Pristine Weekend Watchlist 5.26.24

Crowding into the Magnificent 7 📈

Good afternoon Team,

Welcome to this week's edition of the Pristine Capital Weekend Watchlist! 👋

In this research note, we’ll cover the following topics in preparation for the upcoming trading week:

Sector relative strength analysis across multiple timeframes

Macro Analysis

Three A+ Trade Setups

And much more! Let's get started! 👇

If you’ve been enjoying our free content, and are committed to putting in the work to make 2024 your best trading year yet, consider upgrading your membership and becoming a premium subscriber.

Sector/Style Factor Relative Strength Analysis

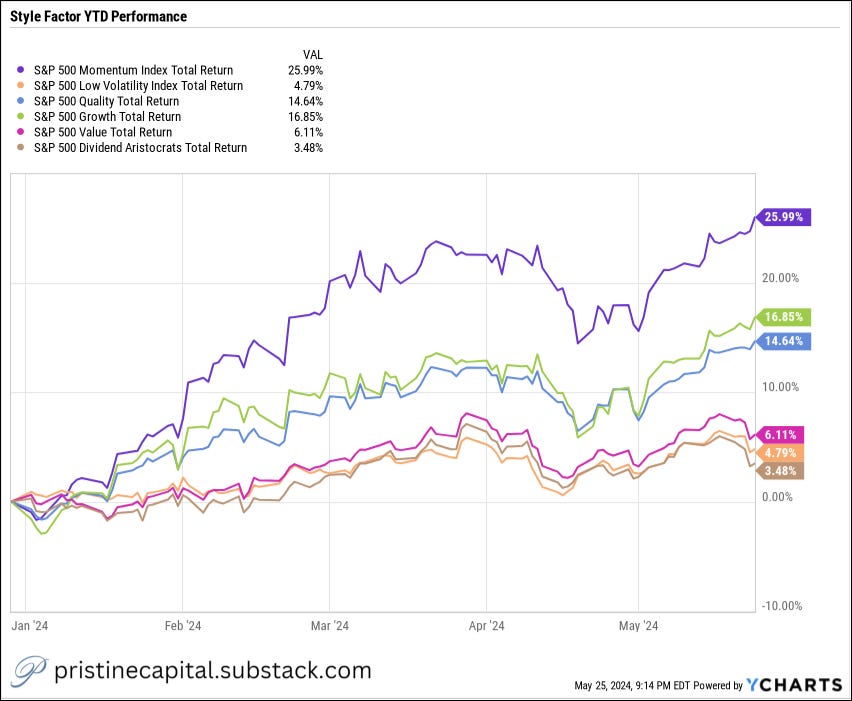

The momentum, growth, and quality style factors are leading YTD, while the value, low volatility, and dividend style factors haven’t made any upward progress since late march👇

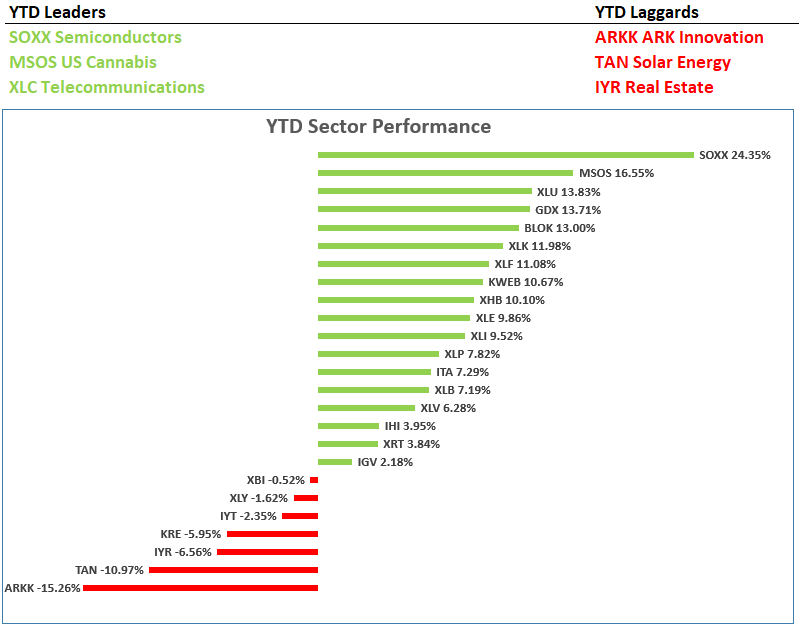

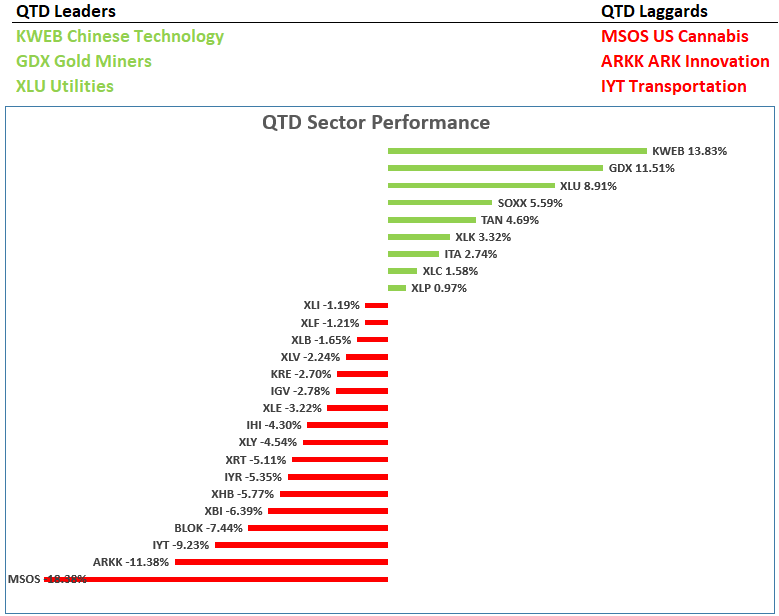

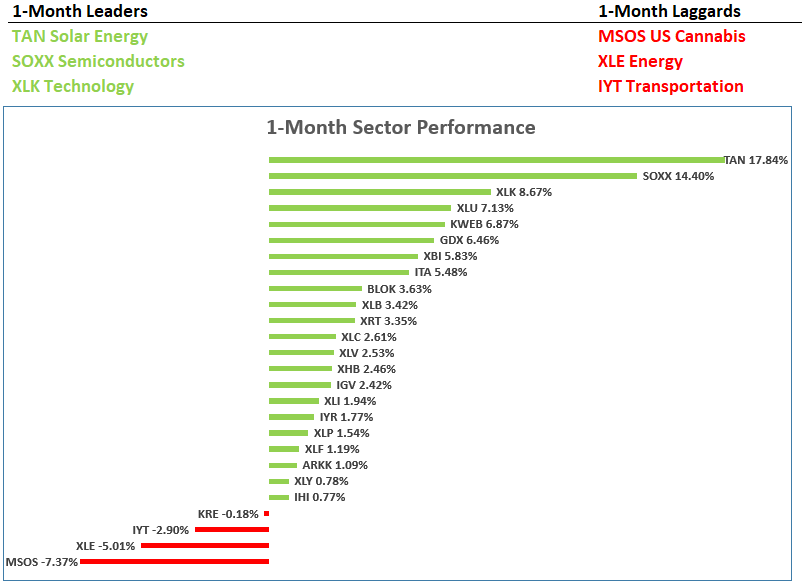

The key takeaway for me as I look at the below sector/industry charts on multiple timeframes, is that 2024 has been a year of rotation. The leaders and laggards on each of the below timeframes are different. SOXX is now leading the market on a YTD basis, while TAN, which is the second-to-worst group on a YTD basis is leading on the 1-week and 1-month timeframes👇