Pristine Market Analysis & Watchlist 6/21

Rotational Selloff

Team,

Rotational selloff in equities, with a side of vol crush. I believe we are still in the early innings of this selloff. Let’s dive in.

-Andrew

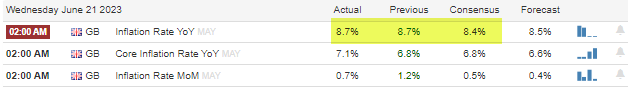

Economic Data

UK inflation data came out hotter than expected overnight, which set the table for today’s US price action.

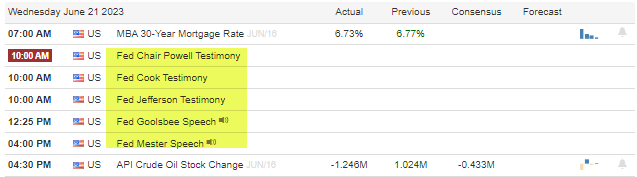

Jerome Powell and other Fed speakers were out and about throughout the US session. While we didn’t learn anything new, Powell reiterated that the fed has intentions of continuing to hike rates later in ‘23.

This was not news to the bond market, which already priced out rate cuts into the end of the year, and has even priced in one additional rate hike.

Equity Dashboard

We’ll call today’s equity session a ‘rotational selloff’. The QQQ and ARKK were relative losers, while the DIA and IWM were relative winners, which is counter to what we’ve seen for the better part of this year.

Index MTD June Performance

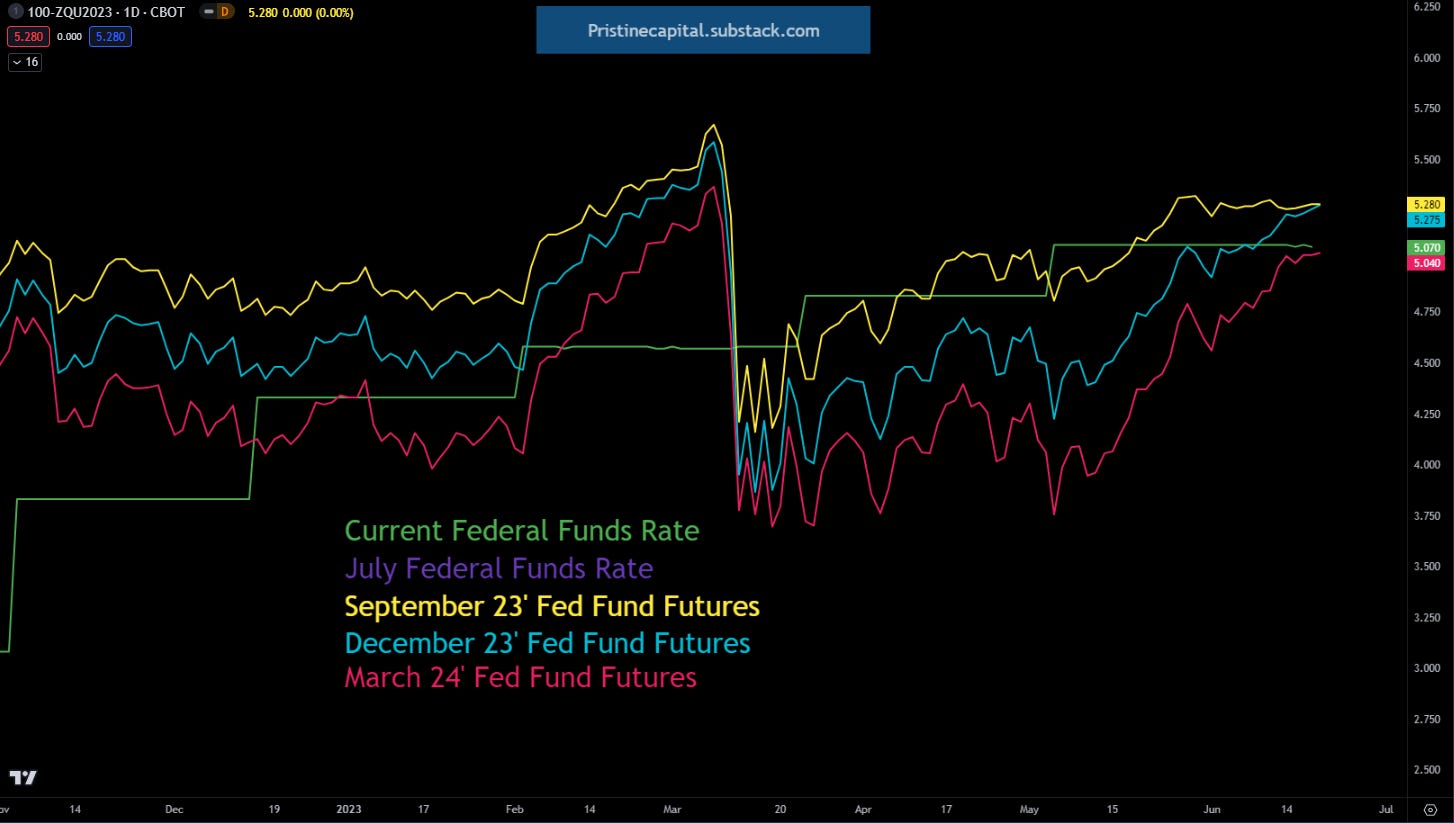

Even after today’s rotational selloff, all of the indices are still sitting on massive gains for the month of June!

Index After Hours Price Action

ES S&P 500 +.05% (10 EMA Pullback)

NQ Nasdaq +.00% (10 EMA Pullback)

YM Dow Jones +.07% (10 EMA Pullback)

RTY Russell 2000 +.04% (10 EMA Pullback)

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities