Pristine Weekend Watchlist 2.4.24

Cross Asset Cracks in Risk Assets🌎

Good evening Team,

Welcome to this week's edition of the Pristine Capital Weekend Watchlist! 👋

In this research note, we’ll cover the following topics in preparation for the upcoming trading week:

Sector relative strength analysis across multiple timeframes.

Cross Asset Risk Analysis

Three high-quality trading setups

And much more! Let's get started! 👇

If you’ve been enjoying our free content, and are committed to putting in the work to make 2024 your best trading year yet, consider upgrading your membership and becoming a premium subscriber.

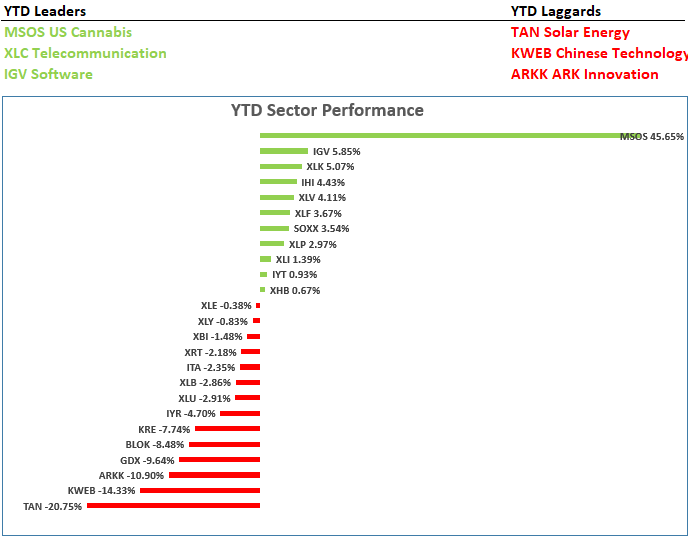

Sector Relative Strength Analysis

The financial media is swept up in the SOXX semiconductors/ AI themes, but the YTD winner MSOS cannabis is largely flying under the radar 😏

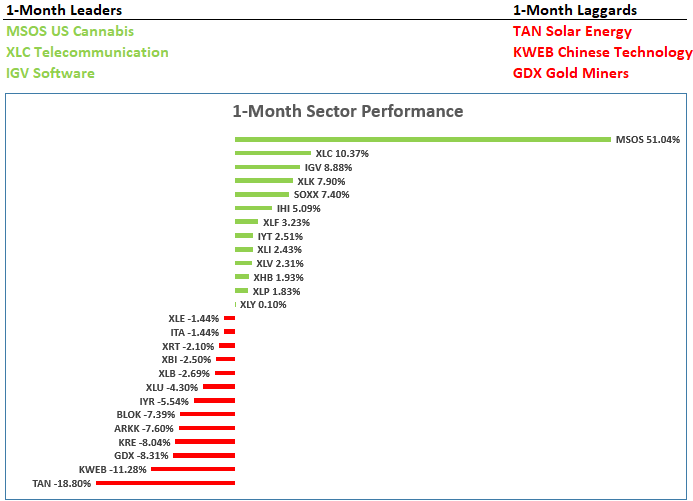

On the 1-month time horizon, XLC communications, which is heavily weighted in META, GOOGL, and NFLX, is in second place, followed by IGV software names 👇

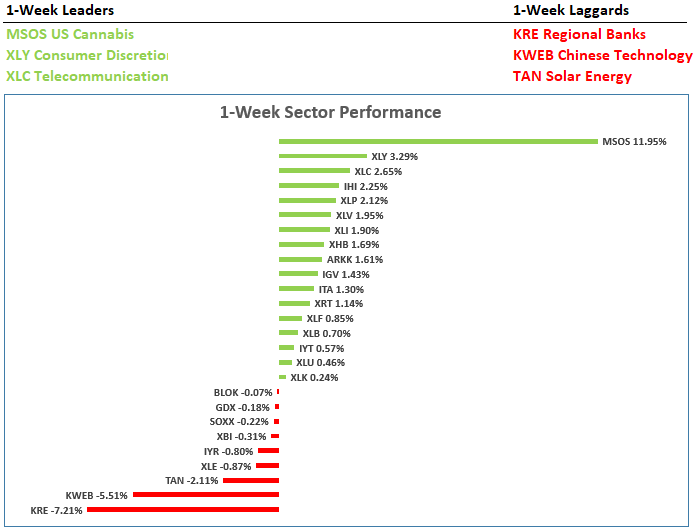

The KRE regional banks were the worst-performing group last week. The risk for regional banks is that they NEED interest rates to move lower in order to survive, so if the US economic data remains strong and rates do not immediately head lower, we could see more blowups. Isn’t it crazy that strength in the real economy could be a source of financial market instability? 🤯

The SPY S&P 500 is putting up an impressive start to the year 👇

But we are seeing cross-asset cracks emerging underneath the surface…