Pristine Market Analysis & Watchlist 9/14

The S&P 500 Fails the Breadthalyzer Test

Team,

The PPI came out flaming hot! But the market…doesn’t care? Let’s take a look at the market we have in front of us, which is quite different than the market we might wish to see. Keep your head up Team!

-Andrew

Economic Data

Both PPI and Retail sales came out higher than expected this morning.

PPI MoM +.7% vs +.4% Est

Retail Sales MoM +.6% Est vs .2% Est

PPI YoY increased from .83% to 1.63% and YoY Core PPI decreased from 2.38% to 2.16%. Core PPI excludes food and energy prices. It’s a good thing no one spends money on food and energy right? 😉

But more important than the data itself, is how the market reacted. Let’s take a look 👇

FX Market

The dollar index put in a bullish candle within a bullish trend channel.

Bonds

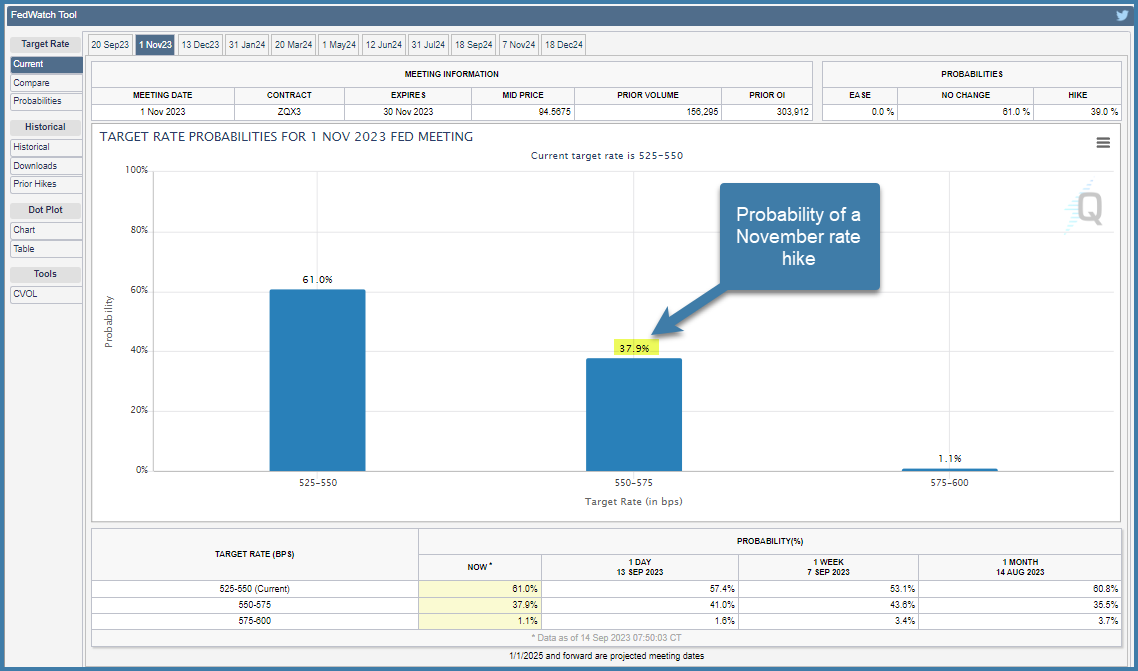

The probability of a November rate hike declined from 41.0% to 37.9%. There is a good chance that the fed hiking cycle is over.

Long-term US treasuries finished the day with red candles, and they are now trading toward the lower end of their tight consolidation patterns. We have no confirmation that the selling in bonds is over.

Equity Dashboard

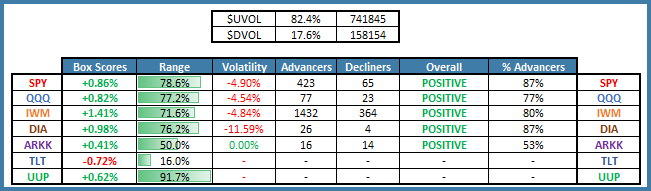

IWM Small caps led equities higher.

With this said, one day does not a trend make. The Nasdaq QQQ outperformance vs IWM Small caps we are seeing is unprecedented.

Equity Index MTD September Performance

The indices have largely chopped sideways in September.

Index Price Cycle Monitor

ES S&P 500 - Above key moving averages and above monthly value area

NQ Nasdaq - Above key moving averages and above monthly value area

RTY Russell 2000 - Above 20-day SMA and monthly point of control

YM Dow Jones - Above key moving averages and testing monthly point of control

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities