Pristine Market Analysis & Watchlist 10/26

The Demise of the Magnificent 7

Team,

The leading stocks are typically the last to fall in a significant market decline. The Magnificent 7 have been the YTD leaders, and they were demolished during today’s session. Remember, it’s always darkest before the dawn! HAGE 🍻

-Andrew

News/Economic Data

Durable goods orders hot 🔥

Q3 GDP growth hot 🔥

Initial Jobless claims above expectations 💧

Long-Term Treasuries

Despite two red hot economic reports, the Bill Ackman bond bottom held 👇

FX Market

DXY dollar index put in a gravestone doji candle, which favors a downside reversal.

Energy

Crude oil remains in check!

Equity Dashboard

The headline indices SPY and QQQ took a nasty spill, but 53.6% of stocks advanced! The IWM small cap index finished in positive territory ✔️

The Magnificent 7, which has been the most crowded trade all year, unwound.

Equity Index October Performance

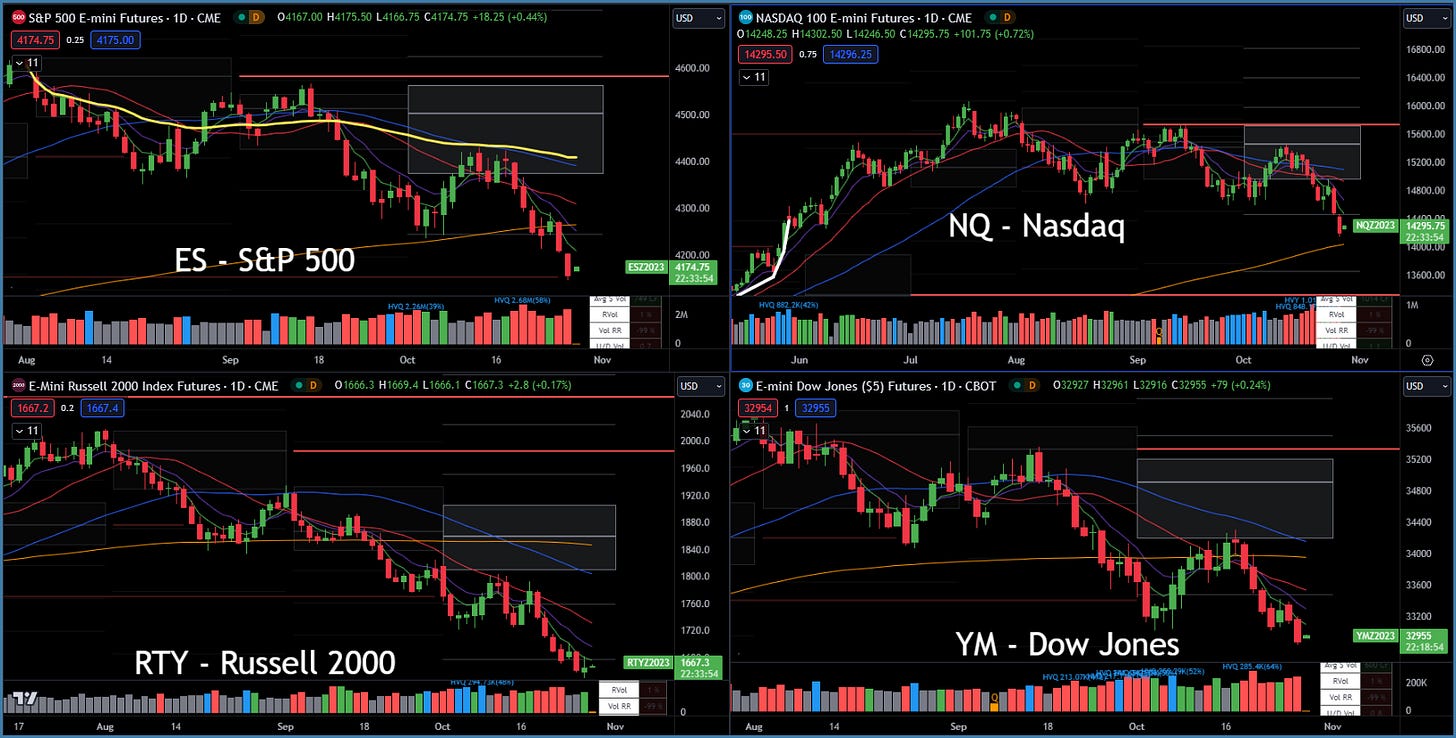

0 out of 4 tracked indices are in positive territory MTD. The IWM small cap underperformance is extreme. Barring the end of the world, we are expecting a continuation of today’s small cap outperformance.

Index Price Cycle Monitor

Indices remain below their short-term moving averages 👇

ES took out a downside VPOC at ~4,152. This is a logical spot for a bounce.

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities