Pristine Market Analysis & Watchlist 6/20

Equities sag and Bitcoin Soars!

Team,

The tide is beginning to turn. Let’s dive in to today’s price action!

-Andrew

Asia

The Nikkei 225, which has been leading the US Nasdaq 100, is beginning to pull back after hitting extreme overbot conditions

US Economic Data

Today’s US session kicked off with housing data that came in well above expectations

Equity Dashboard

Market breadth was weak, with only 21.6% advancers, TSLA and NVDA were able to keep the headline indices relatively pinned for the session.

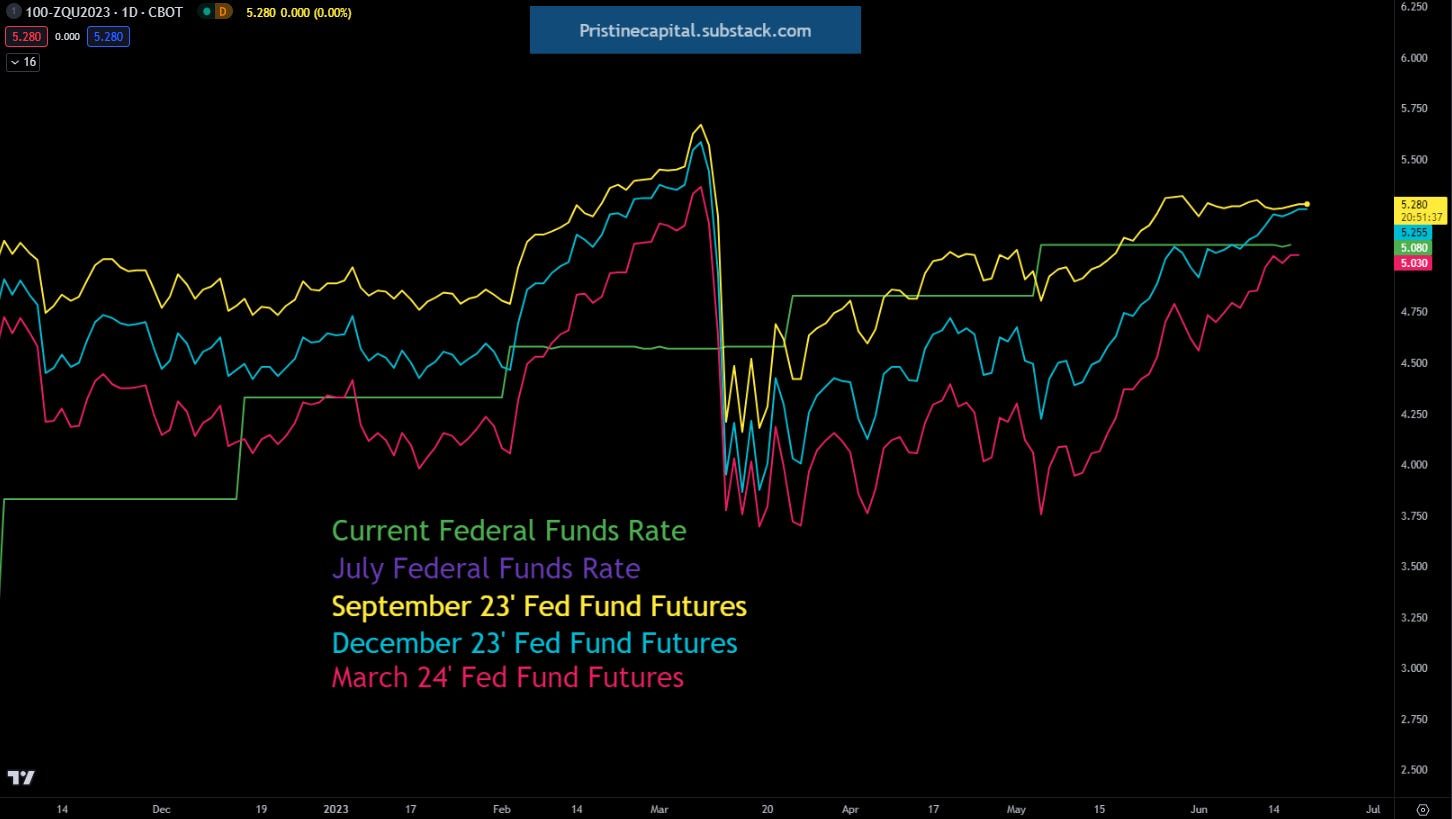

Fed Fund Futures

Markets have gone from pricing rate cuts to an additional rate hike into year end. Surprisingly, this has had no impact on equity markets.

Jaws!

The divergence between Nasdaq QQQ and ZN_F 10yr treasury futures remains.

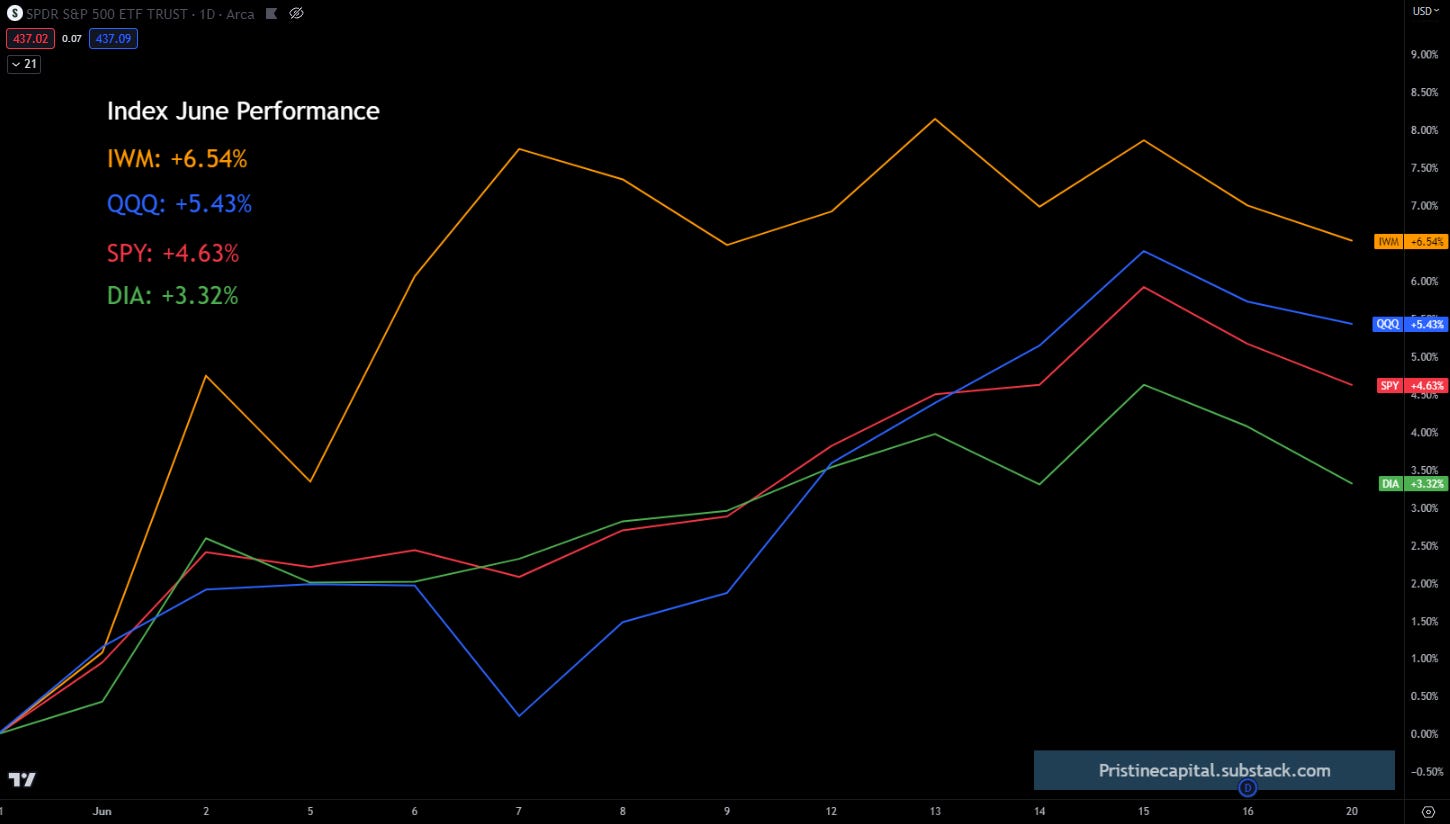

Index MTD June Performance

Index After Hours Price Action

ES S&P 500 -.08%

NQ Nasdaq -.10%

YM Dow Jones -.07%

RTY Russell 2000 -.08%

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities