Pristine Market Analysis & Watchlist 9/28

Seasonal Bottom!

Team,

The rally attempt is underway Team! 🎅

-Andrew

Economic Data

German inflation slowed more than expected, and US jobless claims came in just under the expectations.

FX Market

Finally! A day of selling in the dollar index. Definitely a step in the right direction, but we are still trading inside the white bullish trend channel.

Crude oil traded higher intraday before putting in a bearish reversal candle! Also a step in the right direction. It’s only one day, but we’ll take it!

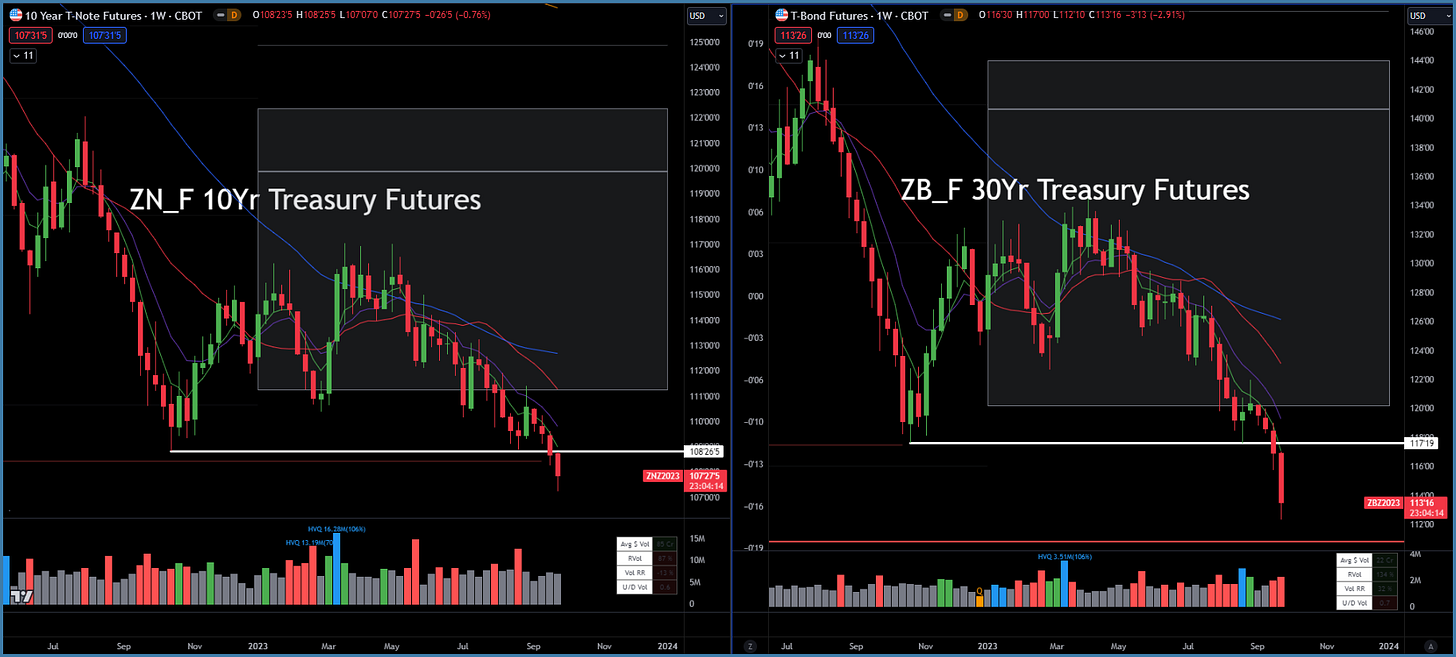

Long-Term Treasuries

Long-term bonds sold off early in the day, but reversed higher as the session progressed. These weekly candles still look ugly, but we have one more day till these weekly candles close. A long lower wick would be nice!

Equity Dashboard

72.1% advancers, which is a character change compared to what we’ve seen over the past few weeks. The duration sensitive ARKK led the way.

Equity Index September Performance

All equity indices are trading in negative territory for September.

Index Price Cycle Monitor

ES S&P 500 - Below key moving averages and below monthly value area

NQ Nasdaq - Below key moving averages and below monthly value area

RTY Russell 2000 - Below key moving averages and below monthly value area

YM Dow Jones - Below key moving averages and below monthly value area

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities