Pristine Weekend Watchlist 7.14.24

Earnings and Event-Driven Trades 📈

Hi Team,

Welcome to this week's edition of the Pristine Capital Weekend Watchlist! 👋

In this research note, we’ll cover the following topics in preparation for the upcoming trading week:

Sector relative strength analysis across multiple timeframes

Macro Analysis

Three A+ Trade Setups

And much more! Let's get started! 👇

If you’ve been enjoying our free content, and are committed to putting in the work to make 2024 your best trading year yet, consider upgrading your membership and becoming a premium subscriber.

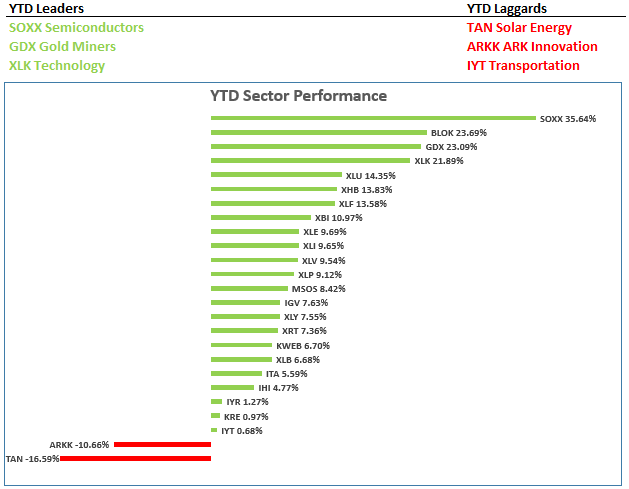

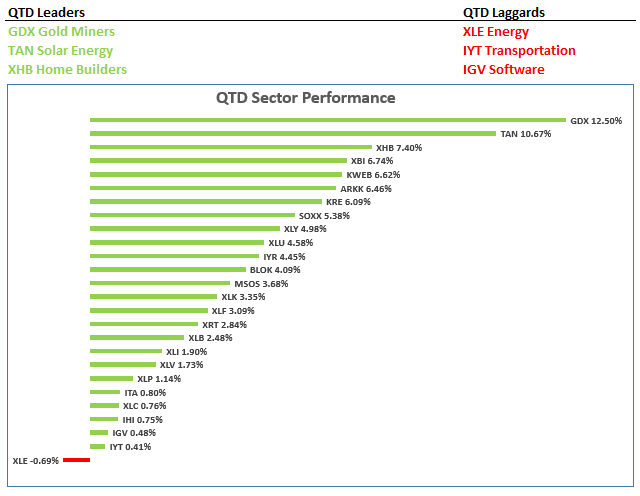

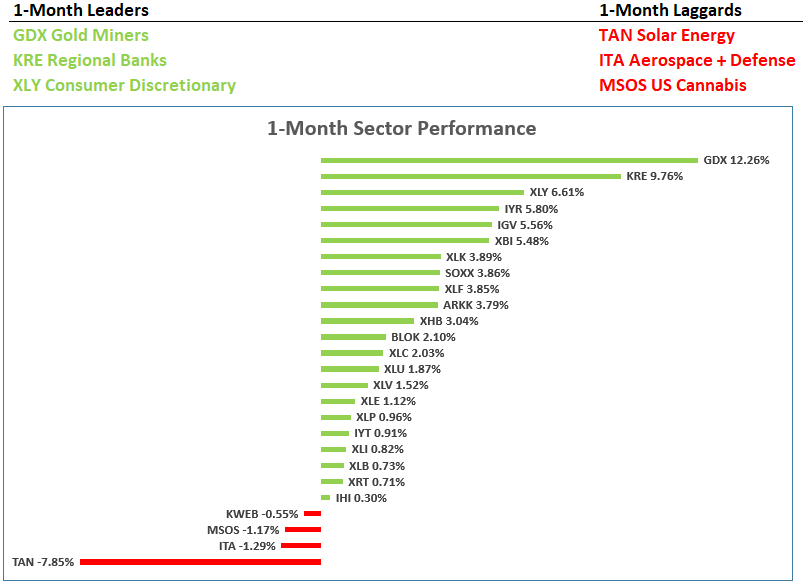

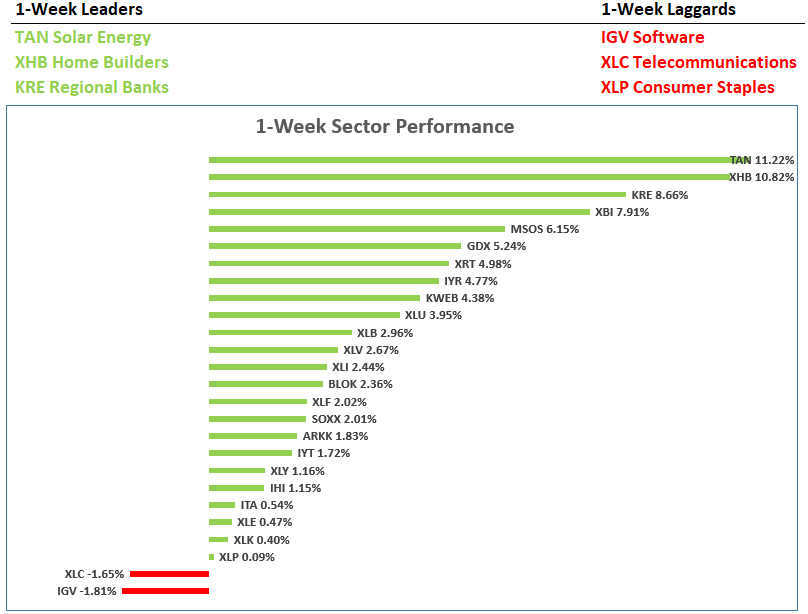

Sector/Style Factor Relative Strength Analysis

Finally a pullback in the momentum style factor and an advance in the value style factor👇

BLOK moved higher on the YTD list👇

GDX gold miners are the Q3 leaders thus far, which shows investors are not as risk-on as one might think👇

KRE regional banks gaining steam on the 1-Month timeframe. Curious to see how these names behave throughout earnings season👇

The laggard TAN solar is leading on the 1-week timeframe. Pain trade! 👇