Pristine Weekend Watchlist 5.5.24

New Leadership Groups 📈

Good evening Team,

Welcome to this week's edition of the Pristine Capital Weekend Watchlist! 👋

In this research note, we’ll cover the following topics in preparation for the upcoming trading week:

Sector relative strength analysis across multiple timeframes

Macro Analysis

Three A+ Trade Setups

And much more! Let's get started! 👇

If you’ve been enjoying our free content, and are committed to putting in the work to make 2024 your best trading year yet, consider upgrading your membership and becoming a premium subscriber.

Sector/Style Factor Relative Strength Analysis

The momentum style factor is leading, driven by a stellar Q1 performance. NVDA earnings on 5/22 will be a test for this group👇

Mainstream financial media is still focused the AI software theme, but the unloved MSOS cannabis and KWEB China internet groups are leading the market YTD 👇

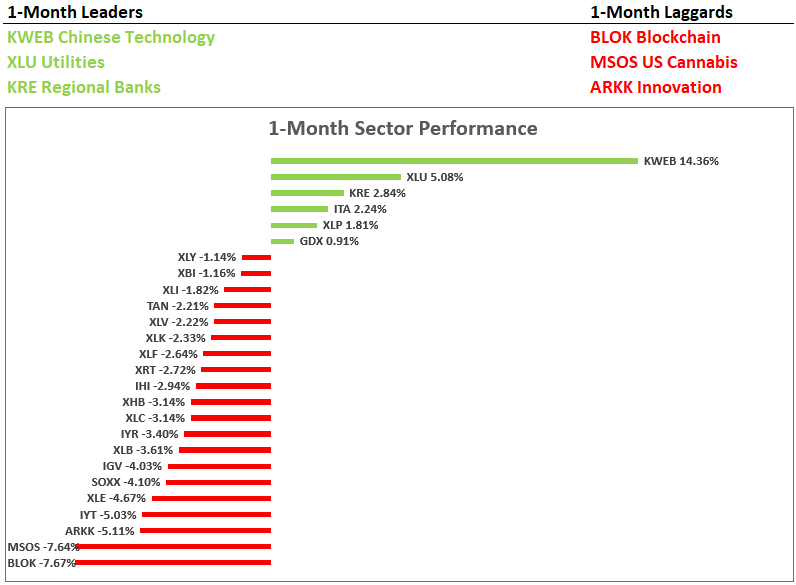

KWEB and GDX are surging so far in Q2. The BLOK blockchain group is going through a corrective sequence 👇

Money is rotating into XLU utilities on the 1-month timeframe👇

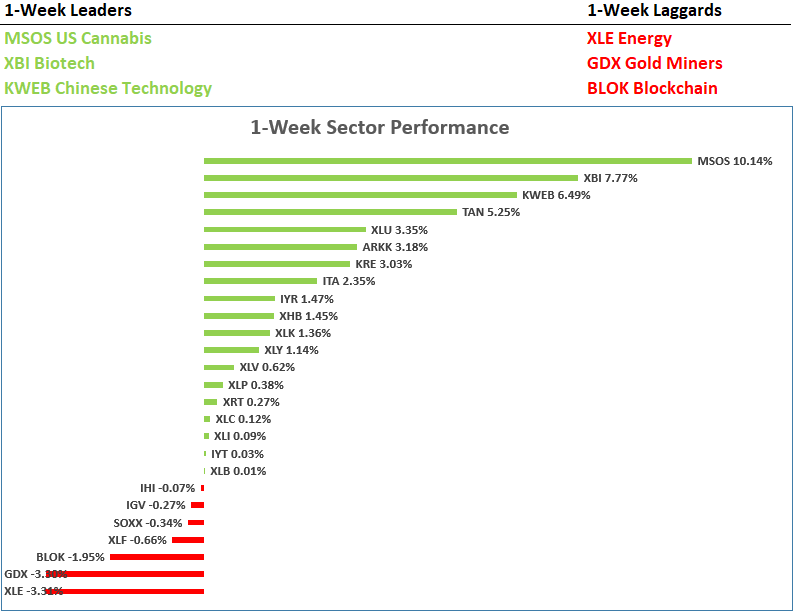

TAN solar stocks rebounded last week, and XLE energy names finally corrected 👇

Across all timeframes, I am seeing rotation out of the most crowded areas of the market, into potentially new leadership groups 💪