Pristine Market Analysis & Watchlist 4/20

Waiting for More Information

Team,

I am pleased to share that we received the following email tonight!

As of March 31st, we were in 3rd place for the US Investing Championship, with a +48.7% YTD return. Knock on wood, but so far April has been another fruitful month.

My goal with Pristine Capital is to share my knowledge and process around navigating the market, and use all newsletter proceeds to reinvest back into the group with better datasets, and more edge for all subscribers. If you would like to join this mission, make sure to upgrade your membership if you haven’t already.

-Andrew

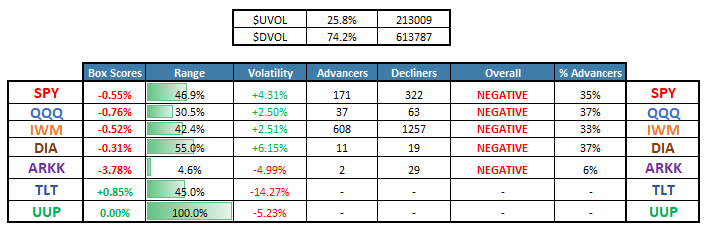

Equity Dashboard

Only 25.8% advancers today. Weak breadth. Nothing to get excited about until we get further information.

TSLA led today’s market weakness after reporting mixed earnings the night before. The two ring leaders for large cap growth stocks over the last ~3 years have been NVDA and TSLA. With TSLA impaired after earnings, the market needs NVDA to come through in a big way when it reports.

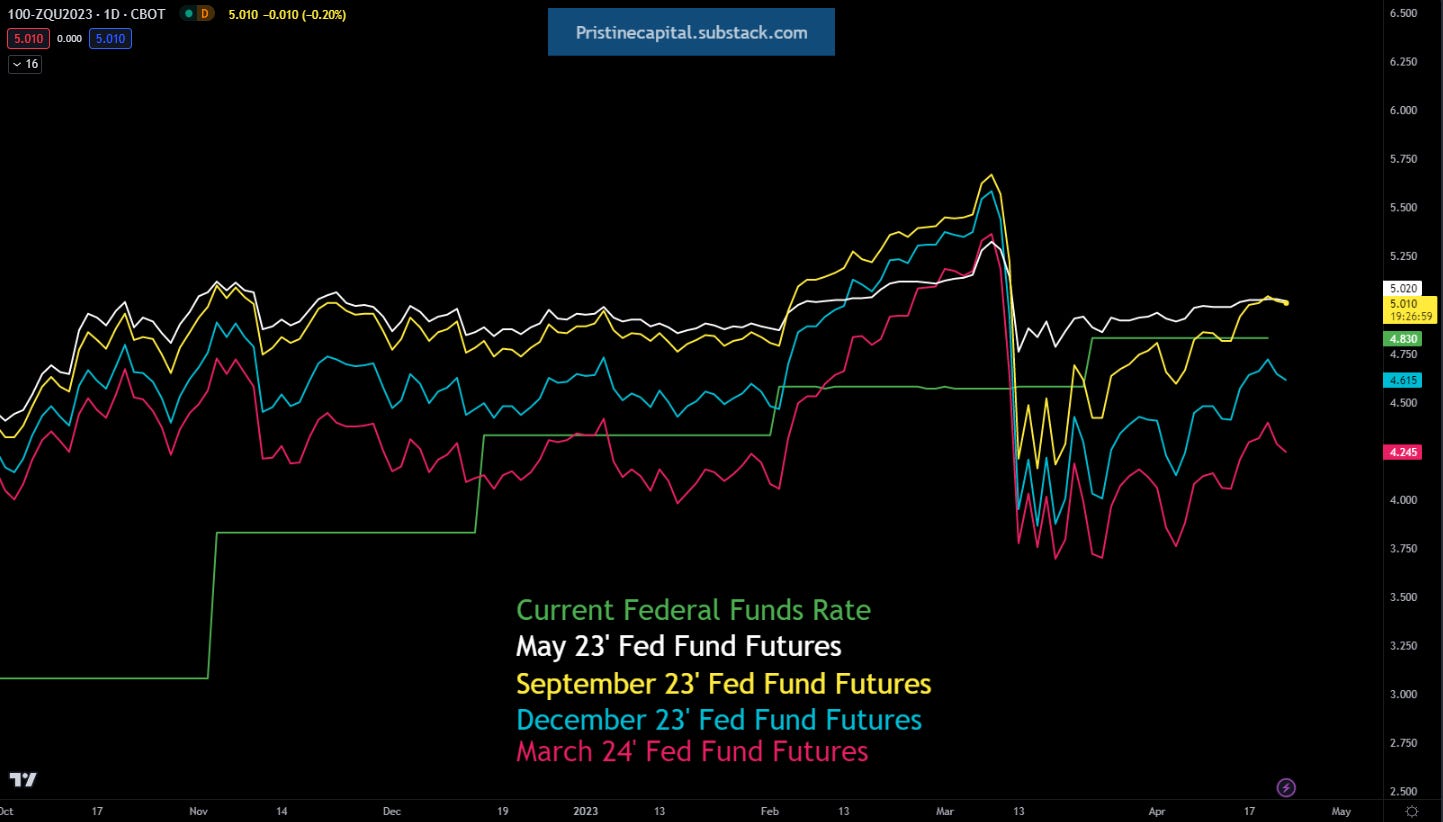

Fed Fund Futures

Fed fund futures continue to move higher as market participants price in a lower probability of immediate economic catastrophe. It is worth continuing to monitor these movements, because the market is still pricing in at least one rate CUT into year end. If the market is forced to quickly price out all rate cuts, that could create ripples in equities.

ES_F S&P 500 Price Action Analysis

Emotions are running high in the market, but overall the price action has been pretty tight for the last three weeks. Take it one day at a time.

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities