Pristine Market Analysis & Watchlist - 1/5

On the Cliff's Edge

Good evening everyone,

Must…get…out…of…this…trading range!

We have a lot to cover tonight, so let’s dive in!

-Andrew

The Big Catalyst

We must begin tonight’s newsletter with the key catalyst that set everything else in motion today:

At 8:30 AM ET, the ADP employment report came out 56.6% higher than expected! The federal reserve explicitly stated that they would like to see softness in the labor market to ensure that inflationary pressures are in the rear view mirror, so this unexpected labor market strength served as a shock to both the FX market and bond market:

FX Market

The dollar index ripped higher immediately after the ADP report was released:

The USD finished the session +.86% (+.97 ATR), and strengthened vs all peers:

Dollar strength was a major source of equity market weakness last year, so it came as no surprise that equities struggled today

Short-term Treasuries

A stronger labor market could lead the fed to hike the fed funds rate to a higher level than previously anticipated and/or leave it elevated for longer than expected, putting upward pressure on short-term yields. The 2yr treasury futures contract also sold off in reaction to ADP, finishing -.14% for the session. This doesn’t sound like much, but it was a full 1 ATR move for this instrument!

Against the backdrop of outsized premarket moves in both the FX and bond market, we knew that today would be an uphill battle for stocks:

Equity Dashboard

38.1% market advancers, with relative weakness in megacaps vs small caps

The TLT long-term treasury ETF gapped down, but closed on the high-of-day 💪

Finviz Heatmap

You might want to cover your eyes for this. The megacap tech sellers that emerged in early December are still at large!

Yesterday’s bounce in the semiconductors was given back, and XLE energy stocks finished green

S&P 500 ES_F Price Analysis

I have good news and bad news. The good news? We are still trading inside of the prior two weekly candles. The bad news? We are testing the low end of the range headed into tomorrow’s NFP data:

S&P 500 ES_F Stuck in a Balance Area

While we must now give the directional edge to the market bears, we remained in balance for the 13th consecutive trading session:

Net New Highs/Lows

Remember that day we made net new highs? That was fun. Today we flipped right back to red with 19 net new lows:

Nasdaq NQ_F Price Action Analysis

The Nasdaq finished -1.47% on the session, is working on it’s 5th consecutive red weekly candle, and closed directly on the yearly value area low of ~10,847.5. We are fast approaching a make-or-break moment for megacap tech:

Below the yearly VAL, the next two downside reference points are the prior lows from 11/14 (~10,644) and 10/13 (~10,496) 🚨🚨🚨

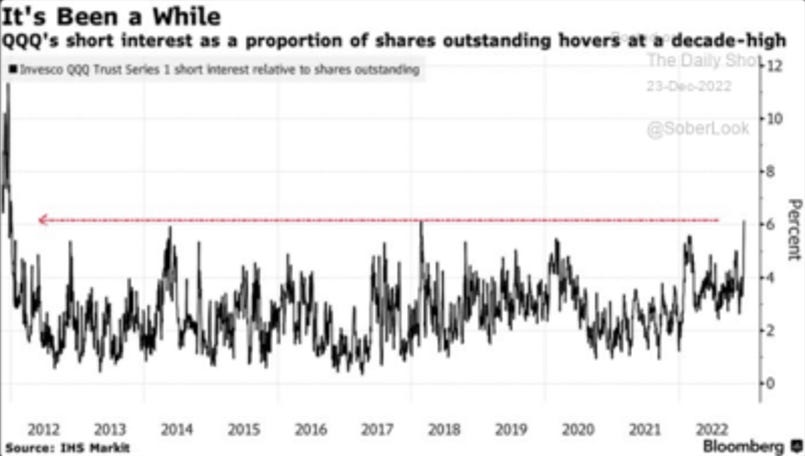

Nasdaq QQQ Short Interest

This is all occurring while there is record short interest in the Nasdaq ETF:

Sectors - Ranked by Momentum

China KWEB continues to march to the beat of it’s own drummer:

Key Takeaways

The FX and bond markets provide valuable clues for equity traders

The S&P 500 is still stuck in balance

Tomorrow’s NFP data presents more binary event risk

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities