Pristine Market Analysis & Watchlist 10/30

Equity Bounce into Fed Wednesday

Team,

One day does not a trend make, but it’s great to see some green on the screen for a change. Fed meeting incoming Wednesday. HAGE 🍻

-Andrew

News/Economic Data

Long-Term Treasuries

Another day, another green candle for TLT. Notice how the red 20-day SMA is catching down to price? This is becoming an easy hurdle to clear 👇

FX Market

DXY dollar index finished below the 20-day SMA. This uptrend is turning into a sideways trend. On a weaker than expected NFP report this Friday, we could see the dollar break down.

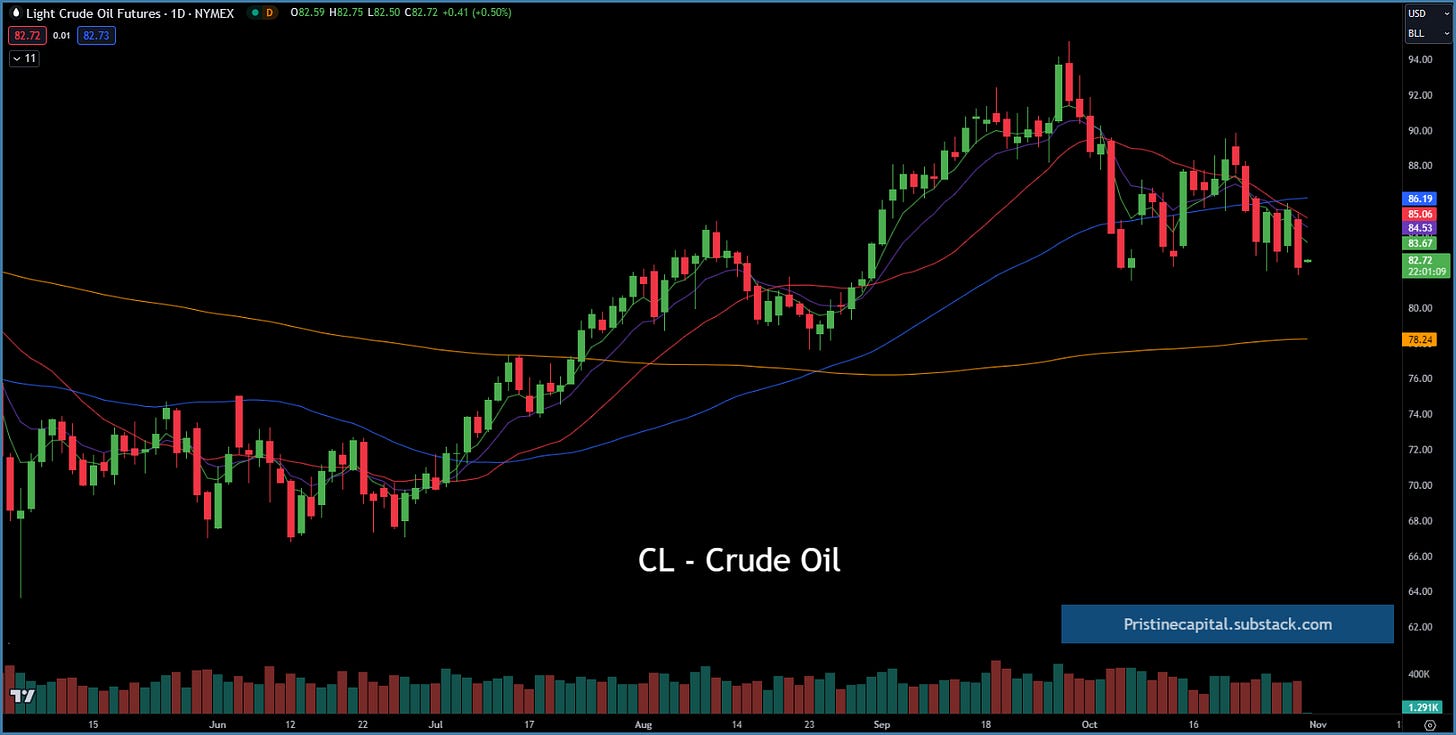

Energy

The geopolitical conflict in the Middle East is spooky, but the energy market isn’t phased. Crude oil has given back most of the fall gains.

Equity Dashboard

One day doesn’t make a trend, but it is great to see 70.7% equity advancers✔️

Equity Index October Performance

0 out of 4 tracked indices are in positive territory MTD. The IWM small cap underperformance is extreme. Barring the end of the world, we are expecting a small cap bounce!

Index Price Cycle Monitor

The Dow Jones poked above its 5-day EMA, and the other indices are close behind 👇

ES took out a downside VPOC at ~4,152. This is a logical spot for a bounce.

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities