Pristine Market Analysis & Watchlist 2-6

Beware the Jaws!

Good evening everyone,

We continued to see repricing in the FX and bond markets today, as market participants further digested Friday’s strong NFP report.

We have a lot to cover tonight, so let’s dive in!

-Andrew

We knew a few things heading into today’s session

Equity indices have rallied significantly since the start of the year

Shorts capitulated out of most positions by the latter part of last week

Sentiment is as hot as it’s been since this bear market started

Friday’s jobs report came in hotter than expected, and likely contributed to a minor pullback from overbought conditions

DXY Dollar Index

The dollar index continued to squeeze shorts for the third straight session and finished +.62%. This is a large move for a few days, but the higher timeframe trend is still down.

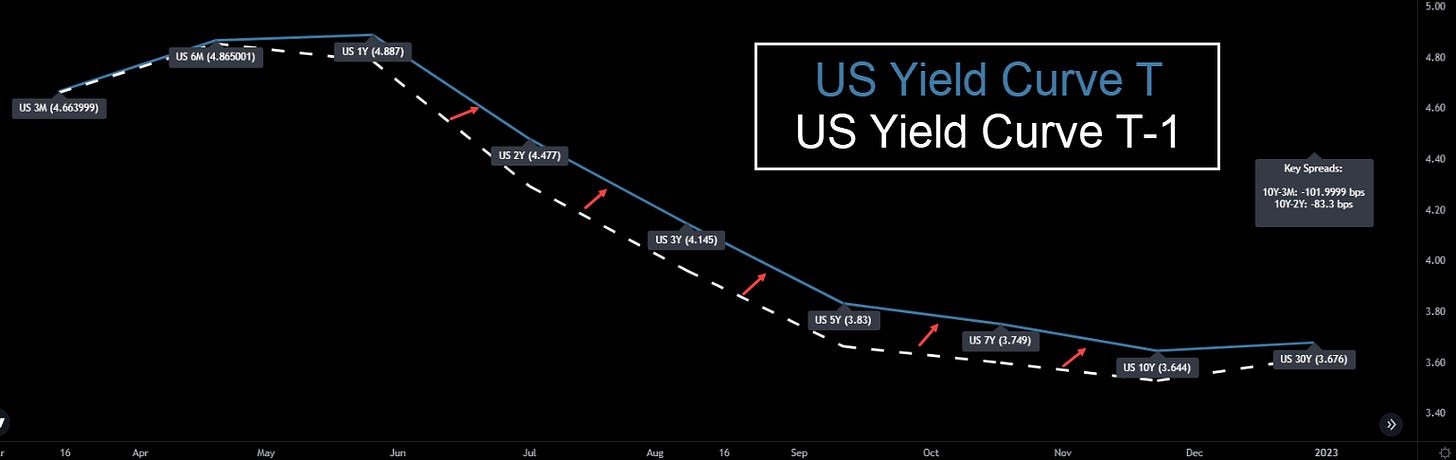

US Treasury Yields

Treasuries sold off across the curve as yields moved higher.

The 10yr treasury futures contract put in an extended range red candle and finished the session below the monthly value area. This made me cautious for today’s session, as every equity selloff throughout this bear market was preceded by a breakdown in the treasury market. We’ve given back almost all of the YTD gains in the 10yr treasury futures as pictured below:

Fed fund futures are now pricing in a more aggressive path of future rate hikes, with the odds of the Fed funds rate landing in the range of 5.25% - 5.50% in June having increased from 4.5% a week ago, to 28.8% today:

As one might expect, this led to a pullback in equities, but they were a bit more resilient than I expected given the carnage in the bond market. The Nasdaq, which typically moves in lockstep with the 10yr treasury futures contract, diverged today. Beware of the jaws!

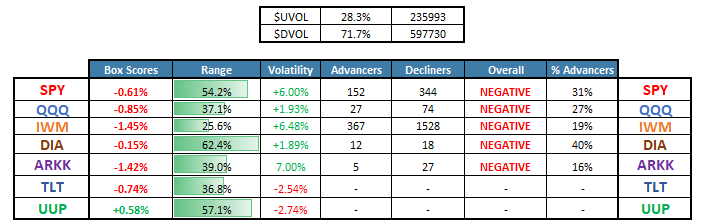

Equity Dashboard

The IWM small caps were today’s relative loser, while the S&P 500 only finished -.61%

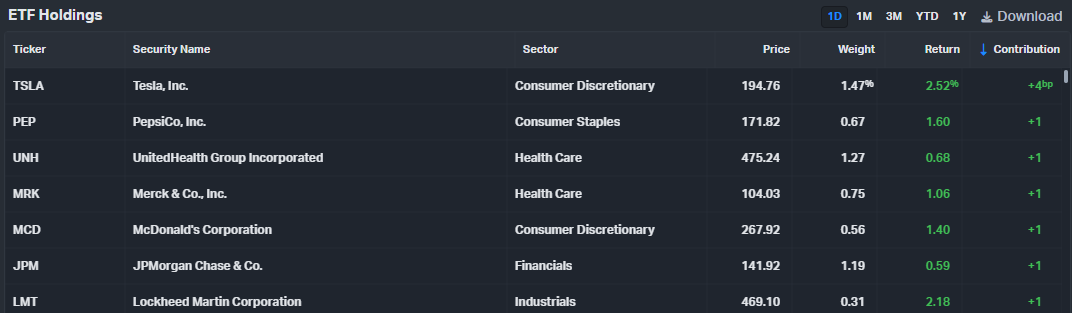

Aside from TSLA, which participated in the blow-off of any and all companies related to the buzz word ‘AI’, defensive names reigned supreme and insulated the SPY from more significant losses. The top positive contributor’s to today’s SPY performance were as follows:

S&P 500 ES_F Price Analysis

On the daily timeframe, today’s pullback only brought us down to the 5-day EMA! Retests of this key moving average happen all time in both uptrends and downtrends, so it doesn’t tell us a whole lot. Let’s zoom in to the hourly chart!

So far this pullback from the highs has been orderly. We tested the weekly point of control (the most highly traded level from last week) ~4,115 multiple times today, but sellers could not hold price below it. I will be watching this level closely during tomorrow’s session! My bias is that we will end up falling below this level, but I must remain open to being completely wrong. If we can’t close below it, we must remain open to a retest of the top of value at ~4,182.25

Sectors - Ranked by Momentum

Almost every day since the beginning of the new year, market participants rotated their money out of defensive areas of the market and into risk-on areas, but today was a change of character, in that the best performing groups were XLU utilities, XLP consumer staples, and ITA aerospace & defense

Earnings on Tap

We are covering all of the following reports and earnings reactions in Discord

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities