📊Quarter-End Incoming!

Pristine Weekend Watchlist

Welcome to this week's edition of the Pristine Capital Weekend Watchlist! 👋

In this note, we’ll cover the following topics to prep for the upcoming trading week:

Sector relative strength analysis across multiple timeframes

Macro Analysis

Three A+ Trade Setups

And much more! Let's get started! 👇

Our TradingView indicators are now available for purchase at https://tools.pristinecapital.net

Sector/Style Factor Relative Strength Analysis

A key part of our technical process is tracking momentum across style factors and sectors on multiple timeframes. Our goal is to follow the flow of capital and spot trend changes early

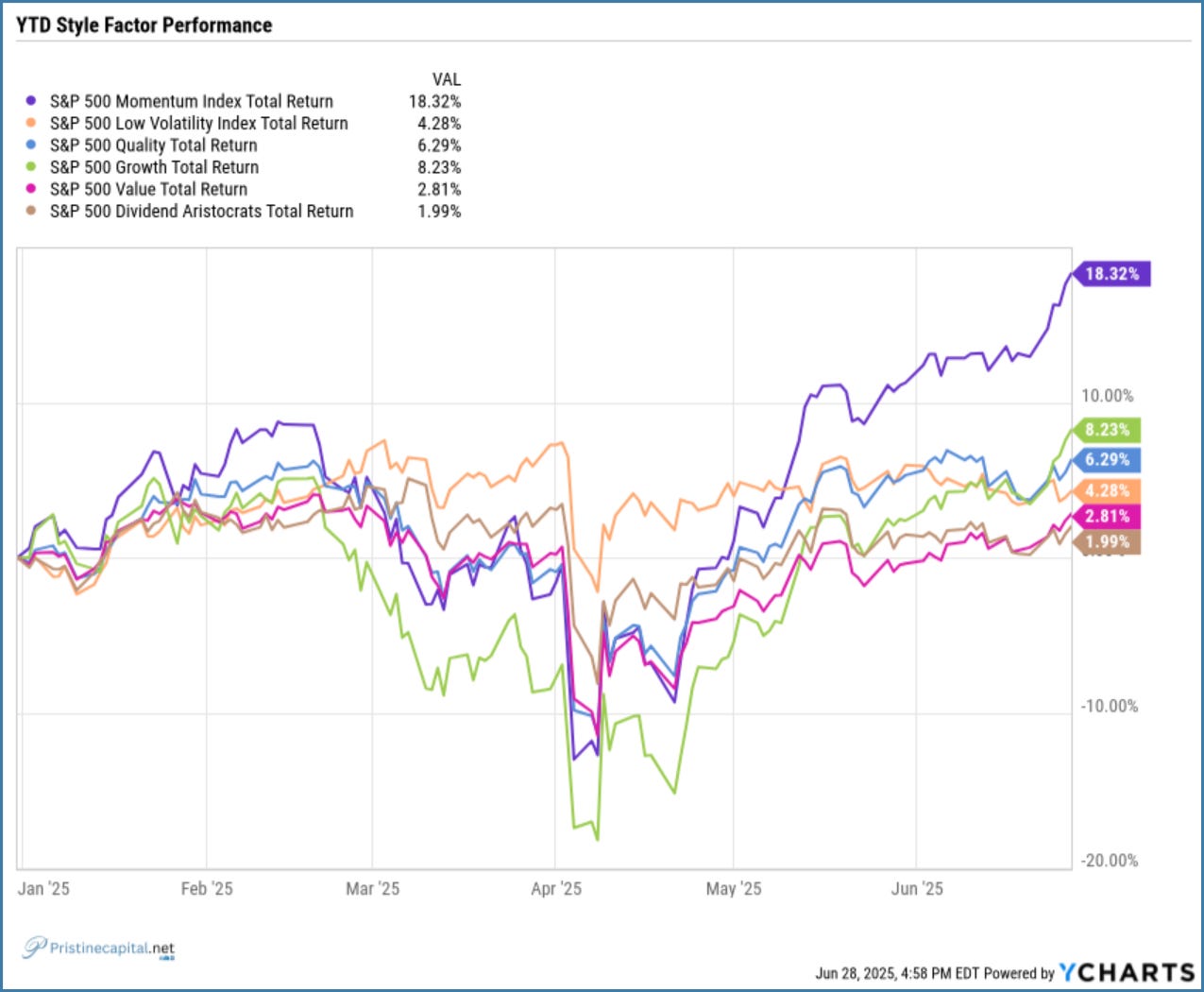

Style Factor YTD Performance

The Momentum style factor is going parabolic in 2025!👇

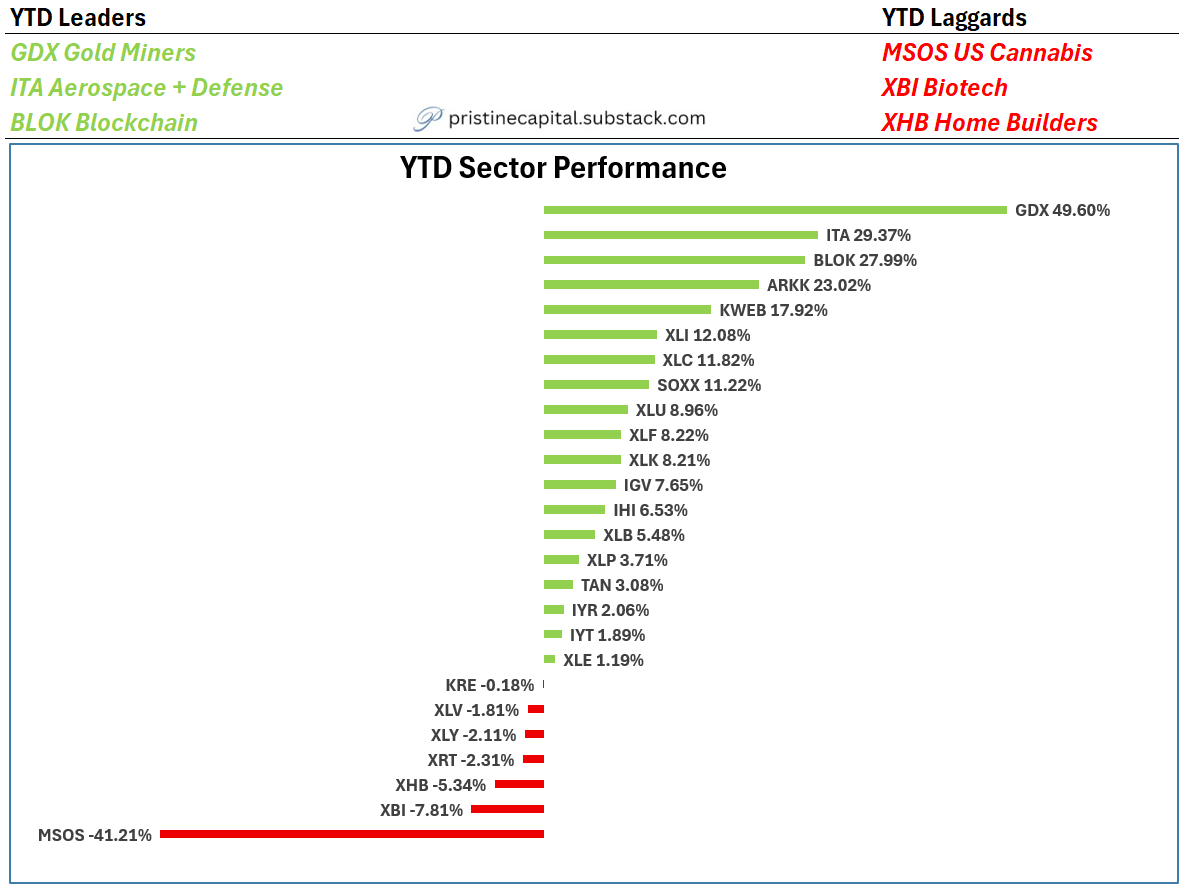

YTD Sector Performance

GDX gold miners super-performance run & ITA aerospace & defense leading 👇

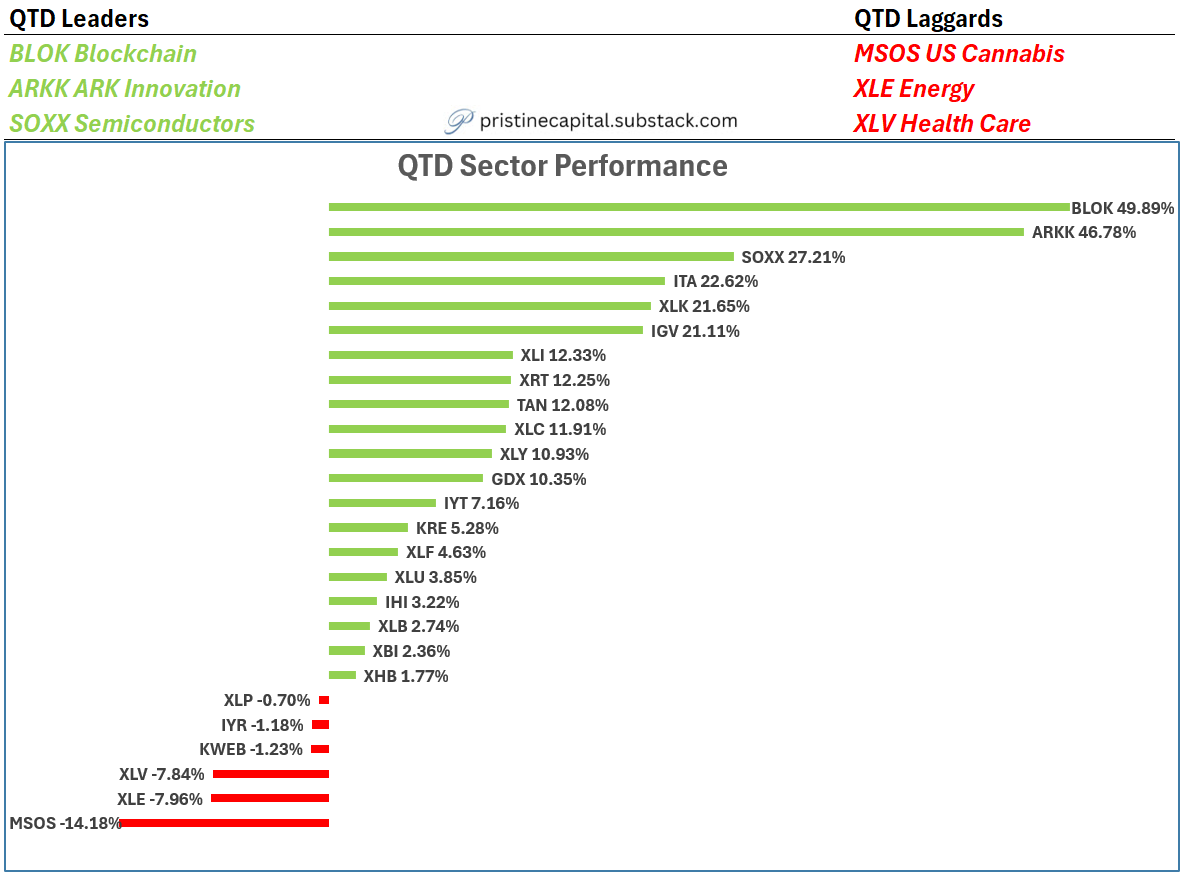

QTD Sector Performance

Incredible Q2 run in BLOK and ARKK. Keep in mind that Q2 is coming to a close 👇

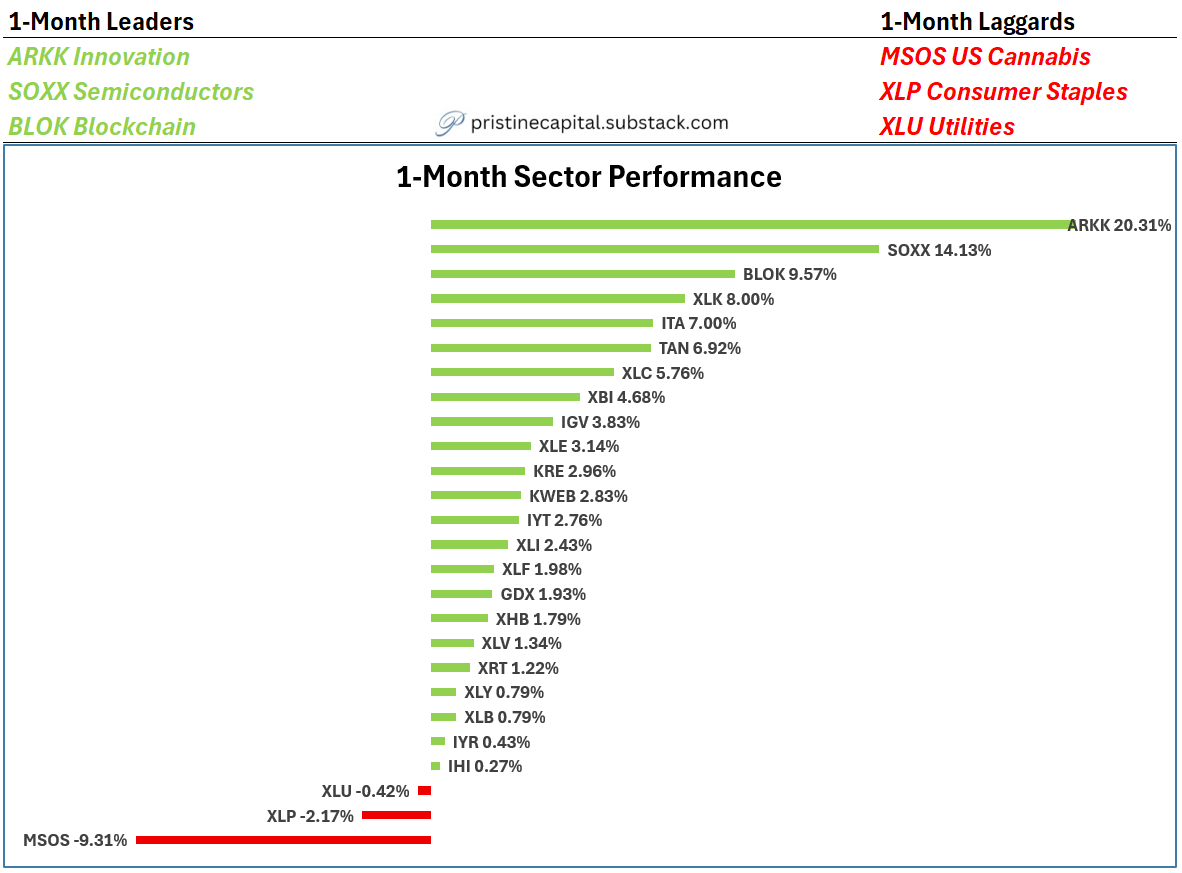

1-Month Sector Performance

ARKK high-risk growth stocks leading 👇

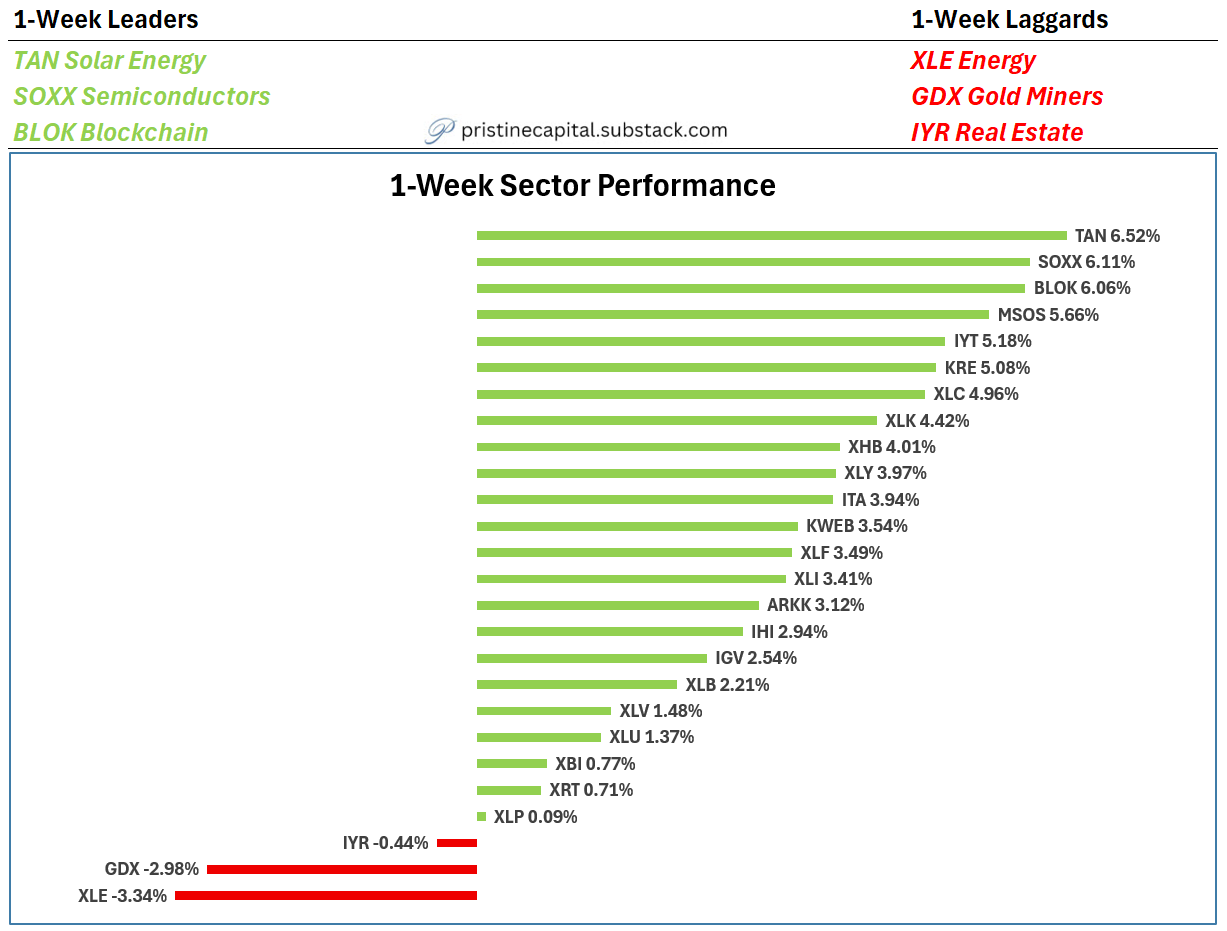

1-Week Sector Performance

TAN solar, SOXX semis, BLOK blockchain big week

XLE declined as the geopolitical risk came out of the market 👇

In the sections below, we’ll assess the macro landscape, cover the top YTD performers in all equity indices, and outline three trading setups for the week ahead. All that and more. Just scroll down.