Pristine Market Analysis & Watchlist 4/11

CPI Incoming!

Team,

It’s that time again. CPI incoming tomorrow at 8:30 AM ET, followed by PPI the following day, and bank earnings on Friday. Buckle up!

-Andrew

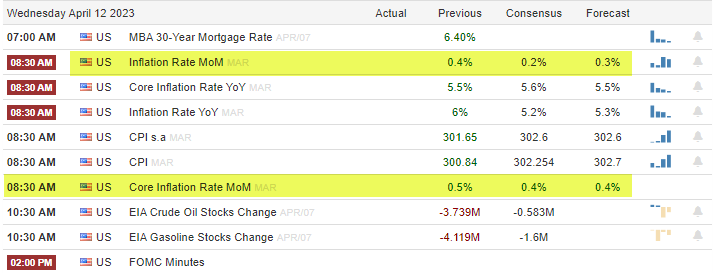

The market is expecting a +.4% MoM and +5.2% YoY CPI reading tomorrow:

And against this backdrop is pricing in a 67.2% probability of a 25 basis point rate hike in May.

When it comes to incoming economic data, it’s all about what the market is pricing in, vs the reality of the print!

The market is still pricing in rate cuts into late ‘23 and early 24’, so it’s safe to say that inflation is no longer as big a concern for the market as it once was.

Case in point…check out our style factor performance for full year ‘22, back when inflation was the primary market driver.

The growth style factor was hit the hardest, and large-cap growth specifically.

Now let’s fast forward to our YTD style factor performance. Do you notice anything different?

Growth is now outperforming value, as investors believe the worst of inflation is in the rear-view mirror!

Equity Dashboard

78.4% advancers, with small caps leading. We are seeing the rotation out of megacap tech that we noted as a top theme heading into Q2. Let’s see if this trend continues throughout the rest of the week.

ES_F S&P 500 Price Action Analysis

The S&P 500 has been range-bound since August ‘22. Assuming that inflation data comes in close to consensus, my baseline expectation is that we test the top of the yearly value area 4~,252.5 in Q2. At this level, I believe there would be a lot of forced buying from players that were waiting for a retest of much lower levels. A high probability short setup will likely appear once those players are forced to join the party!

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities