Pristine Market Analysis & Watchlist 8/8

Bulls Buy the Dip Ahead of CPI...Again

Team,

One more day of noise. And then we get the river card…CPI!

-Andrew

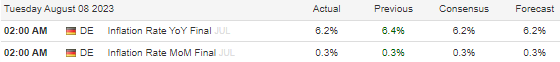

Overnight

German CPI came out in-line with expectations at +.3% MoM and +6.2% YoY

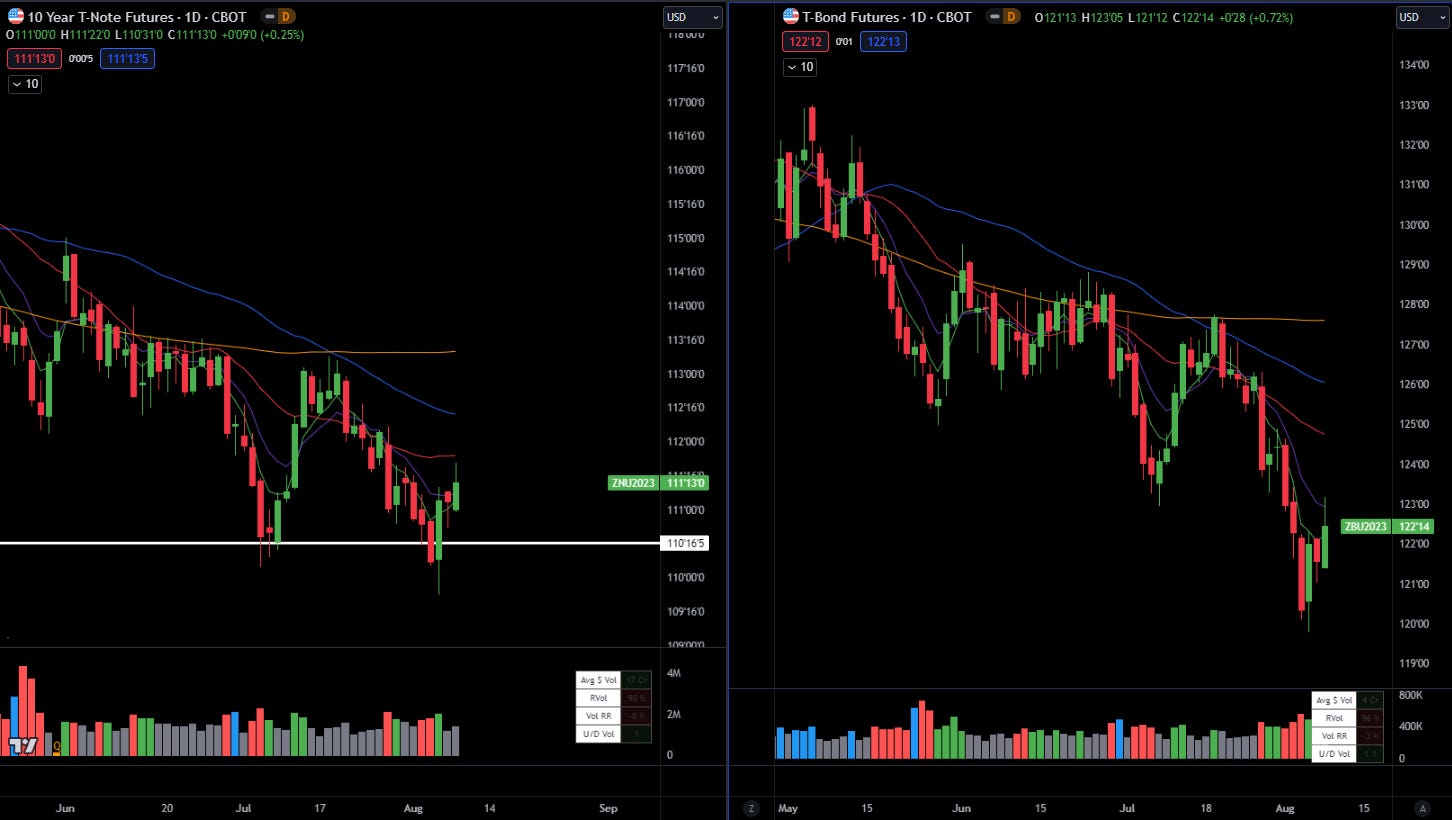

10Y and 30Y Treasury Futures

The bond bounce continued. Perhaps the China growth scare led to a bid here overnight!

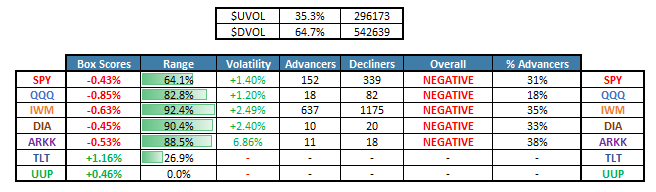

Equity Dashboard

Weak breadth with only 35.3% advancers

Volatility expanded pretty sharply this morning, which is unusual to occur days BEFORE a binary event. But by the time European markets closed, the VIX and VVIX were already getting crushed. Was this our big volatility event? My baseline assumption is that there is a bigger volatility event to come soon, but we will only know for sure with 20/20 hindsight.

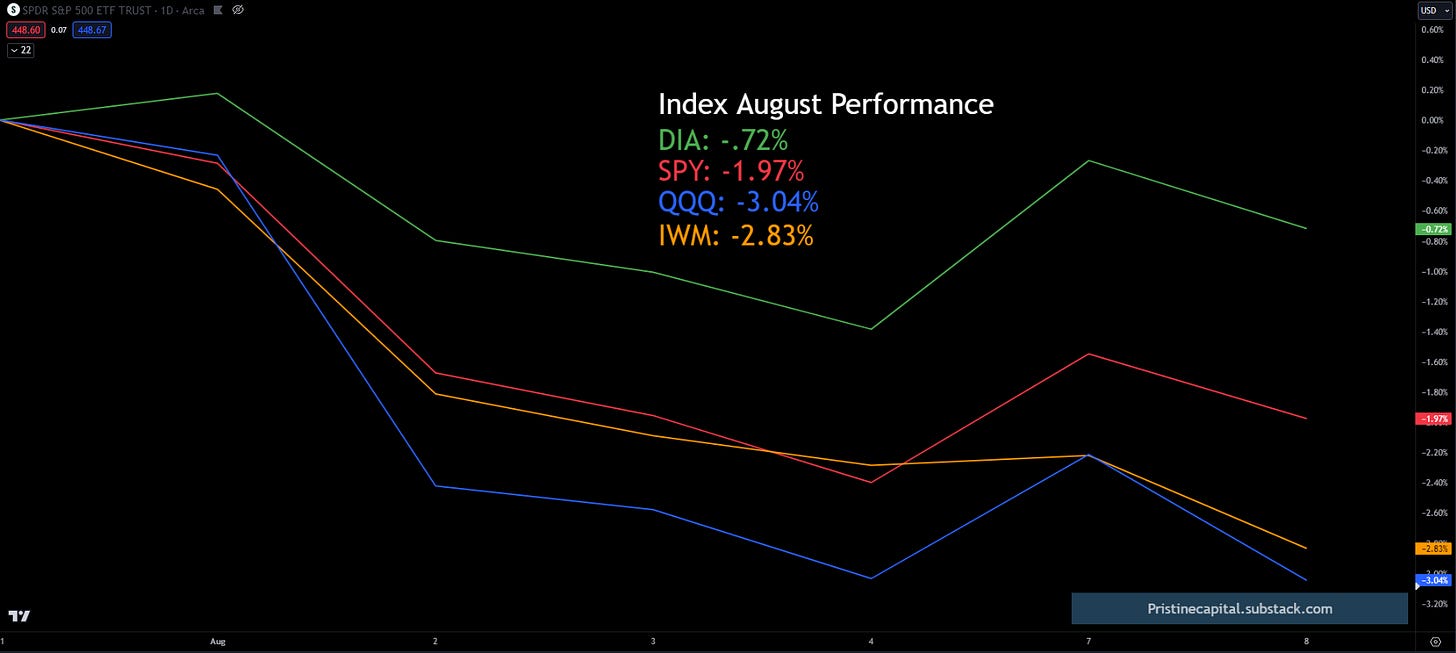

Index MTD August Performance

The indices are experiencing a minor pullback in August.

Index After Hours Price Action

ES S&P 500 -.06% - Below 20-day SMA & Undercut the Monthly VAL

NQ Nasdaq -.04% - Below 20-day SMA & Monthly Value Area & Testing 50-day SMA

YM Dow Jones -.08% - Above 20-day SMA & Fell Below Monthly POC

RTY Russell 2000 -.10% - Below 20-day SMA & Tested the Monthly VAL

Economic Data

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities