Pristine Market Analysis & Watchlist 4/3

Stagflation is Bullish?

Team,

Don’t forget to enter our S&P 500 quarter-end price target raffle! Enter your price target in the Google Sheet in the ‘Announcements’ channel in Discord. Winner gets bragging rights and an Amazon gift card!

Okay. Let’s talk markets.

-Andrew

OPEC Oil Production Cuts

Today’s events kicked off with news that OPEC+ would be cutting oil production by 1MM+ barrels per day!

This created a large overnight gap-up in crude, and it finished toward the YTD highs over $80/barrel!

This calls into question whether or not the worst of inflation is behind the market. Our Truflation dashboard bounced up to 4.29% in the aftermath of the oil move.

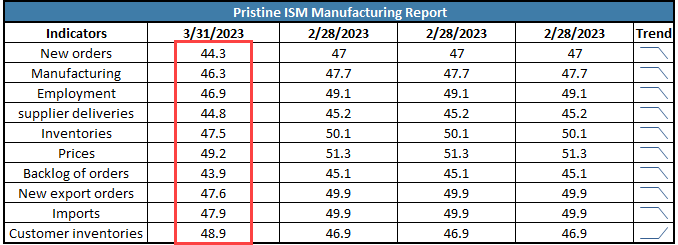

But here is where the plot thickens! The US ISM manufacturing report came out shortly after the open, and EVERY component of the report was a sequential slowdown from the month prior!

The market responded well to this data, despite the outsized move higher in crude oil.

The ZN_F 10yr treasury futures rallied sharply on the recessionary ISM manufacturing report.

The DXY Dollar index sold off to the low end of it’s range on the prospect of no further rate hikes needed!

Equity Dashboard

And equities were…mixed. The DIA Dow Jones led with a +.99% advance and ARKK lagged with a -1.88% decline. With 53% advancers and 47% decliners, the market had a rather indecisive tone.

SPY S&P 500 Price Action Analysis

Against a rather uncertain backdrop, the S&P 500 has gone…parabolic

So where does this leave us heading into tomorrow’s session?

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities