Pristine Market Analysis & Watchlist - 1/4

Strong Market Breadth

Good evening everyone,

After a sloppy, choppy session, the market resolved higher!

We have a lot to cover tonight, so let’s dive in!

-Andrew

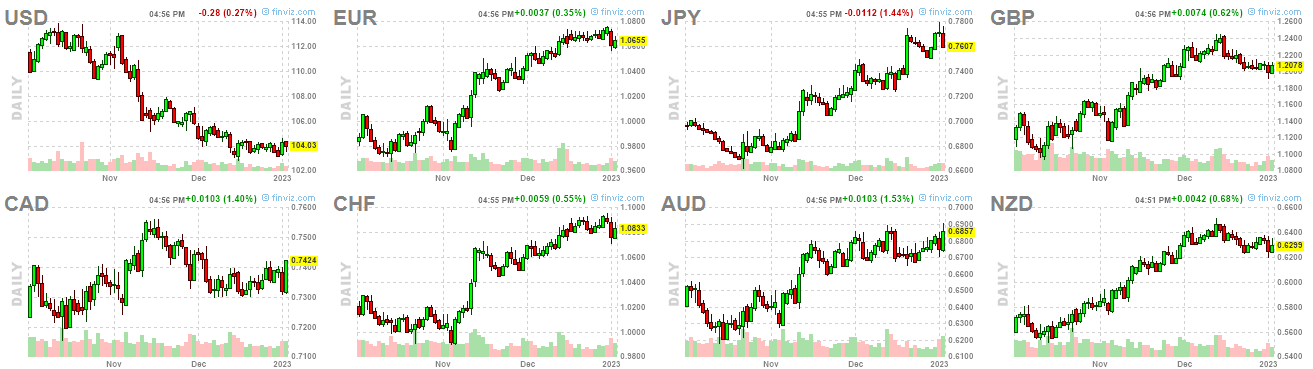

FX Market

The dollar resumed it’s trend of weakness, finishing -.27% for the session:

Dollar strength was a major source of equity market weakness last year, so it is important to keep a close eye on global FX. No news is good news!

Equity Dashboard

86.1% UVOL - Strong breadth conducive to bullish momentum

Stocks up, bonds up, dollar down, volatility down - The ideal configuration! 🏆

Finviz Heatmap

This remains a market rife with single-stock risk, with today’s victim being Microsoft MSFT:

Bounces in in AAPL, TSLA, and semiconductors SOXX NVDA, which were the hardest hit areas in yesterday’s selloff.

S&P 500 ES_F Price Analysis

After rejecting firmly off the teal downward trendline in early December, the S&P 500 experienced two weeks of hard selling, followed by three weeks of tight consolidation:

On a break to the upside, can target a retest of the teal downward trendline ~4000

On a break to the downside, can test the 200-wk SMA ~3700

S&P 500 ES_F Stuck in a Balance Area

Today was day 12 in a choppy balance zone:

While it rarely makes sense to go all in on one market outcome before breaking out of balance, we are beginning to see some encouraging signs that could point to upside resolution☟

Net New Highs!

For the first time since Dec 13th, more stocks made new 52-week highs than new 52 week lows:

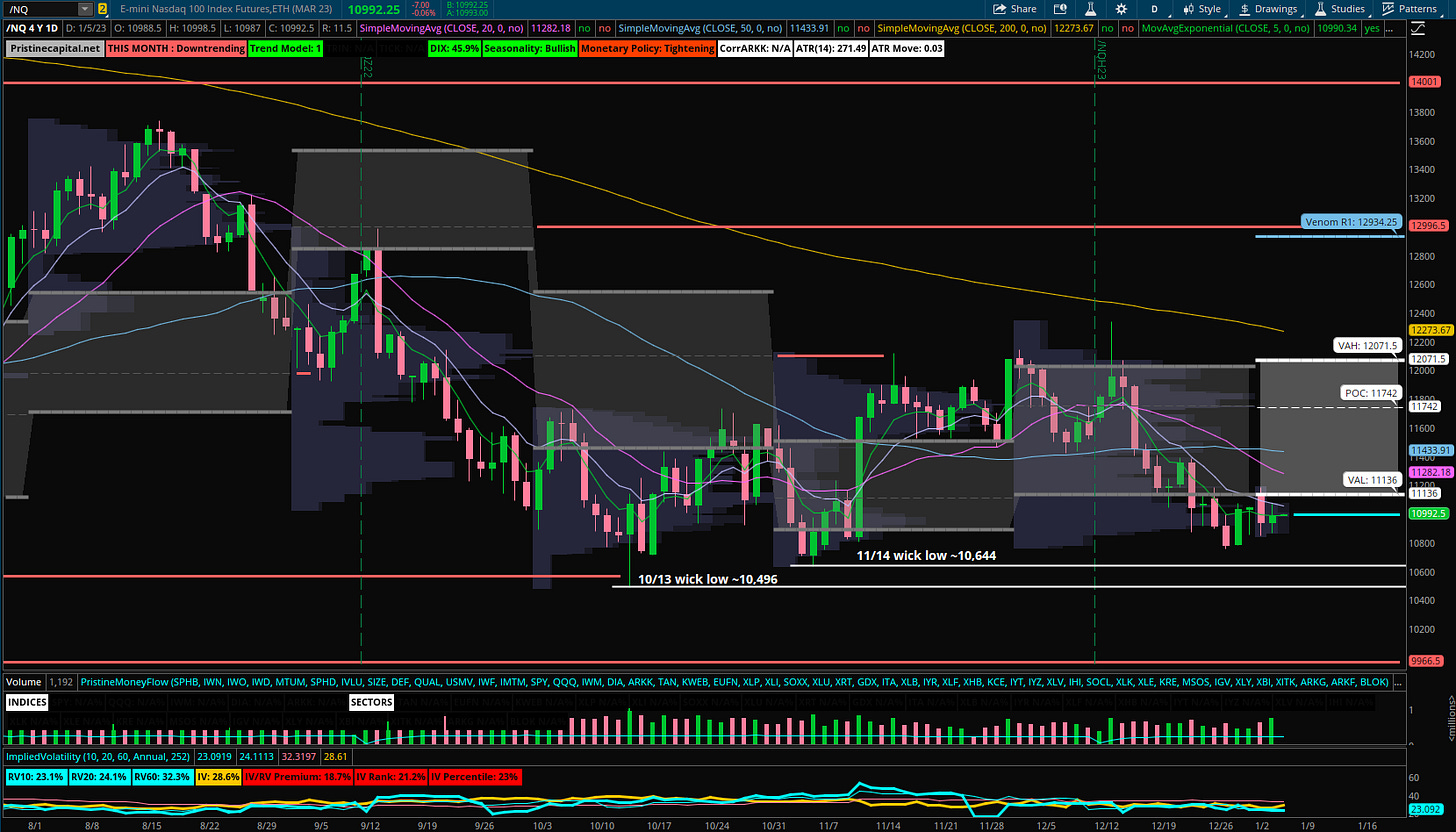

Nasdaq NQ_F Price Action Analysis

Despite an explosive selloff in TSLA and AAPL yesterday, and a similar volatility event in MSFT today, the sellers just can’t seem to take down the Nasdaq. I give a slight, short-term edge to the bulls here:

Price failed to revisit the prior lows from 11/14 and 10/13 🚨🚨🚨

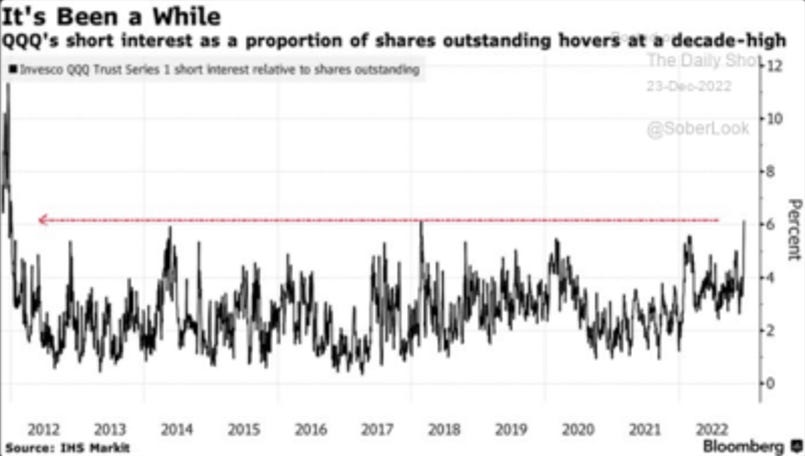

Nasdaq QQQ Short Interest

Let’s not forget that the Nasdaq QQQ ETF is still a consensus short:

Sectors - Ranked by Momentum

We detailed 5 key reasons for Chinese equities to outperform their US counterparts in our weekend watchlist video sent out to premium subscribers this past weekend, and so far we are seeing just that! Consider upgrading to paid if you would like to see similar analysis in the future.

Chinese technology stocks KWEB, Gold miners GDX, and European Financials EUFN remain at the top of the momentum leaderboard, and they all finished today’s session with impressive daily performances:

Key Takeaways

The S&P 500 is still stuck in balance

We saw plenty of encouraging signs in today’s price action including strong breadth, net new highs outpacing new lows, relatively weak areas of the market failing to resolve lower, and strength in the bond market

I give a slight edge to the bulls until proven otherwise

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities