Pristine Market Analysis & Watchlist 3/23

The Fed Has Lost Control

Team,

Way to stay disciplined in such a crazy market! We have a lot to cover tonight so let’s dive in!

-Andrew

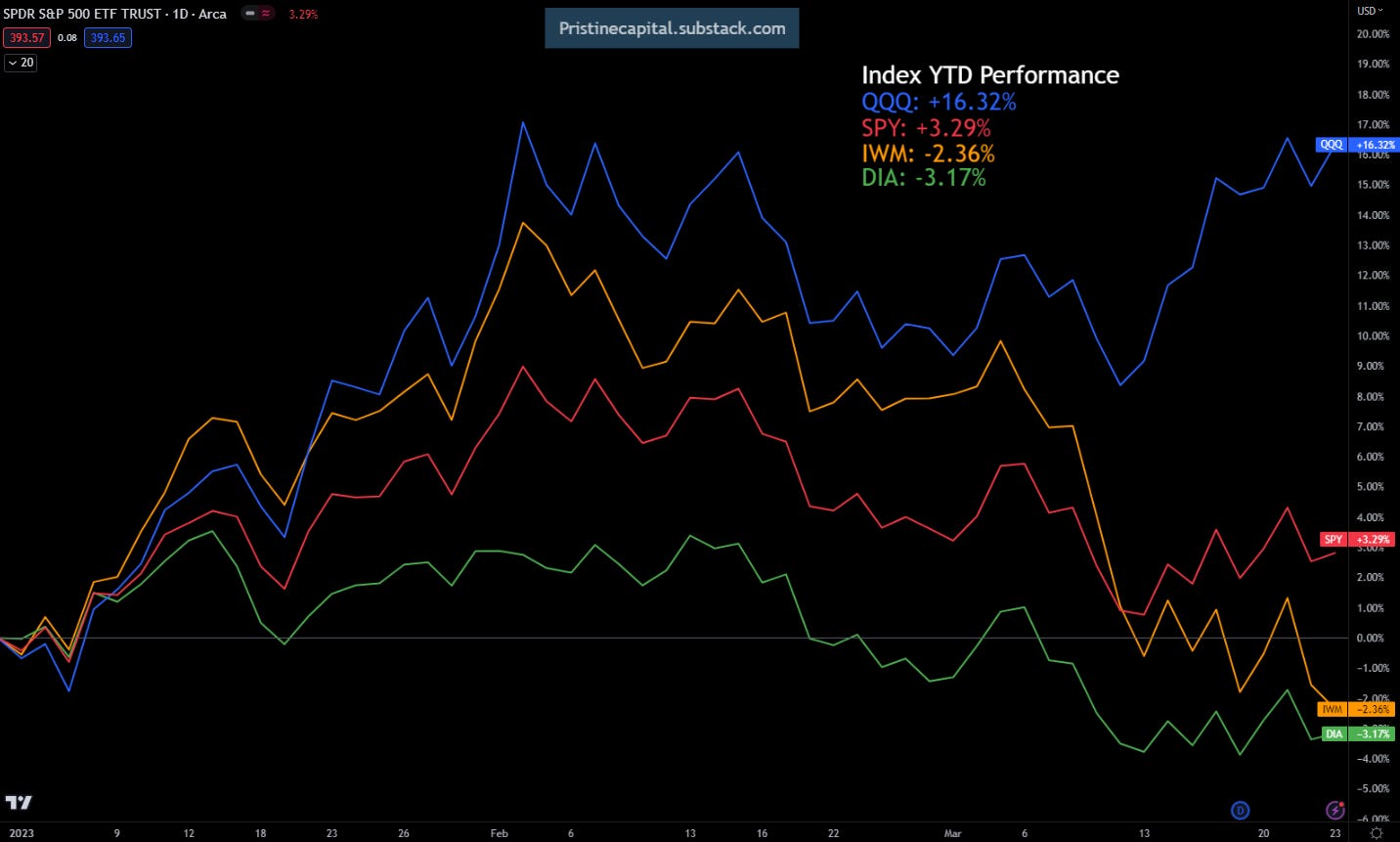

Year-To-Date Scoreboard!

With emotions running high, and quarter-end fast approaching, let’s take a step back and see how the scoreboard is looking!

If you are frustrated that you haven’t doubled or tripled your account yet, just remember that there is no rush. The S&P 500 is +3.29% YTD, and the Russell 2000 is -2.36%!

Check out the following video for some perspective from a veteran regarding how important it is to stay centered and not rush the trading process: https://youtube.com/shorts/74BxSM13mRA?feature=share

The Big Picture

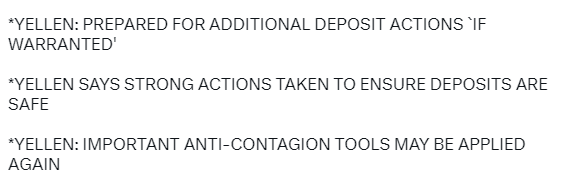

We are trading through a banking crisis, and here is the latest update from our Fed/Treasury overlords:

Janet Yellen went from saying that all US bank deposits would be ensured last week, to saying that this idea was no longer being considered yesterday during the Fed meeting, to now today reversing course once again! We can’t make this stuff up! It’s easy to see why the market can’t move in a clear direction given this uncertainty from policy makers in addressing the crisis.

As always, let’s take a look at the market reaction to these developments via the lens of market generated information.

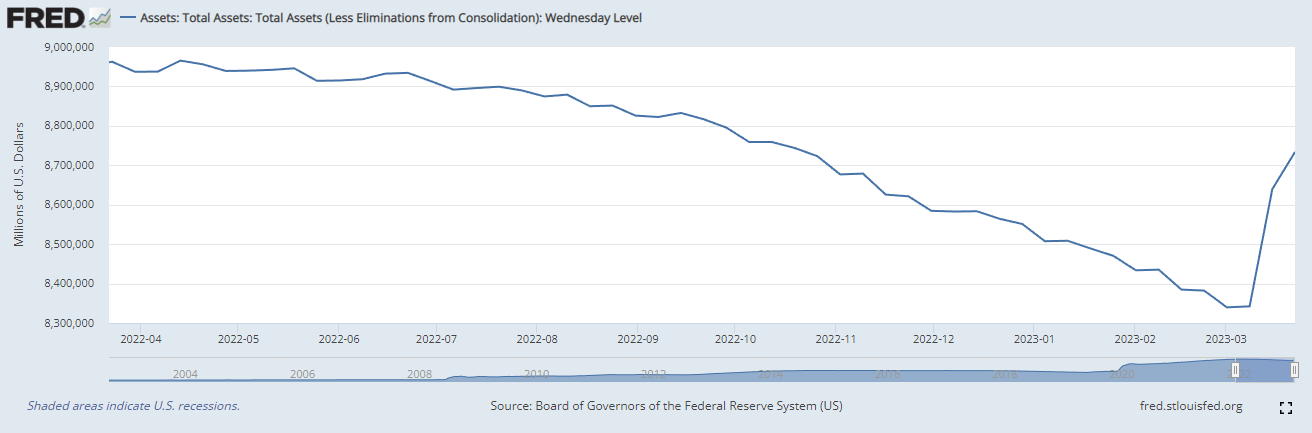

Oh yeah. The Fed just added ~$400 billion to it’s balance sheet and erased ~2/3 of it’s QT program in just a few weeks!

Treasuries

The ZN_F 10yr treasury futures have been bid ever since the crisis broke out and the fed money gun turned on. The system depends on perpetually depressed US bond yields!

Dollar Index

The dollar index has given back almost the entirety of it’s gains since we received hot inflation reports to kick off the year and investors thought the fed was going to raise rates and keep them higher for longer. Based on market generated information, the higher for longer thesis is dead.

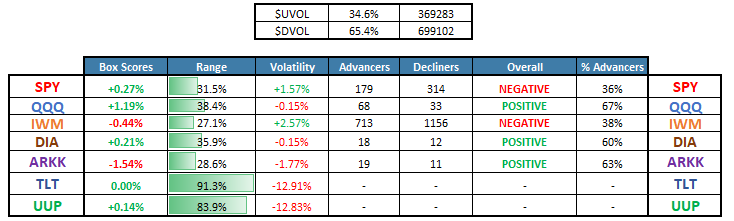

Equity Dashboard

US equity indices were bid today, but breadth was weak with only 34.6% advancing issues. Investors are clearly rotating money out of everything economically sensitive and putting all of their eggs into the megacap tech basket.

This creates a high risk/low edge market environment to navigate. Defense wins championship!

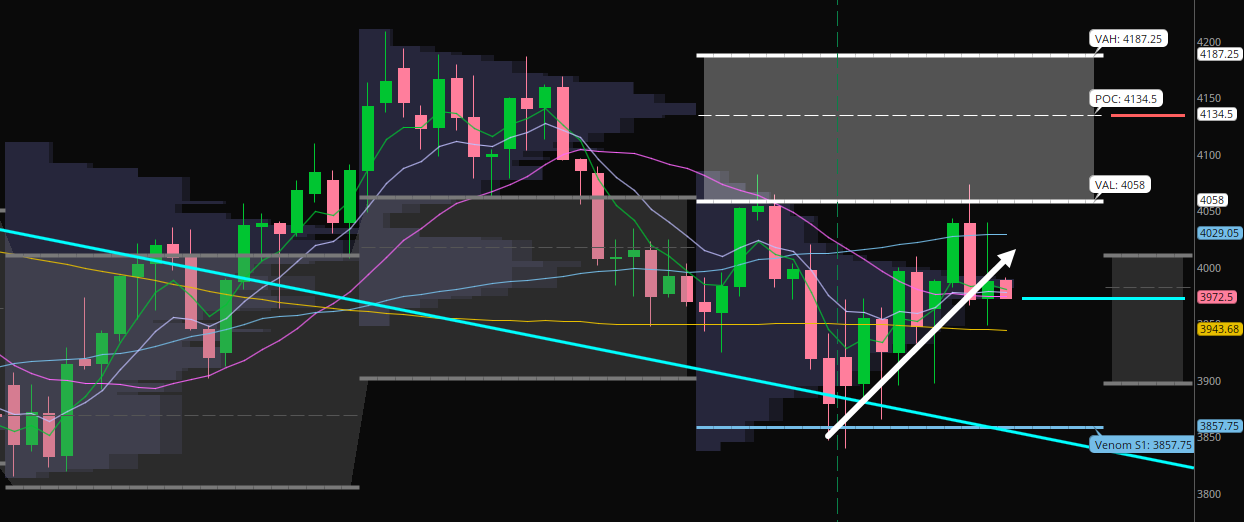

ES_F S&P 500 Price Action Analysis

Look at the below chart for one second only. Now look away. Did your eyes light up as they recognized one of your favorite technical setups?

Everyone is different, but mine certainly did not! This chart looks like something out of a trading horror movie! Once again….defense wins championships!

Let’s continue the discussion below. Goodnight free subscribers!

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities