Pristine Market Analysis & Watchlist 5/11

PPI Flies By

Team,

TGIF Team! We made it past the CPI and PPI reports. Now all we have to deal with is…the debt ceiling. Let’s crush it tomorrow.

-Andrew

Economic Data

PPI came out in-line with expectations, and initial jobless claims came out above expectations:

Treasury Action

Fed Fund Futures

Fed fund futures remained rangebound, and are still pricing in two rate cuts into year end.

10Yr

ZN_F 10yr treasury futures reacted positively to the inflation data, but closed off the highs. This chart pattern is beginning to shape up nicely!

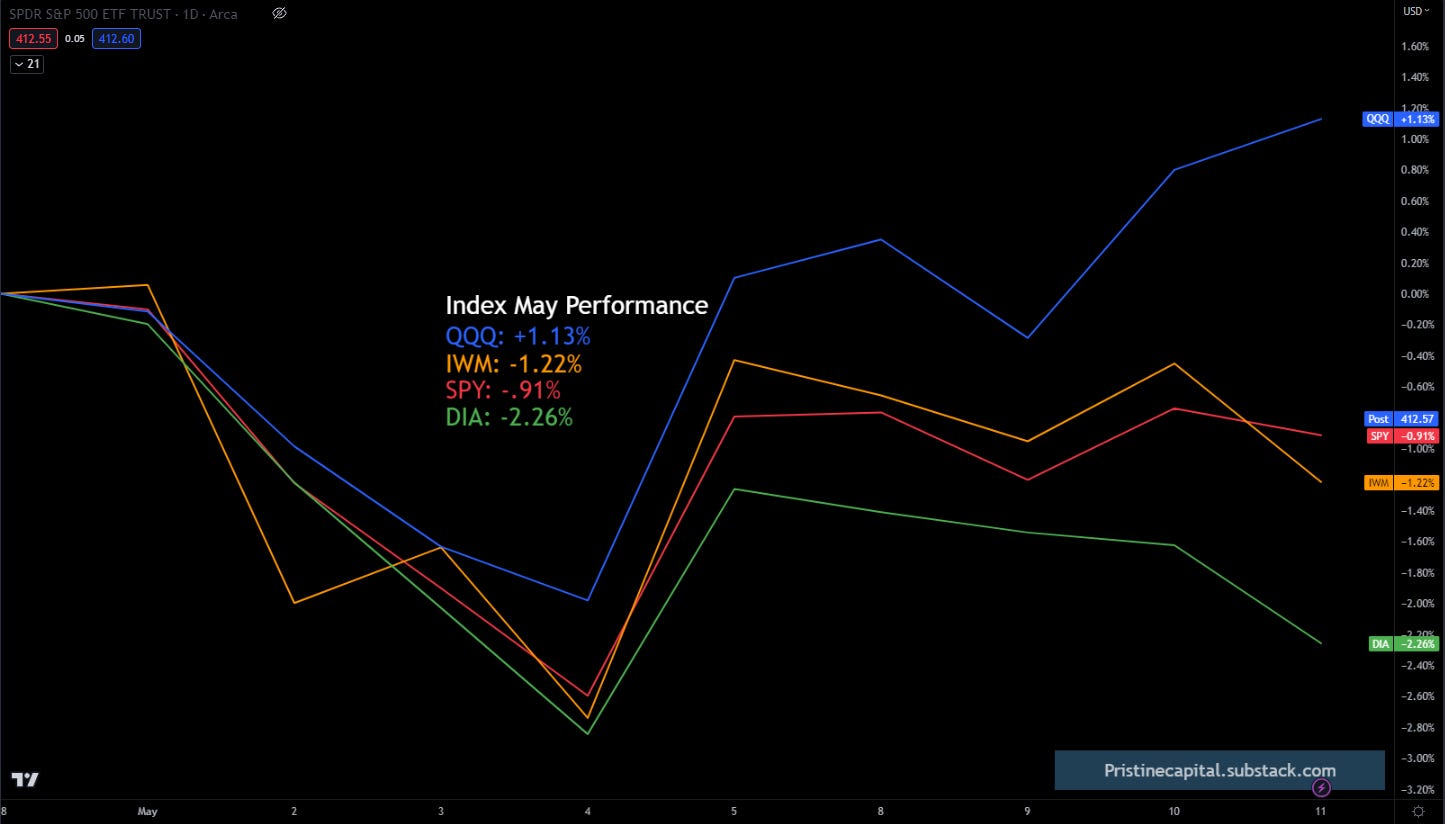

May Index Performance

The Nasdaq continues to lead, and is the only positive index so far this month!

Equity Dashboard

Overall market breadth was weak with only 29.3% advancers, and the UUP dollar index was bid.

A few megacap tech stocks lifted the S&P 500. There is a ton of dynamism occurring in small cap growth stocks, and megacap tech stocks, but most other areas are weak.

Index Price Action

The NQ Nasdaq is practically in overbot territory above the monthly value area, while the RTY Russell 2000 and YM Dow Jones remain in the doghouse! They are both trading below their respective monthly value areas.

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities