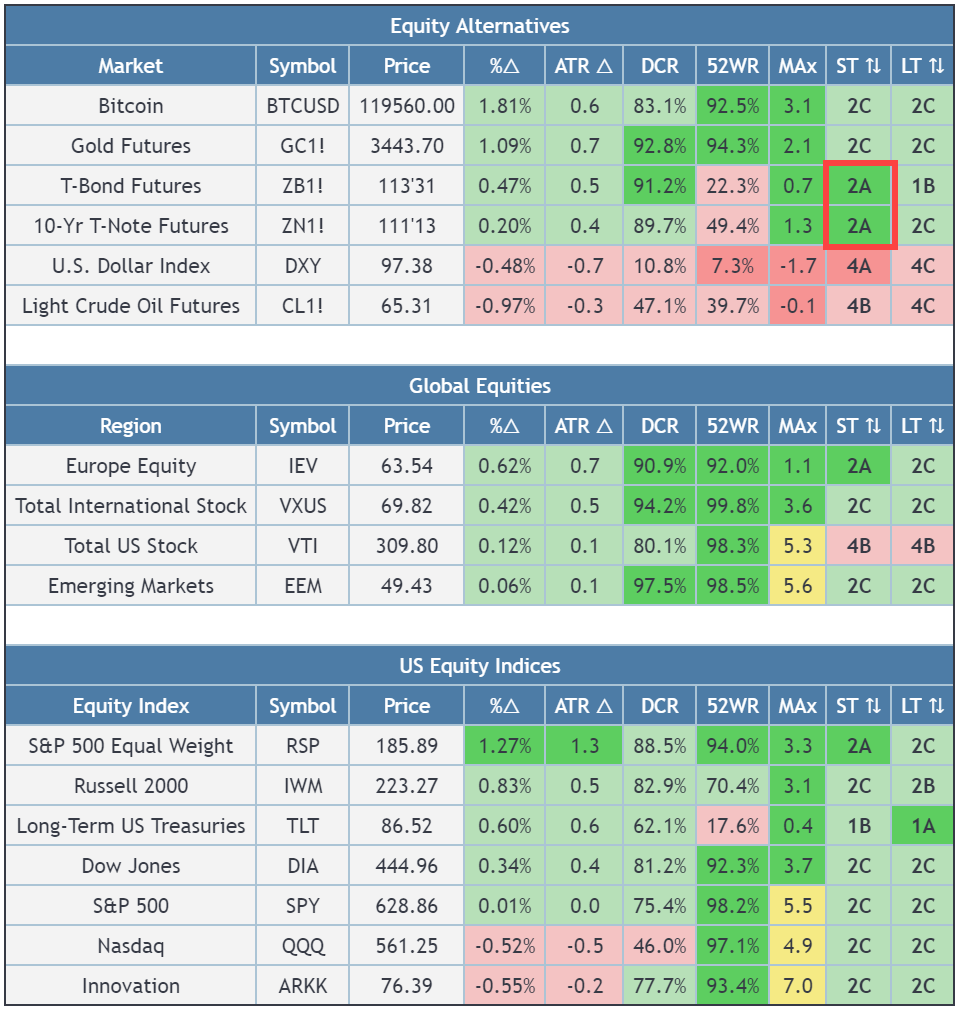

US Bonds ZN & ZB have traded much better over the last few days. Both triggered ST stage 2A by trading above their respective 20D SMA’s 👇

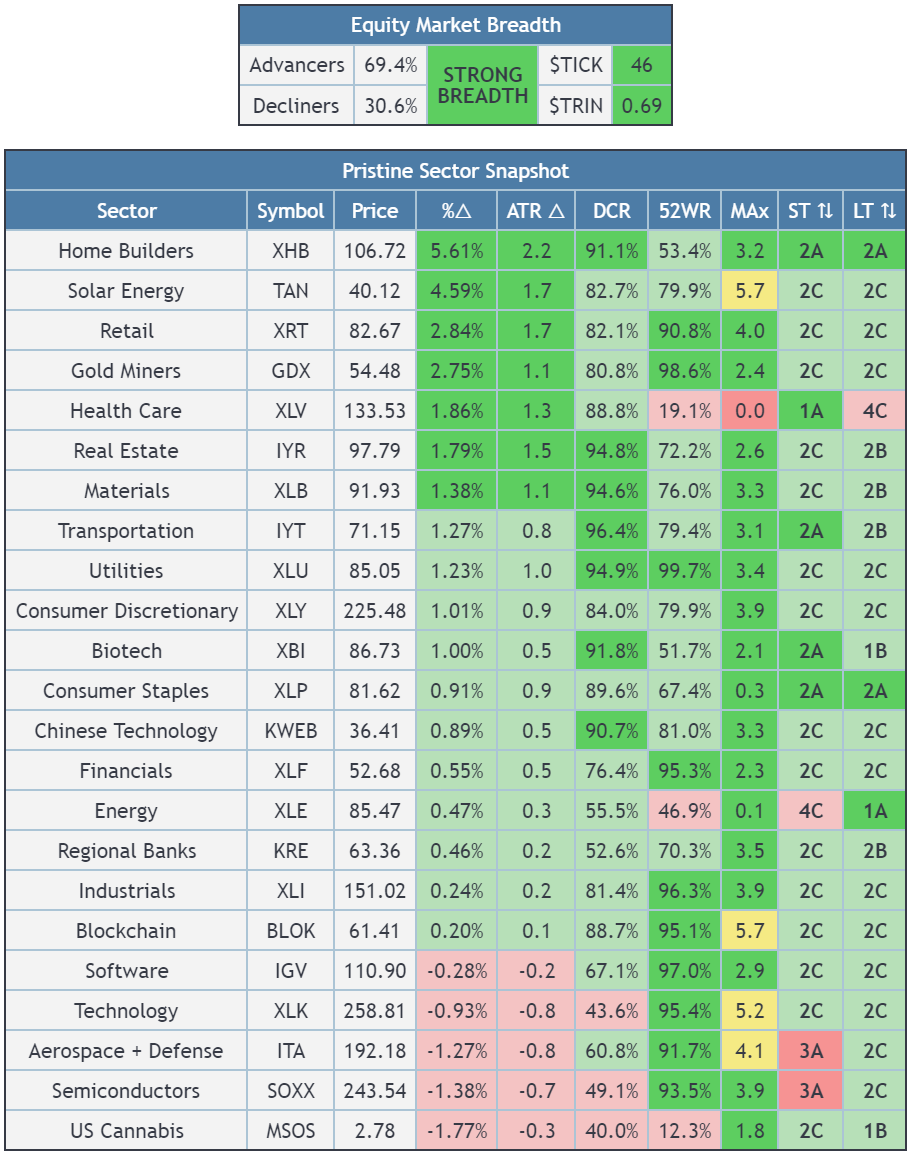

Sharp rotation into less loved sectors XHB TAN XRT GDX. All put in >1 ATR moves today, which is why they are colored dark green 👇

Index Performance YTD 📈

Portfolio progress is highly dependent on the market environment

In case you aren’t making millions yet in 2025, it is important to realize that the S&P 500 is only up 6.60% YTD! This is a much slower pace than the advance seen in 2024 and 2023. Give yourself some grace👇

News Flow🌎

TradingView Tools⚙️

John created an excellent video showing users how to use the Pine screener in TradingView to scan for:

Value area breakouts

Bullish/bearish 80% rule

Prior to working with him, I didn’t have the ability to run these scans. I think you will find value in this 👇

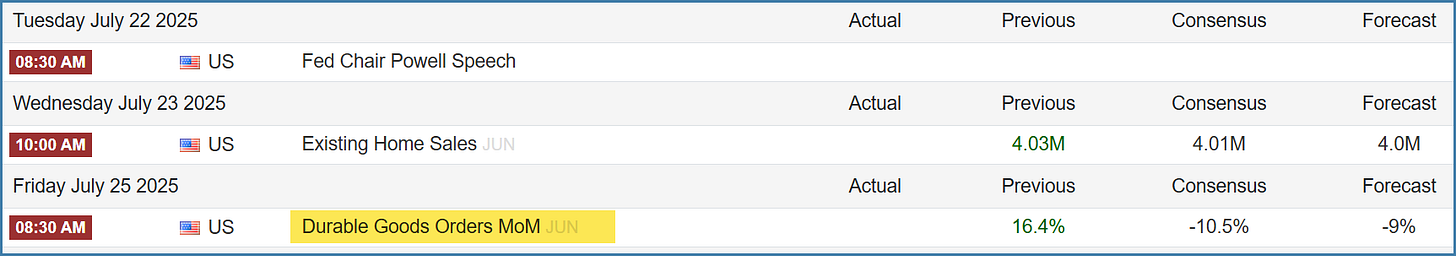

Economic Calendar - Durable Goods Incoming🌎

US Investing Championship Record🏆

│2025 YTD (6/30): -5.65% │2024: +254.0% │2023: +103.5% │

Below we’ll touch on market sentiment, upcoming earnings, outline three trading setups, and more. Just scroll down…