Pristine Market Analysis & Watchlist 11.27

📉Economic Slowdowns are Bullish for Bonds

Median sale price of new homes fall 18% YoY → Bonds rally

Team,

The market is slowly but surely pricing in an economic slowdown. Let’s take a look under the hood and see how we might benefit from this. HAGE🍻

-Andrew

News/Economic Data

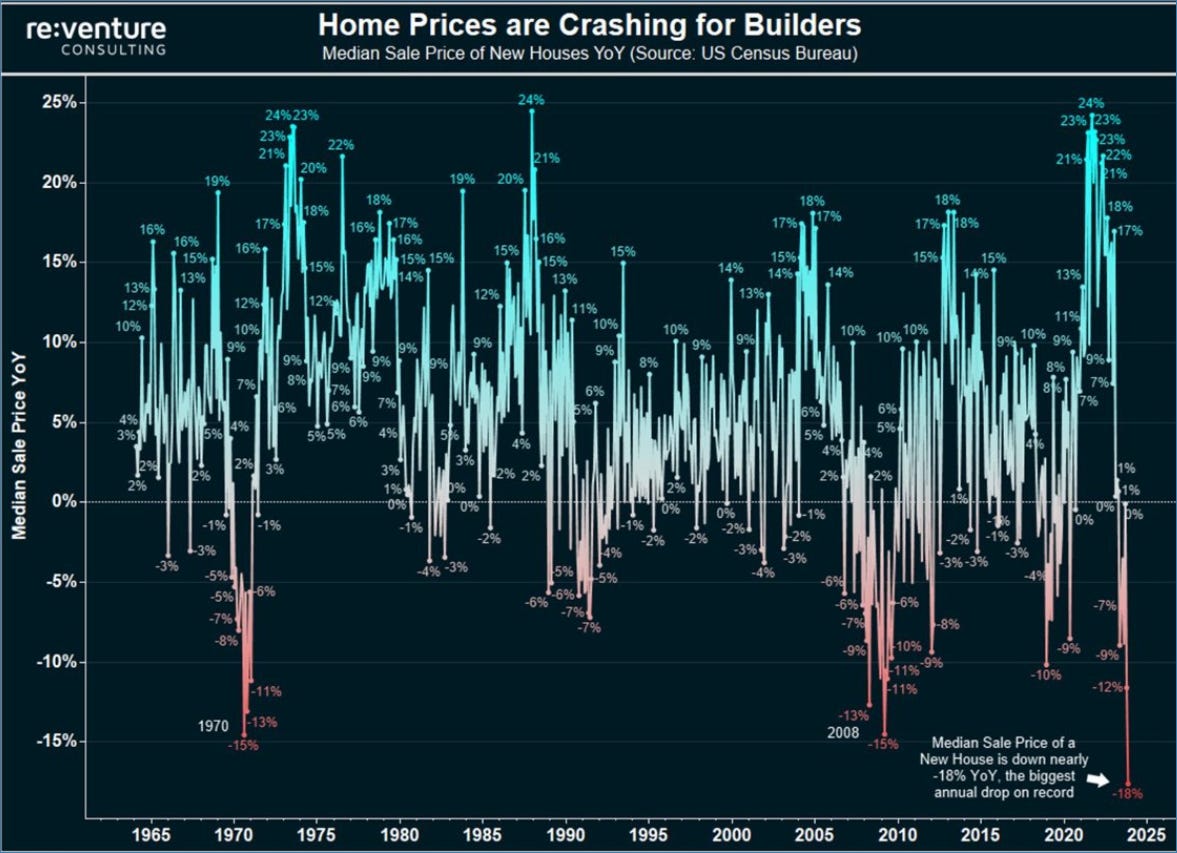

I know a lot of talking macro heads have been erroneously crying recession for the past year, but the below graphic shows the first data point I’ve seen that tells me a US recession could be knocking at our doorstep. The median sale price of a new home fell 18% YoY, which is the largest drop on record 👇

I don’t share this to scare you, but I feel responsible to share what I am seeing in real-time, good or bad, that way we can all put ourselves in the best position to thrive💪

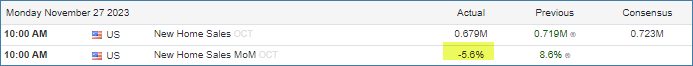

Oh yeah…new home sales fell 5.6% MoM.

Yield Curve Flattening

The economic slowdown we are beginning to witness, combined with the inflation deceleration we’ve witnessed over the past year, is putting downward pressure on bond yields across the curve

Our baseline assumption is that the TLT ETF takes out the upside VPOC at $93.81 by year-end. So long as the price action continues to take 2 steps forward and one step back, it will be there before we know it👇

FX Market

The dollar index chart looks like the TLT chart flipped upside down! Confirmation that the market is pricing lower inflation and growth moving forward ✅

Energy

Crude oil is following a similar trajectory to the dollar index ✅

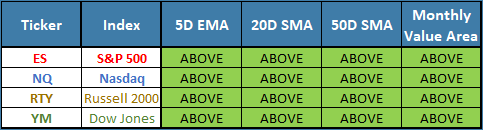

Equity Dashboard

Equity indices experienced a minor pullback today, with a noteworthy uptick in implied volatility. Not the end of the world, but worth monitoring👇

Index Price Cycle Monitor

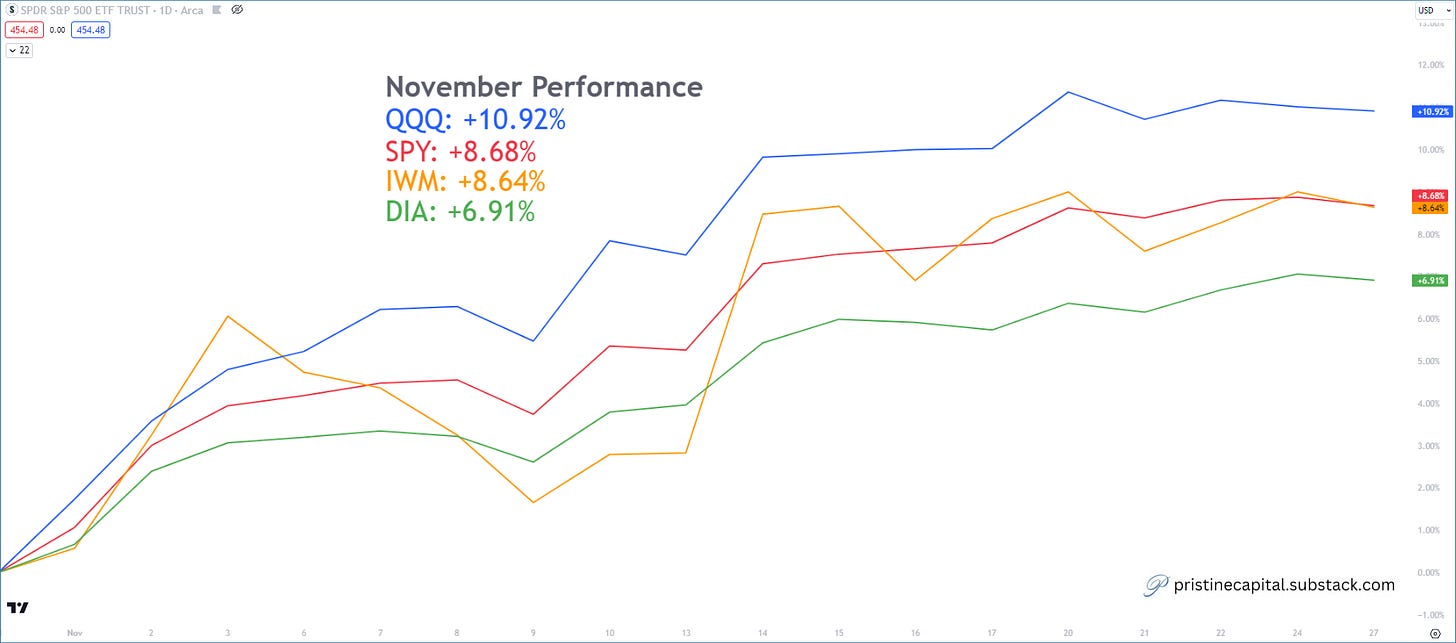

Index Performance Monthly

When in doubt, ZOOM OUT!

The indices have put in a full year’s worth of returns in just a few weeks 👇

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - Our trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities