Pristine Market Analysis & Watchlist 2/28

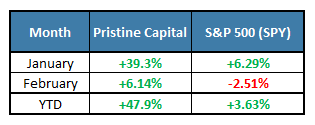

Month-end Performance Update!

Team,

Pencils down!!! The 2nd of 12 innings in the 23’ trading year has officially come to a close.

I’ll be reporting my February performance for the 2023 US Investing Championship once my broker statement is available. As of now it looks like I finished up about 6.1% for the month of February, bringing our YTD performance to ~+47.9%

With that said, two months does not a year make! In the words of the late great Kobe Bryant:

Whether February was your best month or your worst month, it’s time to leave that in the past and look ahead to March.

-Andrew

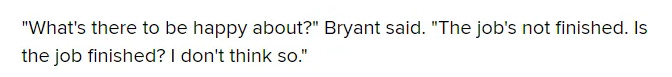

Economic Data

Chicago PMI and the CB Consumer Confidence index came in lighter than expected:

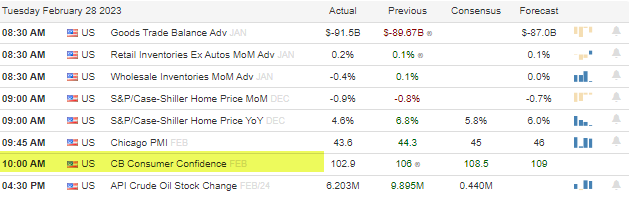

Equity Dashboard

Market breadth was mixed with 41% advancers. Equity indices finished mixed, with the lower quality IWM small caps and ARKK innovation stocks finishing the strongest. As we referenced in Discord and last night’s letter, it appears that the tape was painted into month-end!

ES_F S&P 500 Price Action Analysis

The S&P 500 topped on Feb 2nd, and has been stair-stepping lower in a narrow channel ever since. With the calendar flipping over from February to March, we have a new monthly value area! We are going to open the new month below value, which is a sharp contrast from February, where we opened the month above value and then cascaded into it.

We are likely to test the 200-day SMA for the second time tomorrow. This level is of the utmost importance, because there are plenty of trend-following investors that use it to determine if we are in a bull or bear market. I wonder how many stops are resting just below it. Let’s find out together 😎

Zooming in to the hourly chart, after trading in a directionless tape since Wednesday 2/22, we finally broke below the weekly value area low ~3969.25. This level will be great to keep on our screens tomorrow as a bullish/bearish pivot!

Finviz Heatmap

NVDA and TSLA, which have been the two most important stocks in preventing the market from falling apart, both pulled back into month-end.

And NVDA announced a mixed shelf offering after the close!

This is dilutive to current equity shareholders, and could put downward pressure on the stock tomorrow.

Beware the Jaws

This is happening while we still have the jaws setup in play!

March is going to be legendary!

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities