🔋Recharging The Battery!

Pristine Weekend Watchlist 12.21.25

Welcome to this week's edition of the Pristine Capital Weekend Watchlist! 👋

In this note, we’ll cover the following topics to prep for the upcoming trading week:

🦾 Sector relative strength analysis across multiple timeframes

🌎Macro Analysis

📈Three A+ Trade Setups

And much more! Let's get started! 👇

Sector/Style Factor Relative Strength Analysis

A key part of our technical process is tracking momentum across style factors and sectors on multiple timeframes. Our goal is to follow the flow of capital and spot trend changes early

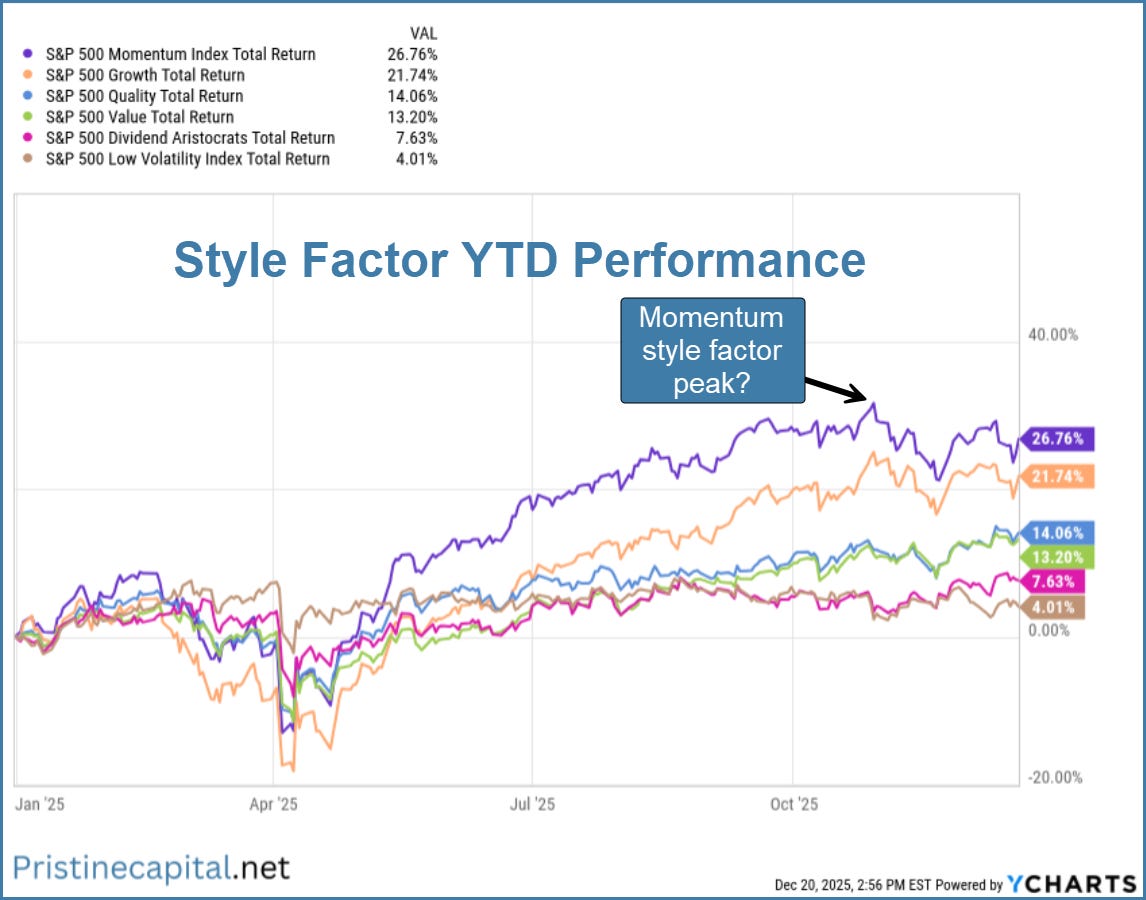

Style Factor YTD Performance

The momentum style factor peaked in October, but the Value and Quality style factors are trading closer to NEW highs👇

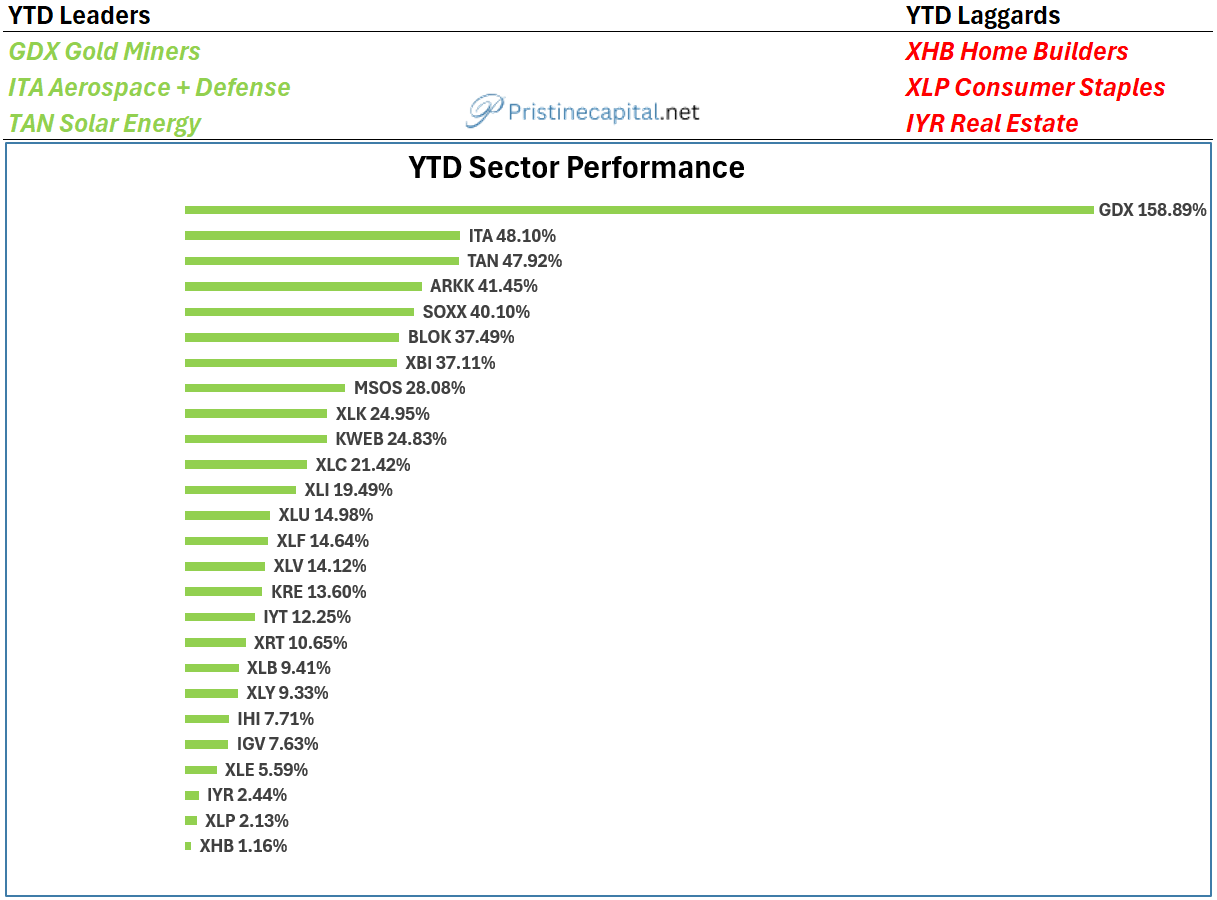

YTD Sector Performance

GDX gold miners reign supreme in the age of the magical money printer 👇

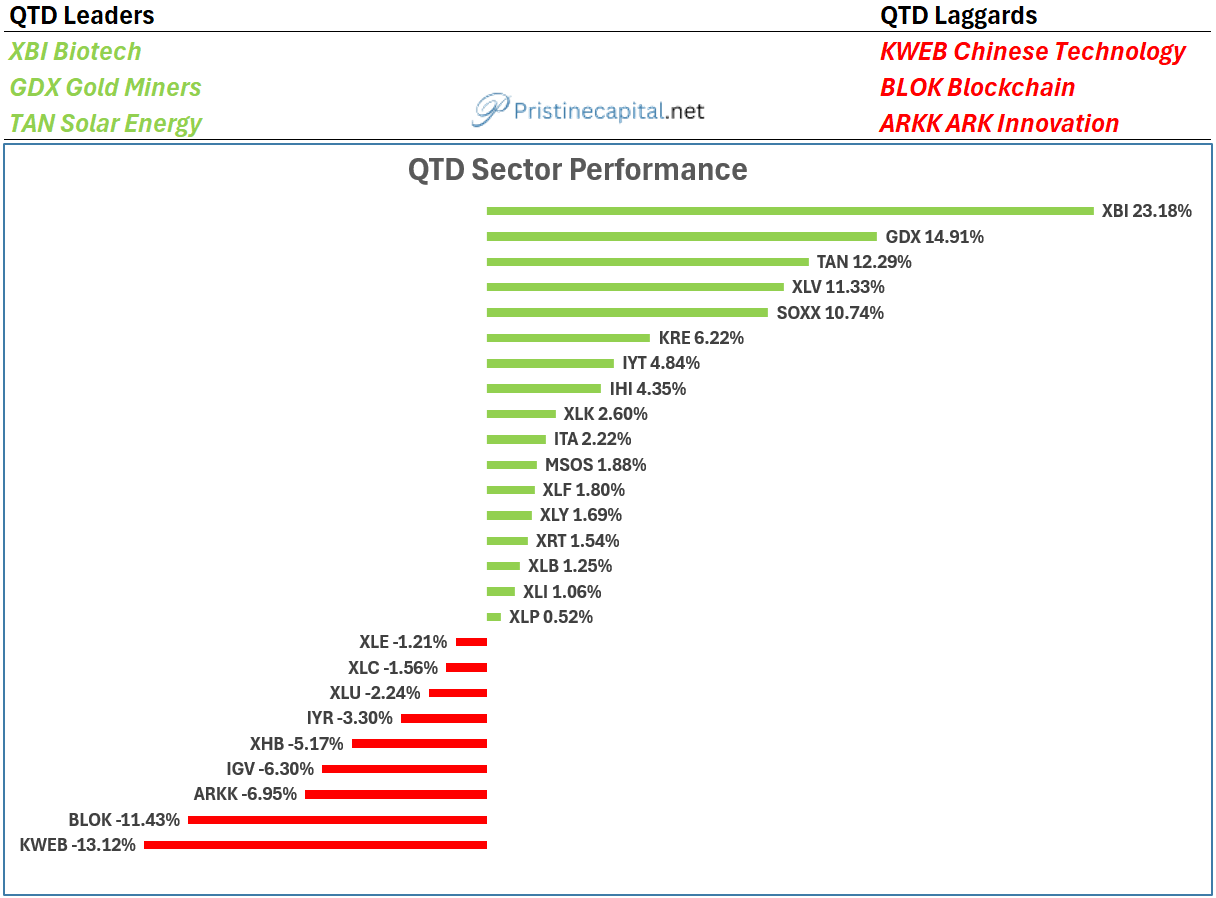

QTD Sector Performance

XBI Biotech leading in Q4. Could be related to expectations of an easier fed, and/or the rotation into small cap stocks more broadly as investors look for alternatives to megacap AI stocks 👇

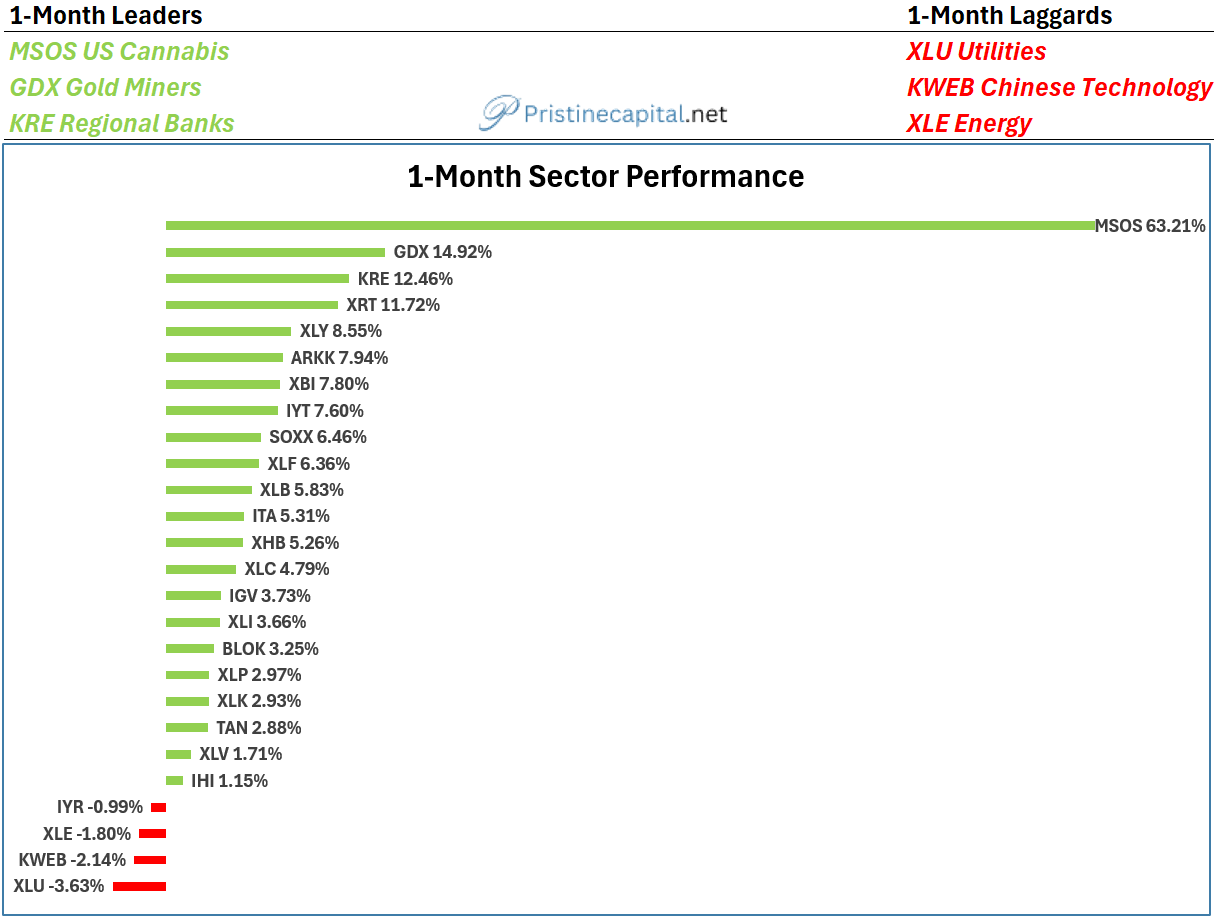

1-Month Sector Performance

MSOS rallied on POTUS signing an executive order to reschedule cannabis👇

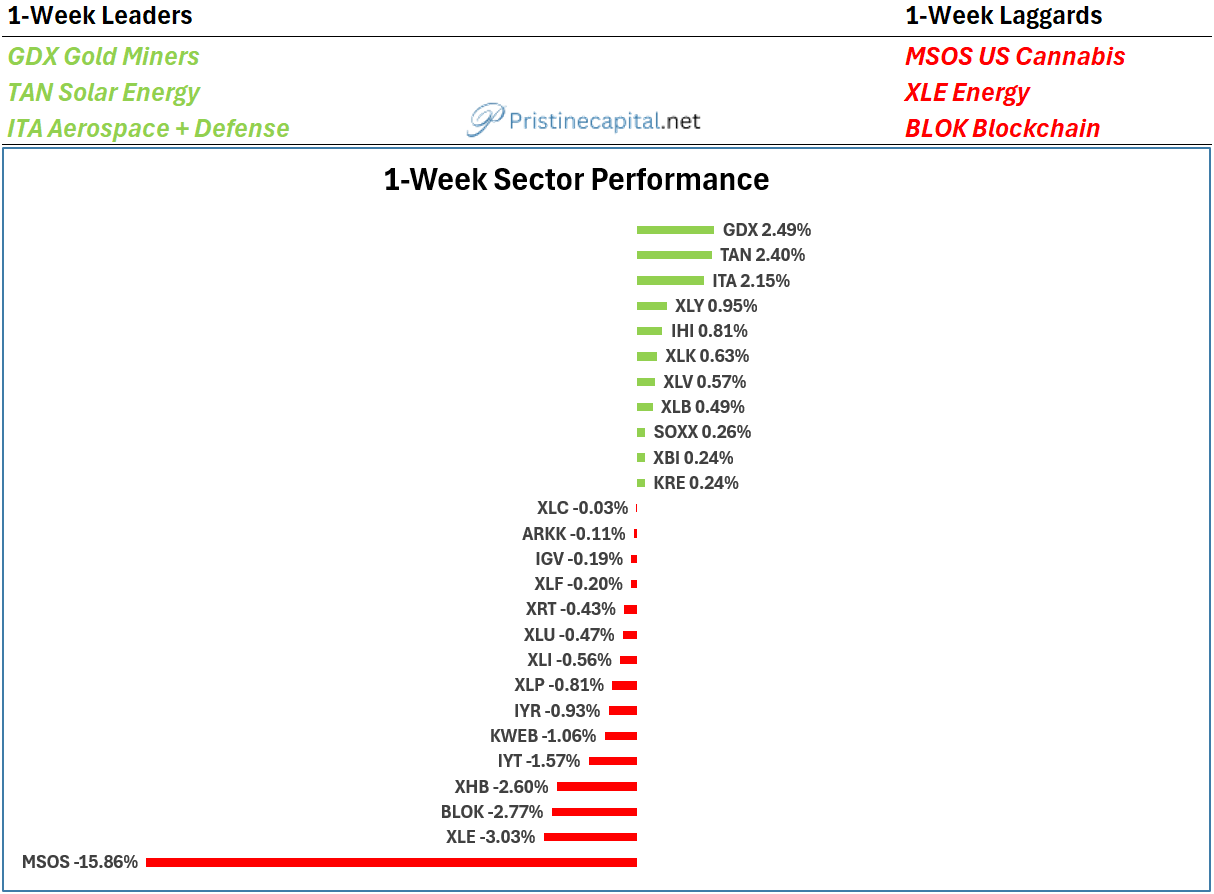

1-Week Sector Performance

GDX closing out the year strong. Wouldn’t be surprised if this is window-dressing by investment managers that want to show their clients they had exposure to the best-performing group of the year👇

Key Ideas/ Macro Backdrop🗝️