Pristine Market Analysis & Watchlist 4/5

High Risk/Low Edge

Team,

This market is tough, but I am confident that we will weather the storm! Let’s find out what we’re made of 🔥

-Andrew

The Big Picture

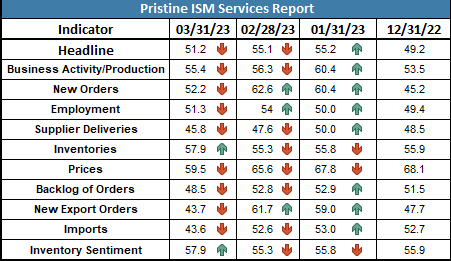

We recently learned that the manufacturing sector is in a deep decline via the ISM manufacturing report. Today we received ISM services data, and while it was still in expansionary territory, it shows that the services sector clearly slowed throughout Q1:

The smart money can easily connect the dots. We are headed into recession, if we are not already in one. And to make matters worse, the data we just received is March data, meaning it does not include any spillovers or behavioral changes that might result from the banking crisis. In summary, we can objectively see that the data is getting worse, and we have logical reason to think that the data can get even worse than it is now, in the future! So where does that leave us from an investing perspective?

When similar situations occurred in the past, the fed would cut rates and ease monetary policy, which tends to be good for asset prices. But this environment is a bit different in that inflation is still too high for the fed to aggressively ease monetary policy. For example, crude oil just ripped off the lows in the mid $60s, to it’s current price above $80!

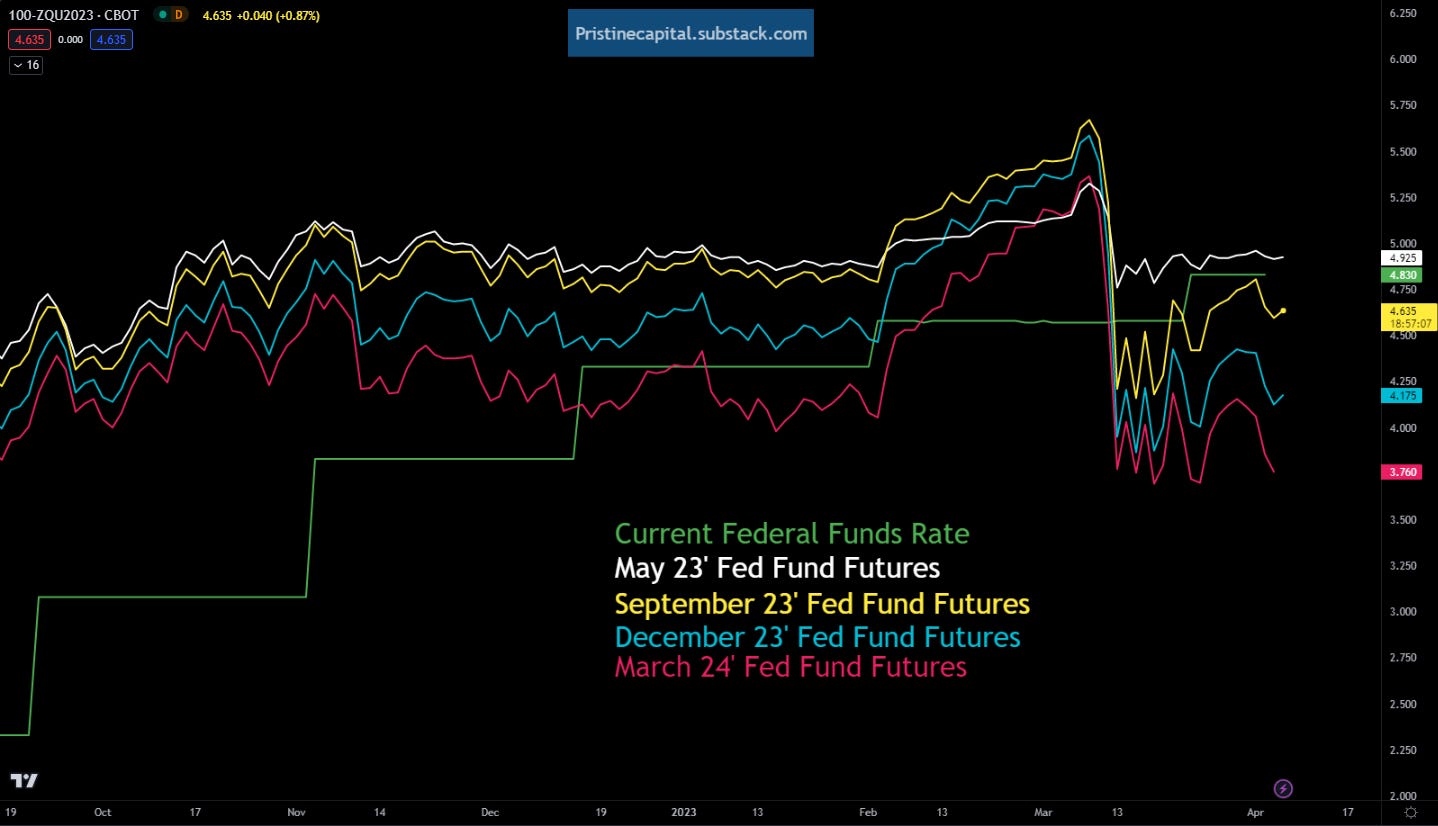

For the time being, the bond market is pricing in that the economic slowdown will outweigh residual inflationary pressures. Bond market participants are currently pricing in about 1 interest rate CUT into September 2023, and more to come in the months following:

So the key question remains… is a recession, paired with more accommodative fed policy, a better environment for stocks than a strong economy paired with a tightening fed?

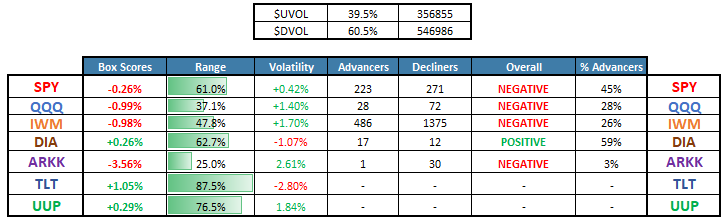

Equity Dashboard

ES_F S&P 500 Price Action Analysis

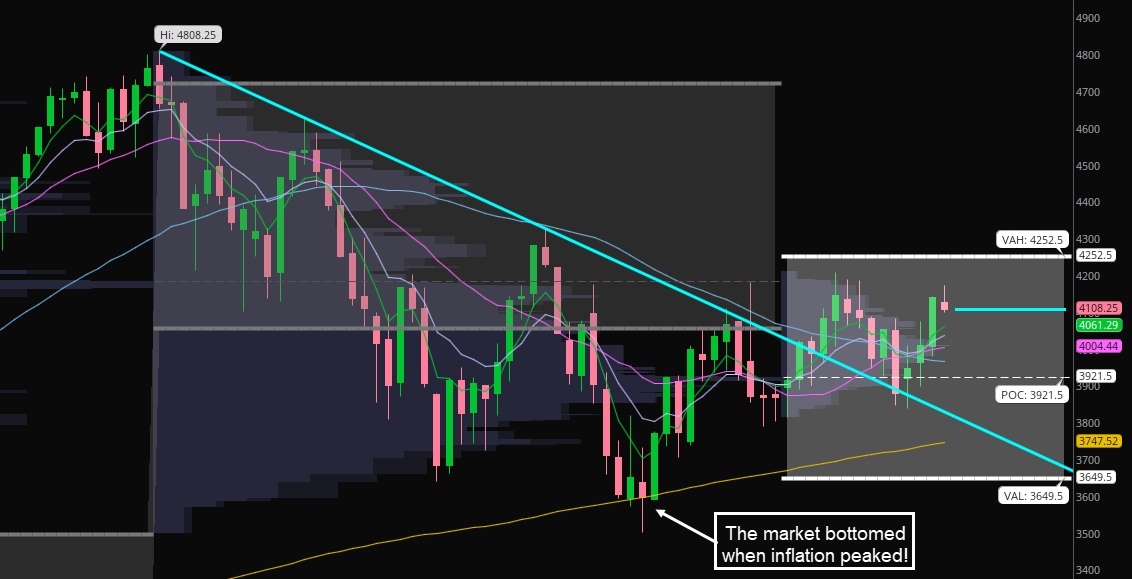

Well…the market bottomed when inflation peaked in October. I don’t think that is a coincidence☟

And let’s not forget…the market ripped higher WHILE THE ECONOMY WAS SHUT DOWN in 2020, because the fed was aggressively stimulating!

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities