Pristine Market Analysis & Watchlist 12.18

📈Riding the wave of bullishness

Indices consolidate to 5-day EMA’s

Individual stocks continue to set up!

Team,

Individual stocks are continuing to decouple from the headline indices despite seemingly negative geopolitical headlines. Trade the market in front of you!

HAGE 🍻

-Andrew

News/Economic Data

Energy

Considering the headlines regarding the Houthi rebel attacks in the red sea, the price action in crude oil was tame✅

FX Market

The price action in the dollar was also muted, reflecting a market that did not price in any significant geopolitical risk✅

Treasuries

The TLT is going through a much needed pullback/consolidation. Since this uptrend began, buyers have stepped in at every retest of the 10-day EMA. If you are looking to jump aboard this trend for a trade up to the $101.40 VPOC, look for a retest of the 10-day EMA 👇

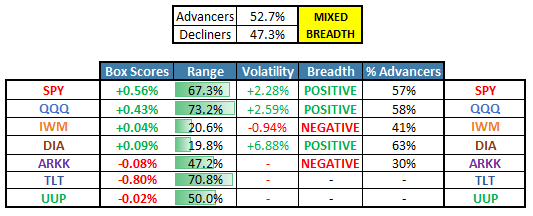

Equity Dashboard

The megacaps cooled off and the IWM small caps took the baton👇

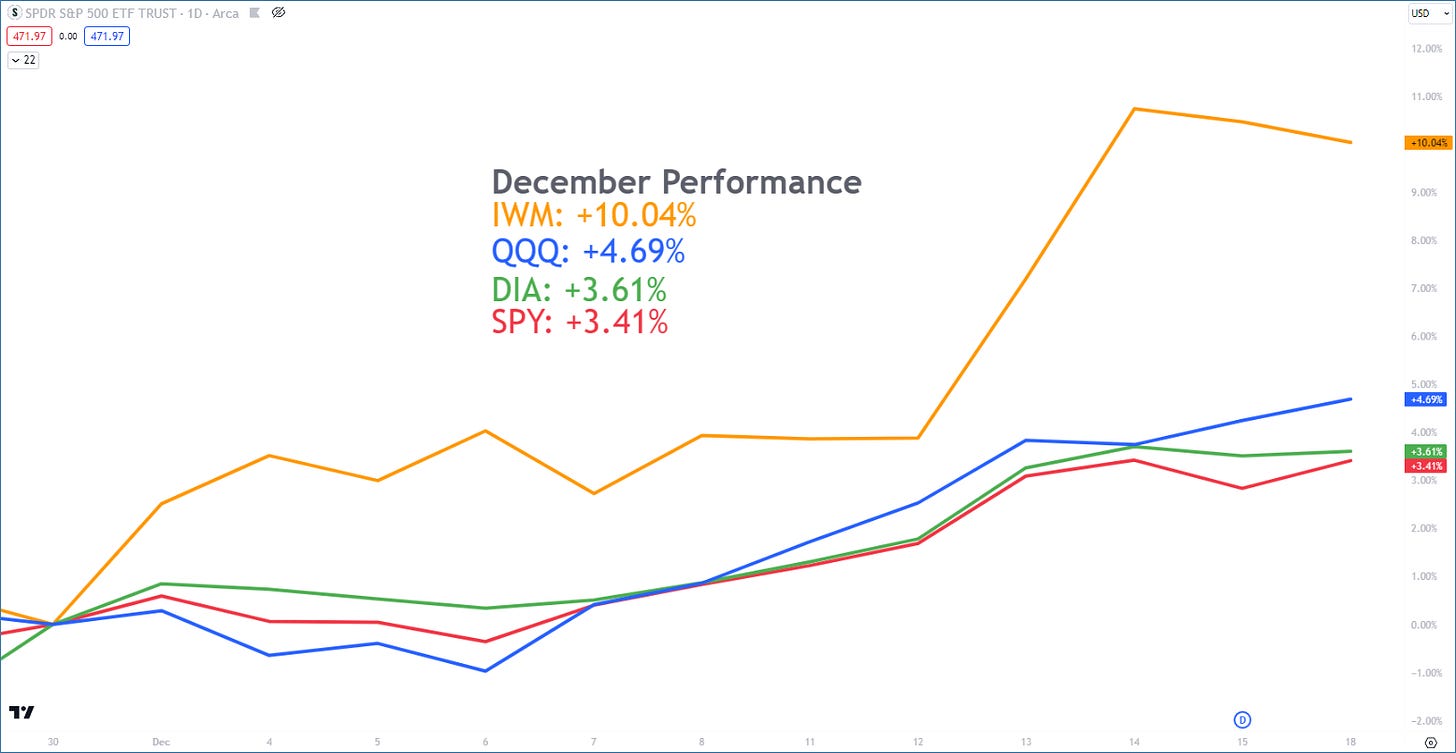

Index Price Cycle Monitor

The indices were so extended to the upside that their respective 5-day EMA’s are only now catching up to price 🔥

Index Performance Monthly

The IWM small caps are up a whopping 10.04% for December. Let that sink in…👇

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - Our trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities