Pristine Market Analysis & Watchlist 9/6

The Stock Market is NOT The Economy

Team,

Great news! The ISM Services data came out above expectations! The bad news? The stock market is not the economy! Let’s dive in 👊

-Andrew

Overnight/Economic Data

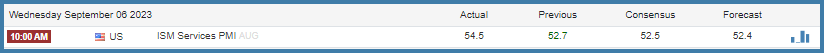

Today’s session kicked off with US ISM Services data that came in better than expected.

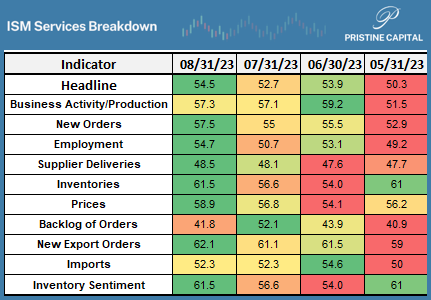

When analyzing the following table, it is important to remember that market participants were hoping for data that confirms the economy and/or inflation is slowing. Unfortunately, the headline number was a multi-month acceleration, as was the prices component 🤦♂️

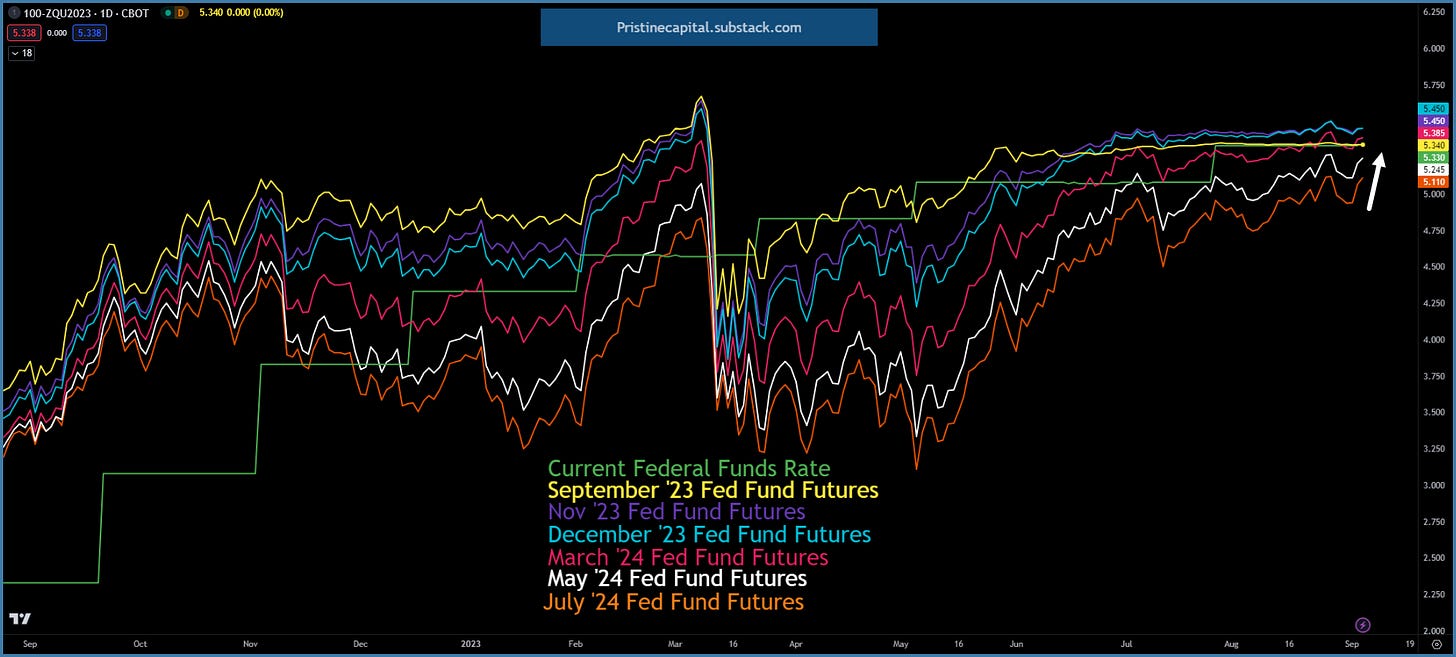

Fed fund futures firmed up on this news.

Long-term treasuries remained in their malaise.

The DXY dollar index remained in its bullish pattern, but is now pretty overbot in the short-term.

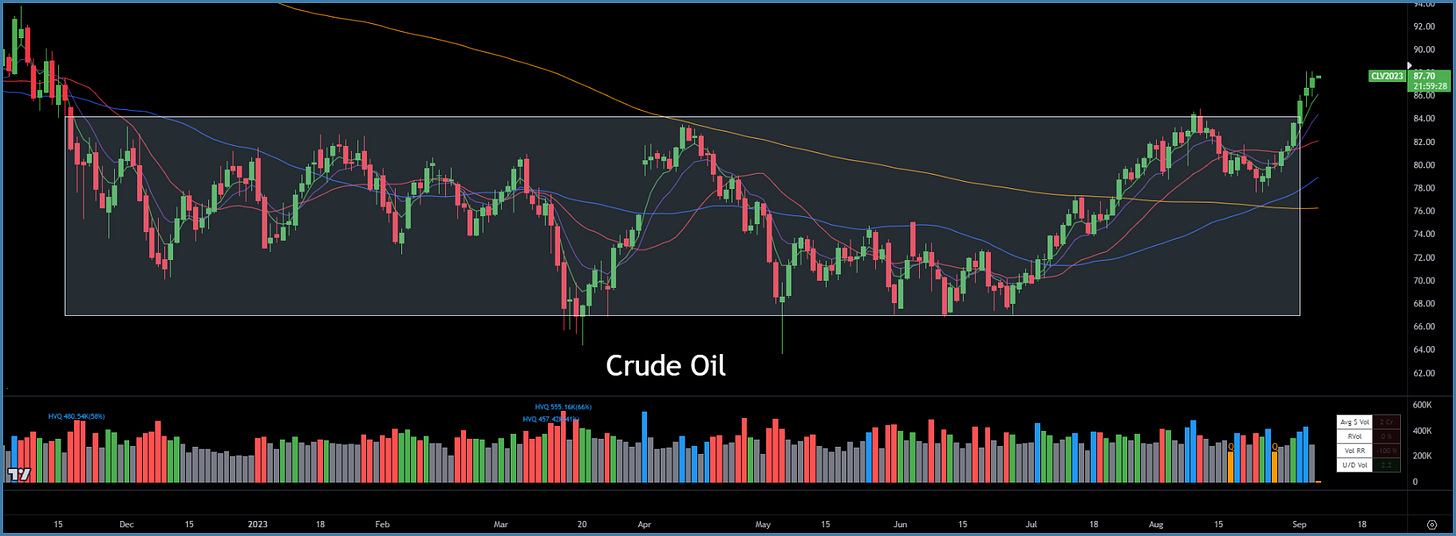

And crude oil continued to climb! Now trading at $87.70/barrel.

Equity Dashboard

Weak breadth, and surprisingly, ARKK outperformed. The market is never wrong, so I must be missing something here, but I wouldn’t expect ARKK to outperform on a day where we get hot economic data.

Equity Index MTD September Performance

All indices are in negative territory for September.

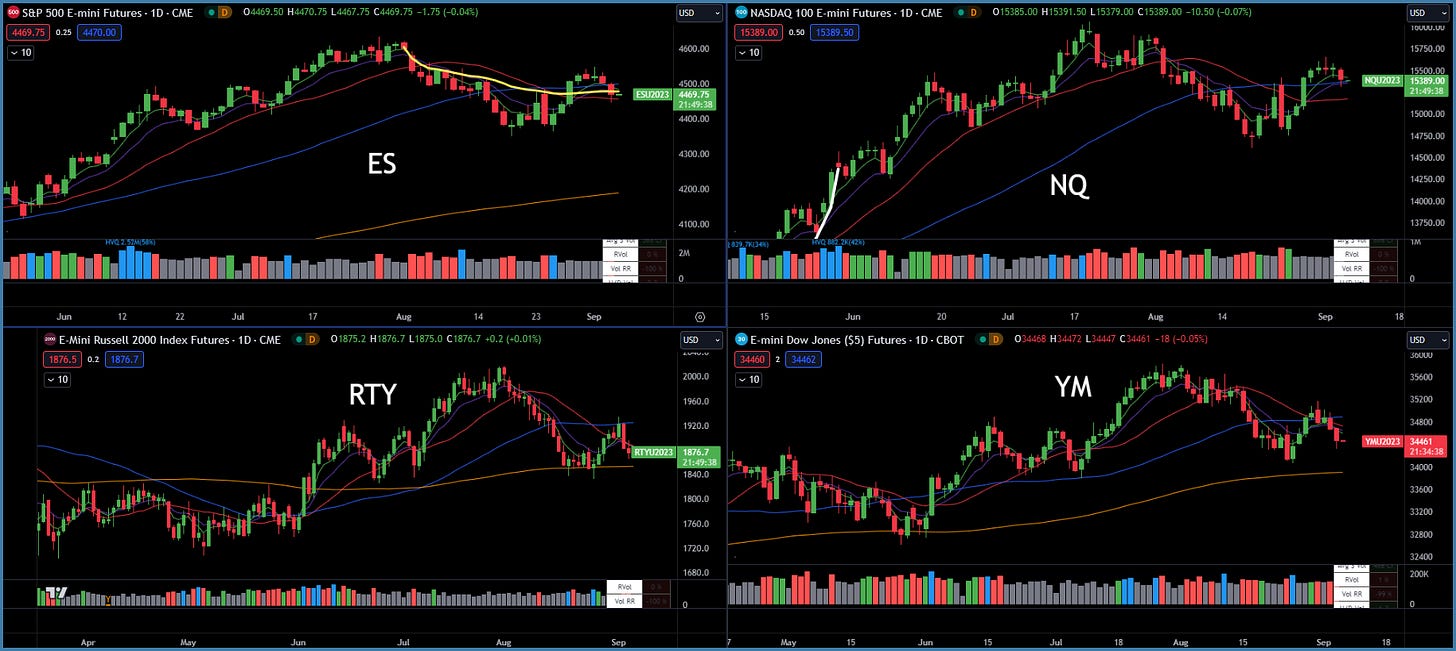

Index Price Cycle Monitor

We have new monthly value areas for September!

ES S&P 500 - Below 50-day SMA & testing 20-day SMA

NQ Nasdaq - Testing 50-day SMA

YM Dow Jones - Below key moving averages

RTY Russell 2000 - Below key moving averages

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities