Pristine Market Analysis & Watchlist 7/10

Picking up Pennies in Front of a Steamroller

Team,

CPI comes out this Wednesday! Let’s take a look at the setup into this highly anticipated event.

-Andrew

Economic Data

Used car prices fell on a MoM and Yoy basis. Deflationary!

Consumer inflation expectations also declined MoM.

10Yr Treasury Futures

10yr treasuries bounced at support. Finally!

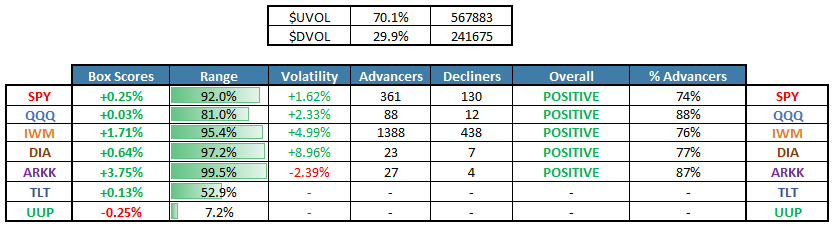

Equity Dashboard

We saw rotation from QQQ megacap tech into IWM small caps following the news that there would be a special rebalance in the Nasdaq 100. We can ascribe any narrative we want to the small cap strength and try to make it seem ‘healthy’, but I believe this rotation is purely mechanical. The indices and volatility are pinned into July opex, and with sell pressure on those top megacap names, small caps function as the release valve.

AAPL and MSFT are the two largest holdings in QQQ, therefore they have the most to lose from the special rebalance.

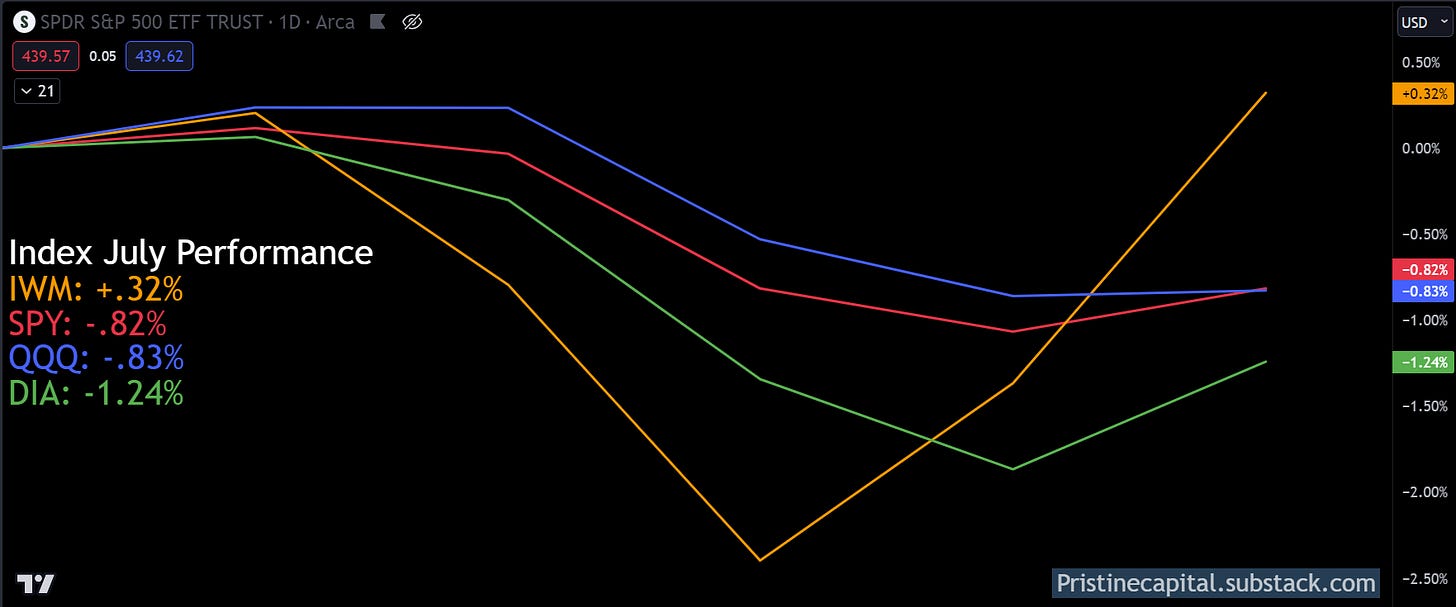

Index MTD July Performance

The IWM small caps flipped into positive territory for the month of July!

Index After Hours Price Action

The S&P 500 is consolidating above the 20-day SMA. The June CPI print comes out on Wednesday 7/12, and we are likely to see a large YoY deceleration in inflation. Is it possible that we break out above the July value area for one last hoorah? Definitely. Would I be a fader of that move. Absolutely.

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities