Pristine Market Analysis & Watchlist 2/13

All Puts Go to Heaven

Team,

Tomorrow is a huge day! The highly anticipated CPI is coming, and with it, a large directional move in equities. Be sure to eat your Wheaties!

-Andrew

In our weekend market analysis video, we outlined a myriad of reasons as to why the risk/reward is skewed to the downside ahead of CPI.

But the equity market finished with a green candle today and that changed everything! Just kidding. The asymmetric setup into the end of February and March remains. Nothing has changed!

Let’s take a look at today’s action, and what to look forward to for tomorrow’s CPI print

Equity Dashboard

Strong breadth today but market volatility did not confirm the rally.

All SPY Puts Go To Heaven

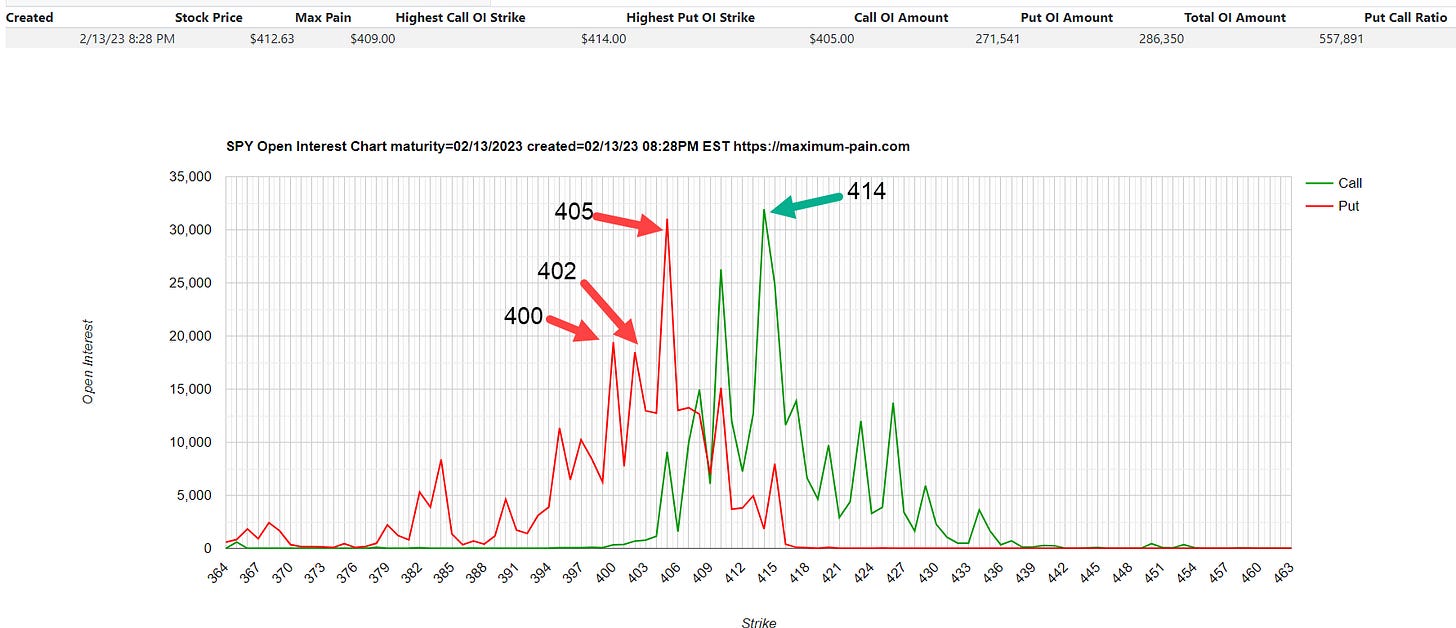

We’ve cited the positive stock buyback associated with legacy put option positions decaying into the 2/17 options expiration for the last two weeks. For today’s 2/13 expiry, there was a heavy concentration of SPY put options at the 400 strike, the 402 strike, and the 405 strike, and a heavy concentration of calls at the 414 strike. Lo and behold, SPY ended the session at 412.83, expiring all of these options worthless! I believe most market participants are reading too much into today’s price action, and that it was just a max pain close into CPI.

But keep in mind, the positive flows associated with options positioning end in two sessions on 2/15. The window of opportunity for market downside is opening, and it’s happening at a time that investors believe the market ‘can’t go down’.

SPY Price Action Analysis

The S&P 500 topped on Feb 2nd, and has been stair-stepping lower in a narrow channel ever since. We closed at the upper end of the channel today. This is a max pain/max ambiguity close! I’m sure there were market participants that threw in the towel and got bullish into resistance today! I was not one of them.

Divergences

The Crypto market did not confirm today’s equity action

And neither did the treasury market

Neither did the MOVE index, which measures bond market volatility 😂

Neither did VVIX, which remains at the highest level since October

I voiced these divergences to a panel of my peers on multiple Twitter spaces today, but I was the lone bear! Everyone believes the market ‘wants to go higher’

Maybe they are right and the market does want to go higher. But we have to align our portfolios with what we perceive the probabilities to be, and to our own tolerance for risk.

Let’s take a look at what big banks are pricing in for CPI ☟

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities