Pristine Market Analysis & Watchlist 3/15

Be Like Water

Team,

We are halfway through the third of 12 innings in the 2023 trading year! If you’ve been holding your own and protecting your capital over the last two weeks, you’re doing a great job, and if you’ve made a few bucks, you’re a rock star! Our approach to the market this month continues to be to optimize for defense, and let others make the big mistakes. Keep up the good work!

-Andrew

I woke up this morning as I usually do…to my cat Waffles pawing me in the face! 😂I checked my phone, and was astonished to see the following:

Another bank blowing up. Cool. But that was just the appetizer!

PPI Data

The US PPI report added another layer of complexity. The MoM number came in at -.1% vs a +.3% consensus estimate:

YoY PPI declined to +4.6%. YoY and is now trading in-line with the current fed funds rate of 4.5%-4.75%. I don’t see inflation as being out of control anymore.

I believe that if the PPI report had come in hot today, the stock market would have completely imploded, but the light number was our saving grace!

Bond Rally

Fed fund futures are pricing in a 45.4% chance of no rate hike at the March 22nd meeting, and a 54.6% chance of a 25 bps hike. It’s a toss-up!

Looking further into the future, most fed fund contracts made new lows! The March 24’ contract is pricing a 3.6% Fed Funds rate, which is almost a full percentage point lower than where it is today!

CL_F Crude Oil

Crude oil is now trading at $68.50/barrel, down from it’s peak of $130.50/barrel. And people are still screaming their heads off about rampant inflation! It never ceases to amaze me how behind most market participants are. When inflation was ramping higher, most market participants had their heads in the sand and didn’t see it. Now inflation is clearly headed lower, and they don’t see that either! 😂

Equity Dashboard

Equity indices finished mixed. The IWM small cap index is a victim of this banking crisis, as it has direct exposure to the regional banks at the heart of the issue. But the Nasdaq QQQ and ARKK innovation ETF finished in positive territory. Not bad all things considering:

We added a few test trades on the long side today, one of which was MSFT:

ES_F S&P 500 Price Action Analysis

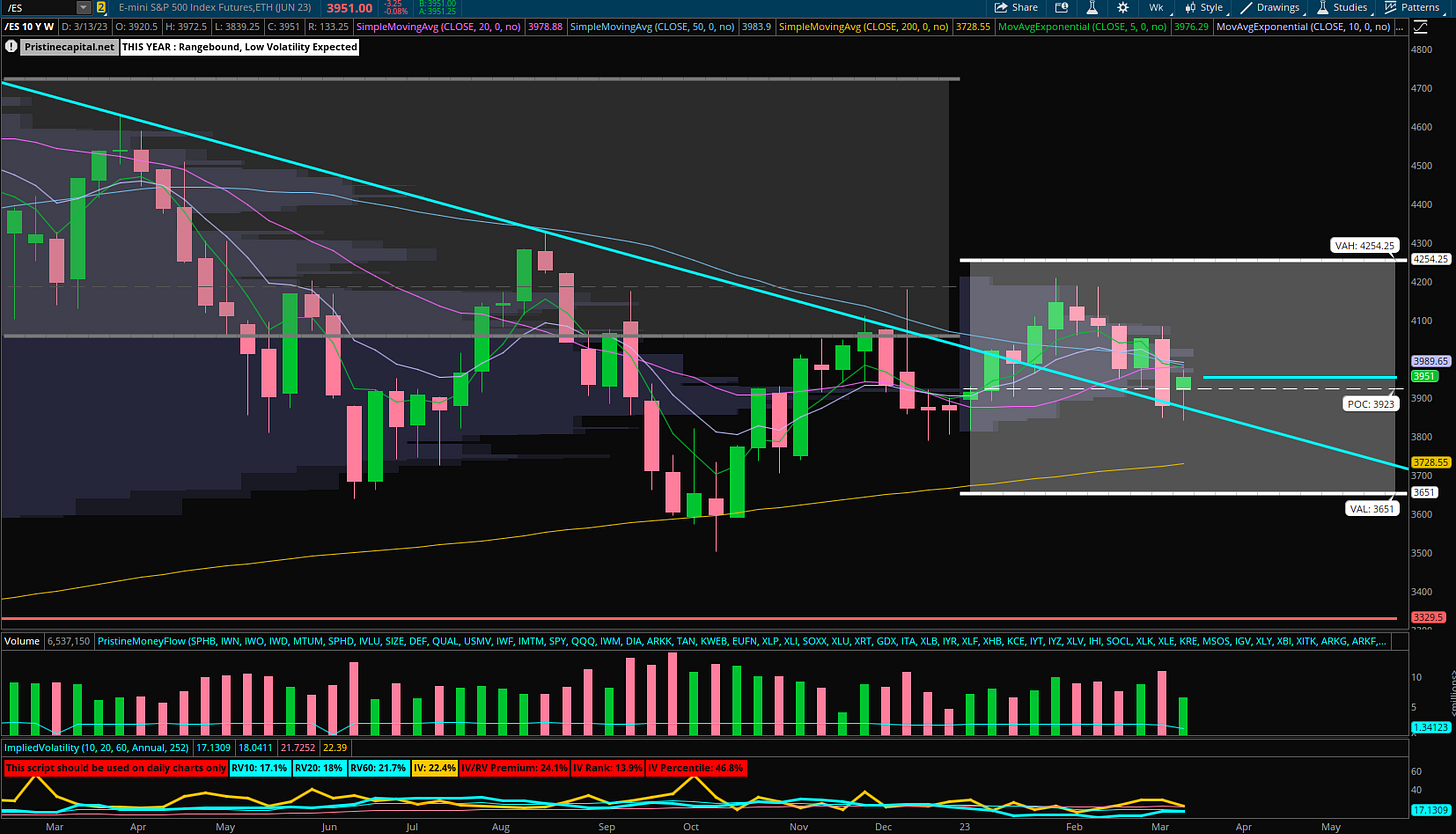

The S&P 500 found support at the teal downward trendline, and also finished above the yearly point of control ~3,923. The bearish narratives and bank implosions are not lining up with the underlying price action in the market.

Zooming in to the daily chart, the market has been rangebound for the past four sessions, and had a nasty intraday undercut of the prior day’s low. I’d imagine that many longs were shaken out intraday…but the market failed to implode!

And finally, zooming into the hourly chart, the ES has shaken out below the weekly value area low multiple times, but has failed to follow through below it! We found our way back into the weekly value area in the after hours session, and it would not surprise me at all if we tagged the weekly POC ~3,988 into Friday’s opex.

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities