Pristine Market Analysis & Watchlist 5/9

CPI Incoming 👀

Team,

Jumping into the fray once again for tomorrow’s CPI print. We ride at dawn!

-Andrew

Economic Data

Small business optimism hit the lowest level in 13 years

Who cares? 🤣

Treasury Action

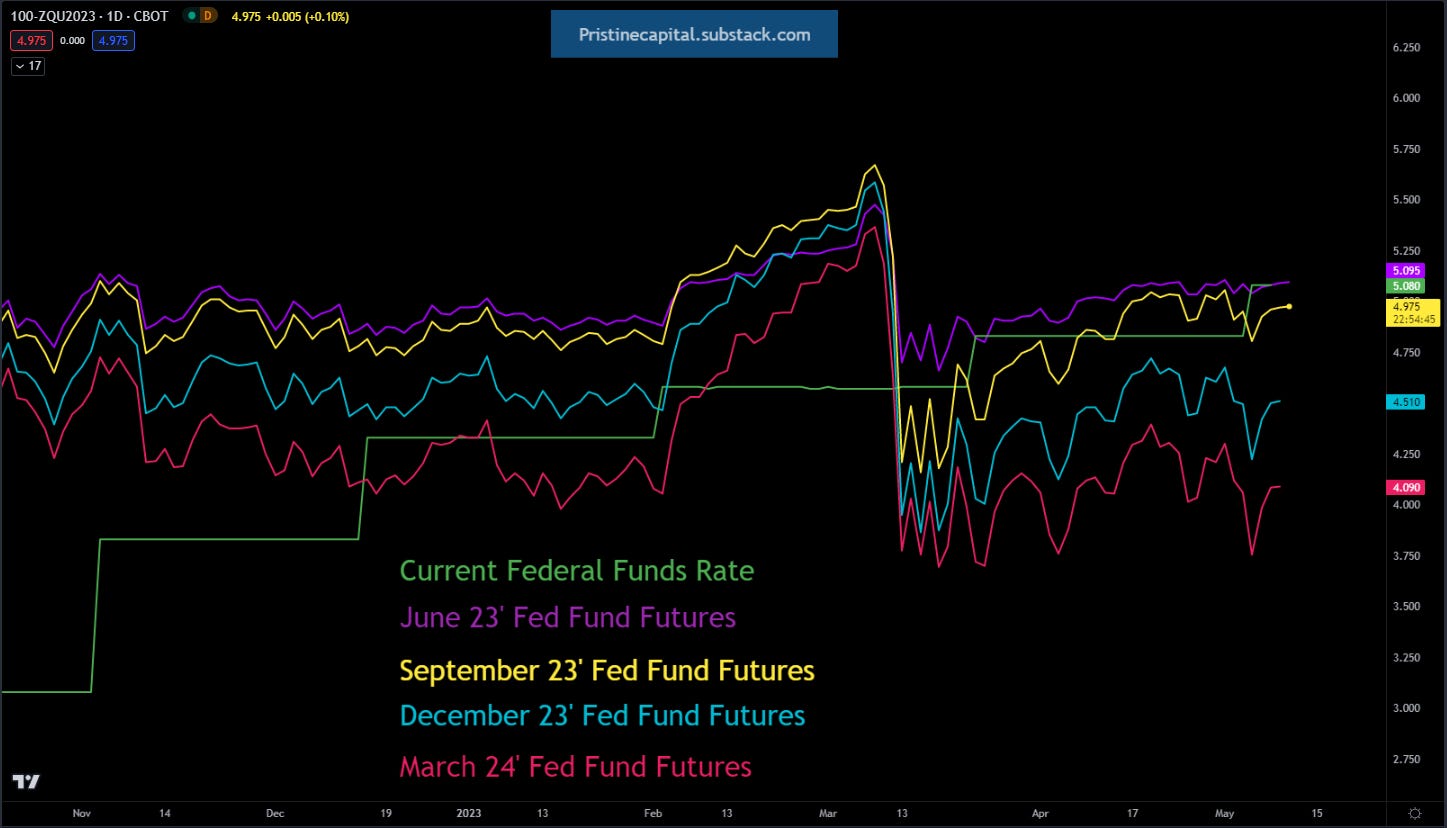

Fed Fund Futures

Fed fund futures continue to creep higher, however, the market is still pricing in TWO rate CUTS into year end! This remains the elephant in the room, and is part of the reason why I’ve reduced my risk into the upcoming inflation prints. This doesn’t matter whatsoever…until it does. Time is ticking on the rate cut thesis.

10Yr

Ten-year treasury futures sold off the last few sessions into CPI. Tomorrow is make or break for bonds. If bonds do not bounce on tomorrow’s data, I can’t see stocks having a good session.

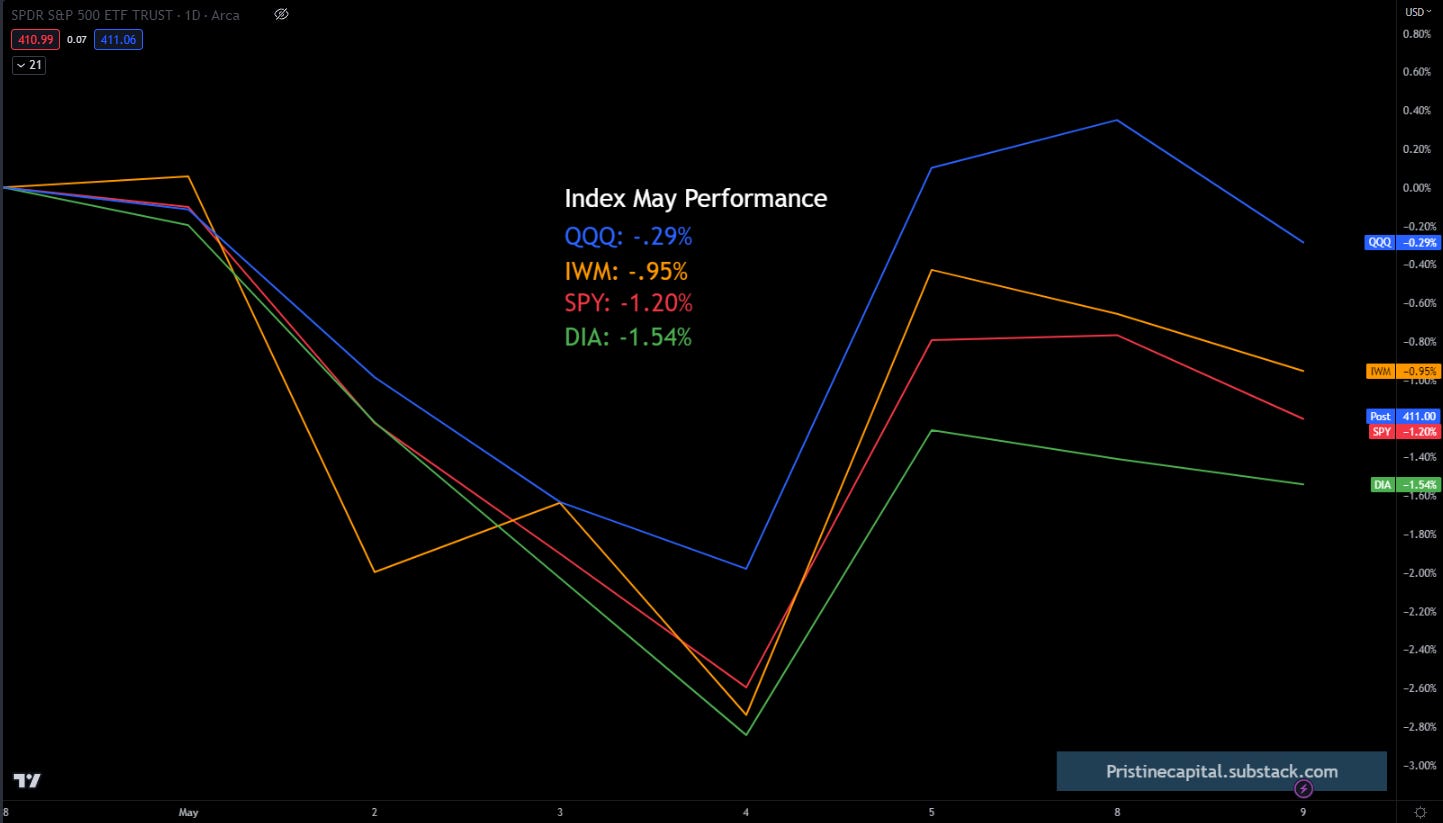

May Index Performance

There has been dynamism in earnings movers over the past week, but the indices are all trading in negative territory. In both March and April, the indices flipped from deep red intra-month, to positive territory by month-end. Most players that didn’t do a great job managing their risk were bailed out. Let’s see if this month is more of the same, or if we get a different outcome.

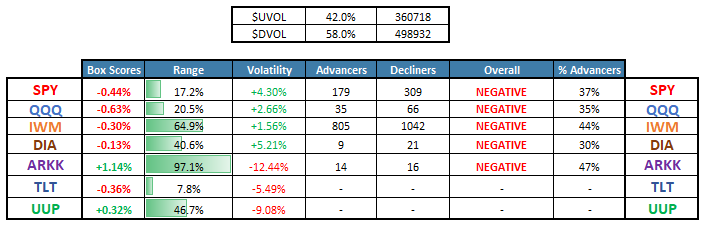

Equity Dashboard

All indices except for the ARKK innovation ETF finished the day in negative territory. Volatility increased heading into CPI, and profit-taking occurred in the crowded megacap tech stocks.

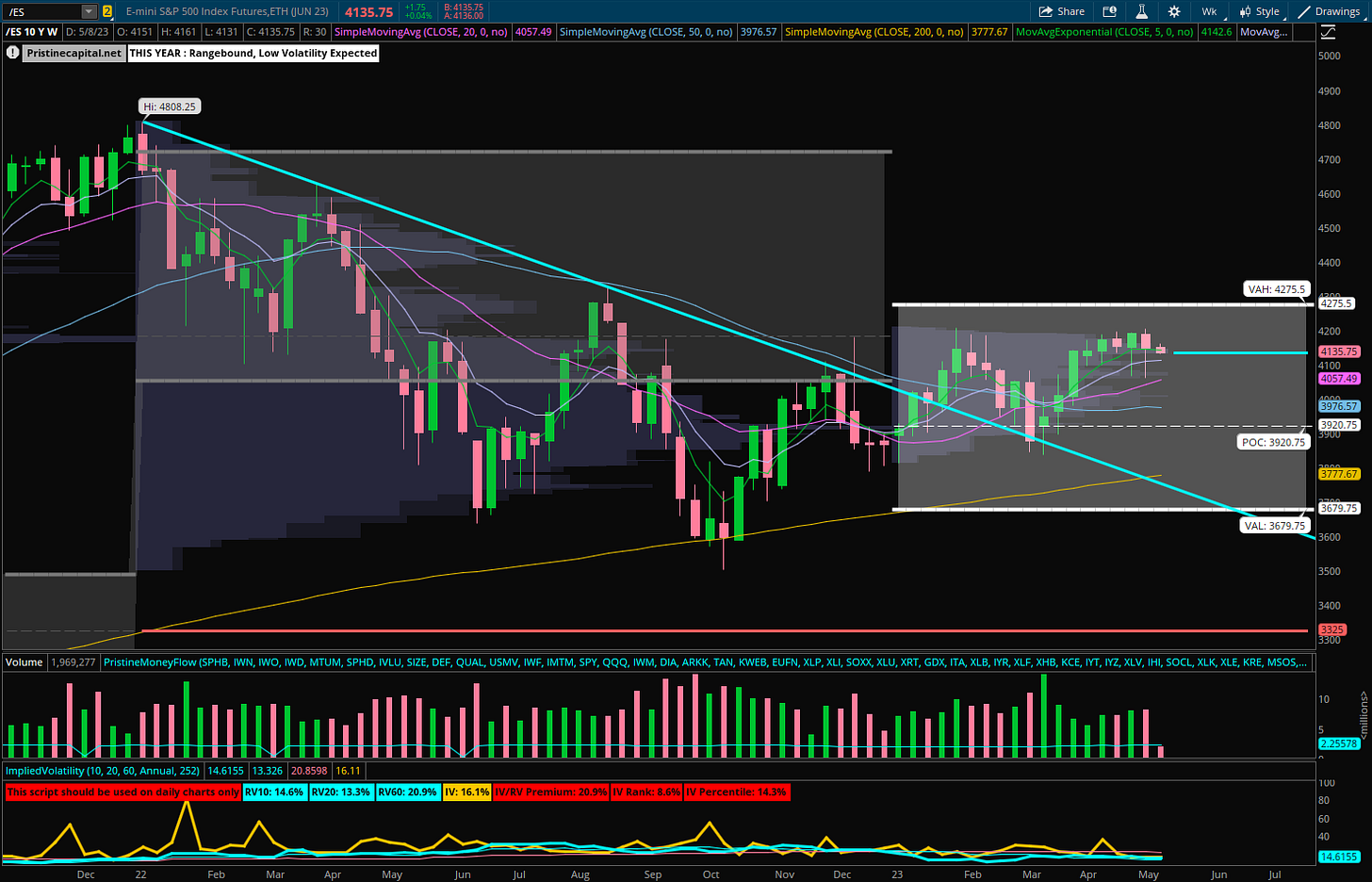

ES_F S&P 500 Price Action Analysis

This is the sixth consecutive week of range-bound trading for the S&P 500. This looks like a coin flip. My baseline assumption is that the market will finally begin to move following this week’s inflation data. My primary objective at this time is to not get caught on the wrong side of that move.

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities