Pristine Market Analysis & Watchlist 9/26

Capitulation!

Team,

It’s always darkest before the dawn.

-Andrew

Economic Data

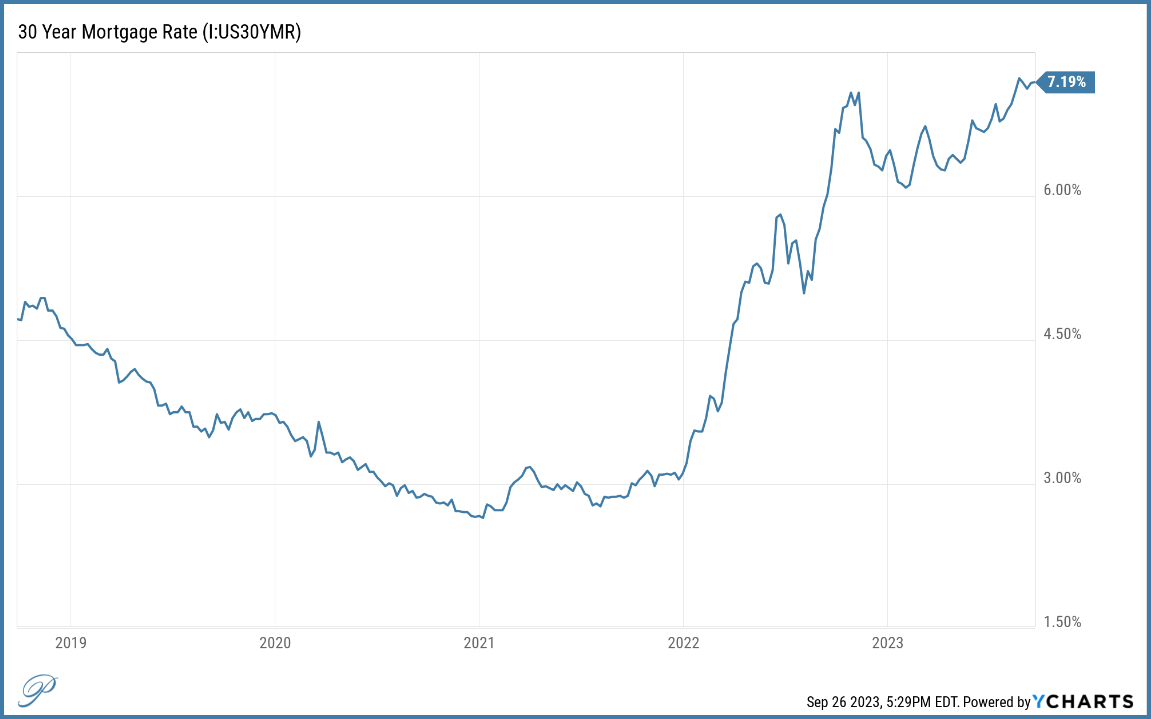

New home sales data came in -8.7% MoM

Which makes sense now that the average 30yr mortgage rate is 7.19% 👀

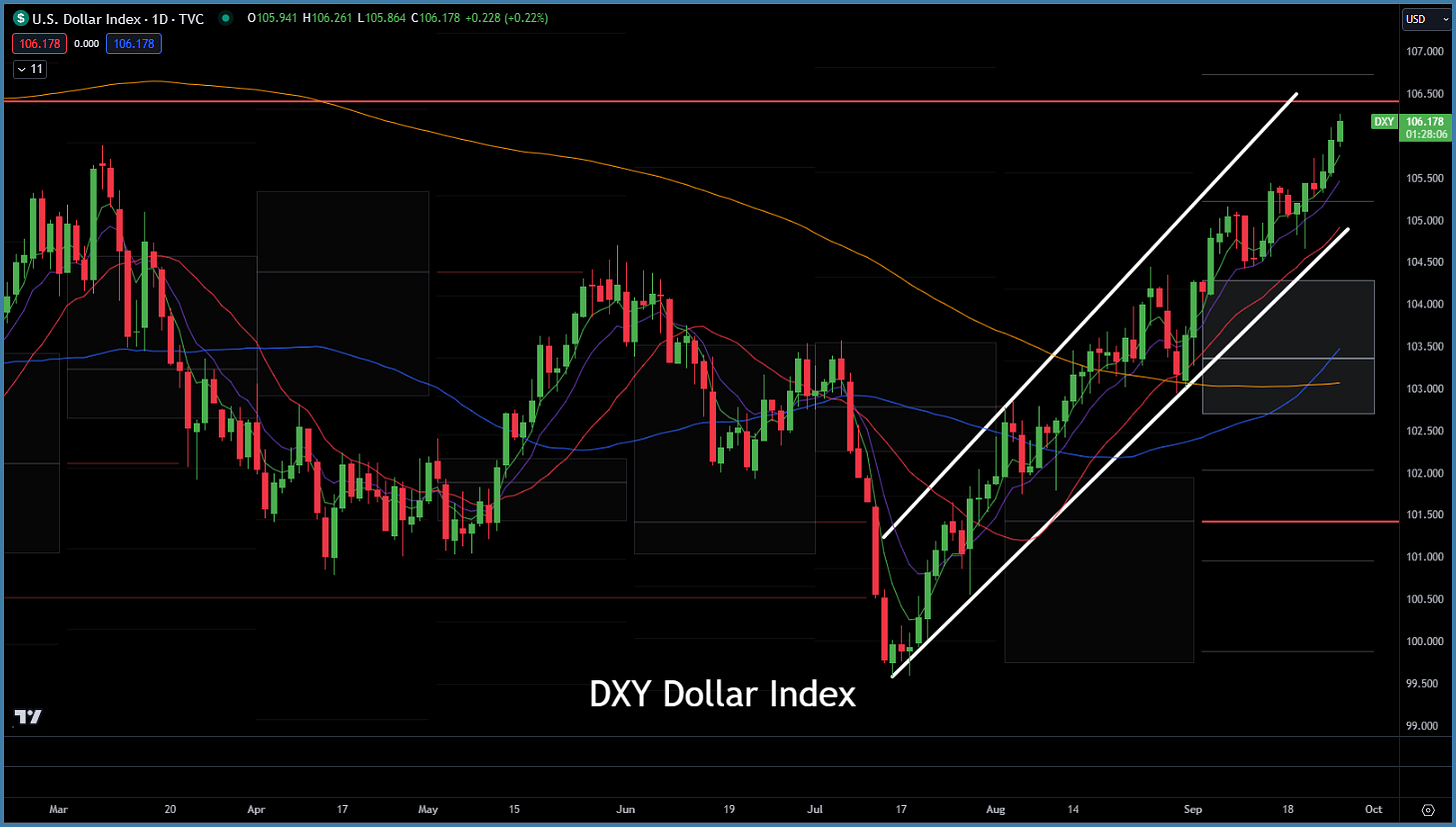

FX Market

The dollar index remains inside the white bullish trend channel. Remember, there is no raging bull market in risk assets when the dollar index is in such a strong uptrend!

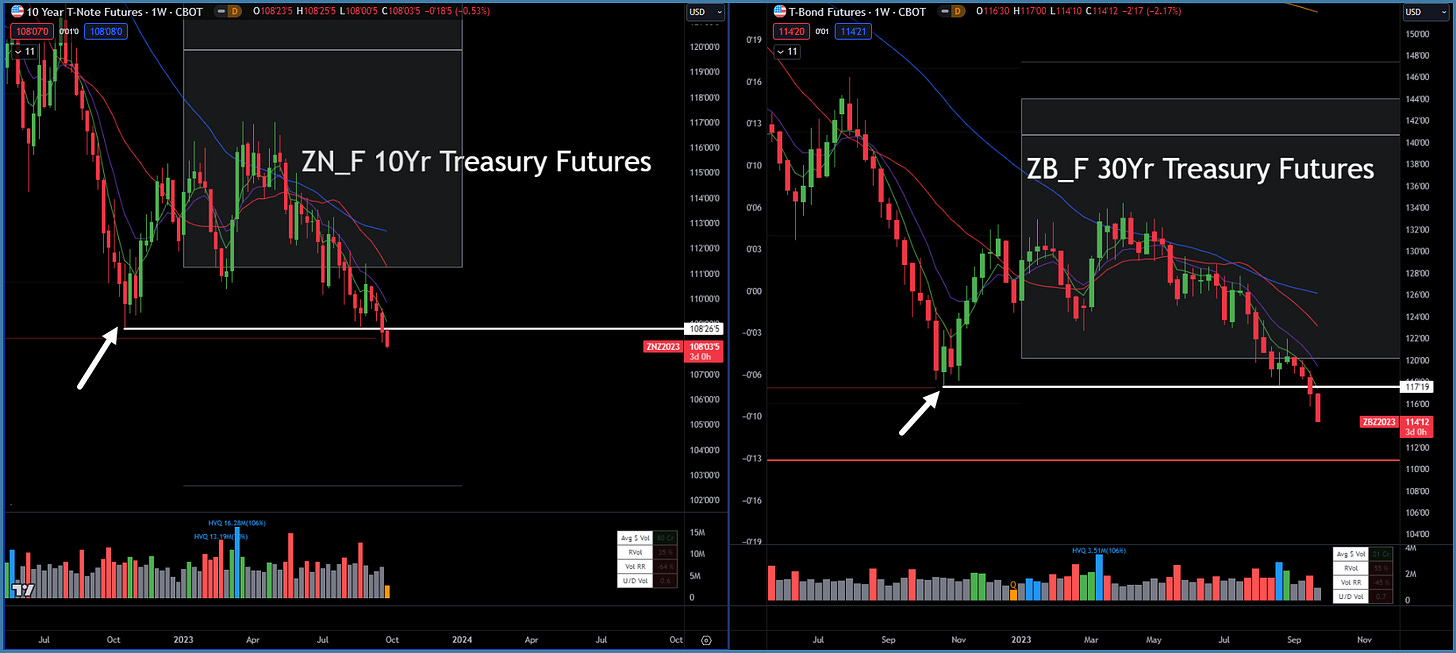

Yield Curve

Long-term treasuries are forming ugly weekly candles. Highly likely that we finish the week below the Fall ‘22 lows.

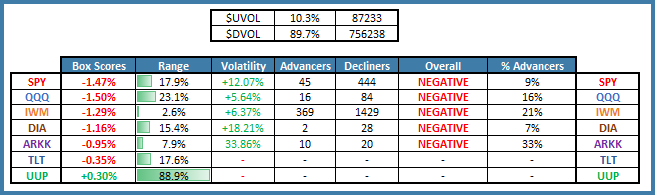

Equity Dashboard

Equity indices put in what appears to be a capitulatory move to the downside. Notice the expansion in volatility? This is typically what happens when investors buy panic put options! Panic put options rarely pay out.

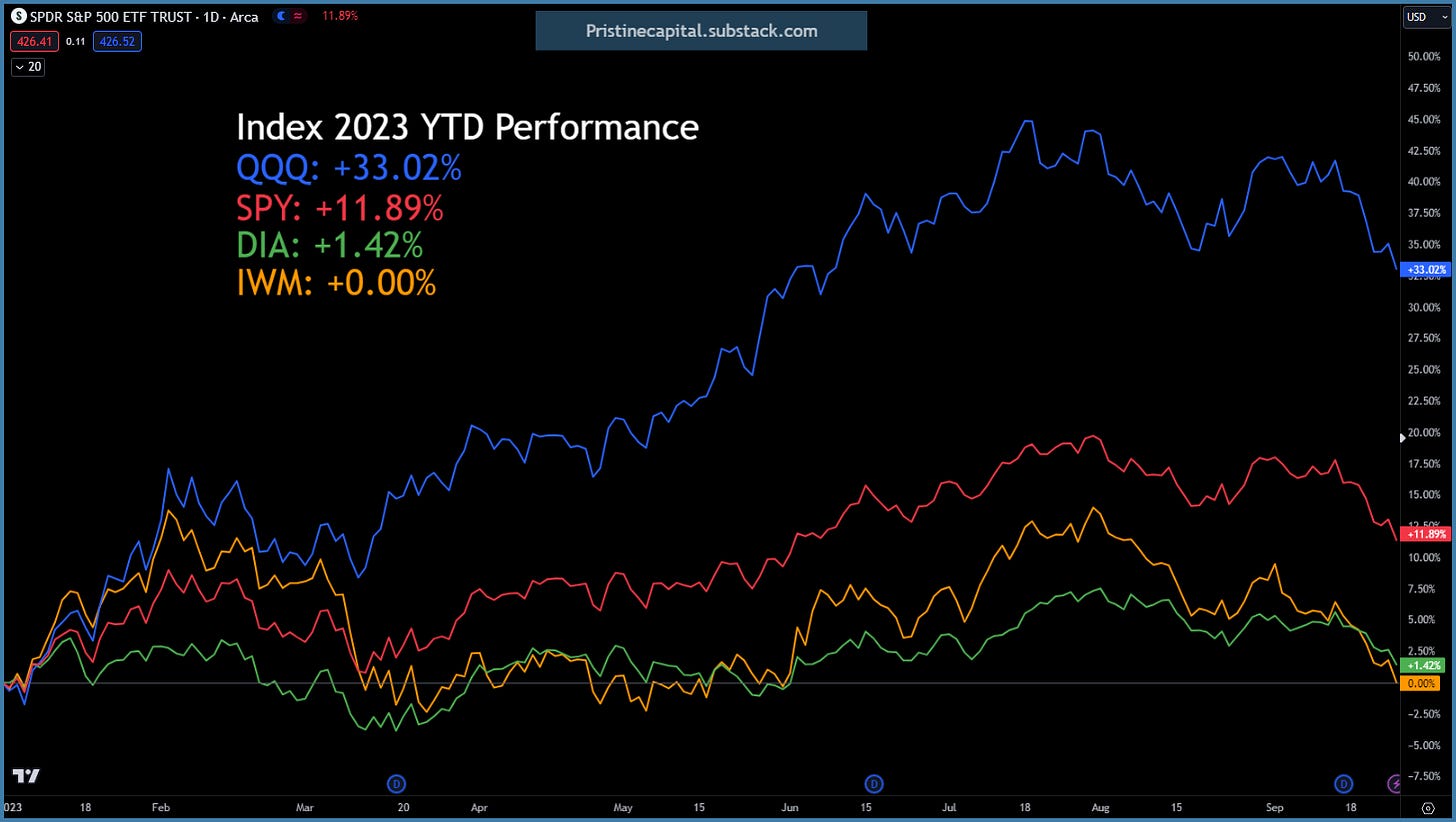

Equity Index YTD Performance

While the indices are currently experiencing a gut-wrenching correction, it is important to zoom out and see the big picture. QQQ and SPY are still sitting on healthy year-to-date gains.

Index Price Cycle Monitor 🤮

ES S&P 500 - Below key moving averages and below monthly value area

NQ Nasdaq - Below key moving averages and below monthly value area

RTY Russell 2000 - Below key moving averages and testing downside VPOC

YM Dow Jones - Below key moving averages and below monthly value area

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities