Pristine Market Analysis & Watchlist 2/8

Carl Icahn Has Entered The Chat

Good evening everyone,

Before we begin, I’d like to thank you for reading this newsletter and for being a member of the Pristine Capital community. I absolutely love trading and investing, and it is an honor to get to share that passion with you every day as we navigate the markets together.

For tonight’s letter, there are two key takeaways that I’d like to expand on

The VVIX spike

Carl Icahn purchasing ES_F put options expiring 2/17

-Andrew

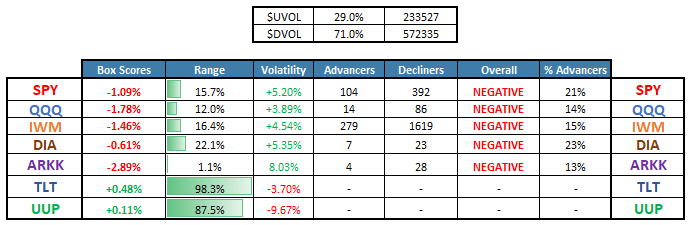

Equity Dashboard

Weak breadth today, the dollar was bid, and treasuries outperformed

Finviz Heatmap

The AI theme continued today, as for most of the session, MSFT, NVDA, and TSLA kept the bottom from falling out of the S&P 500 and the Nasdaq. As discussed in last night’s letter, I believe that the indices are being pinned into the 2/17 monthly opex by existing out-of-the-money put options. But what will happen when the floor is removed on 2/15 (T-2 from opex)?

Nasdaq QQQ Max Pain Pinning

We noted earlier in the session that there was a wall of put options at the QQQ 304 strike expiring 2/8, and that they could serve as a tasty treat for market makers! We finished the session at 304.37, expiring all of those options worthless, while supporting the Nasdaq into the close:

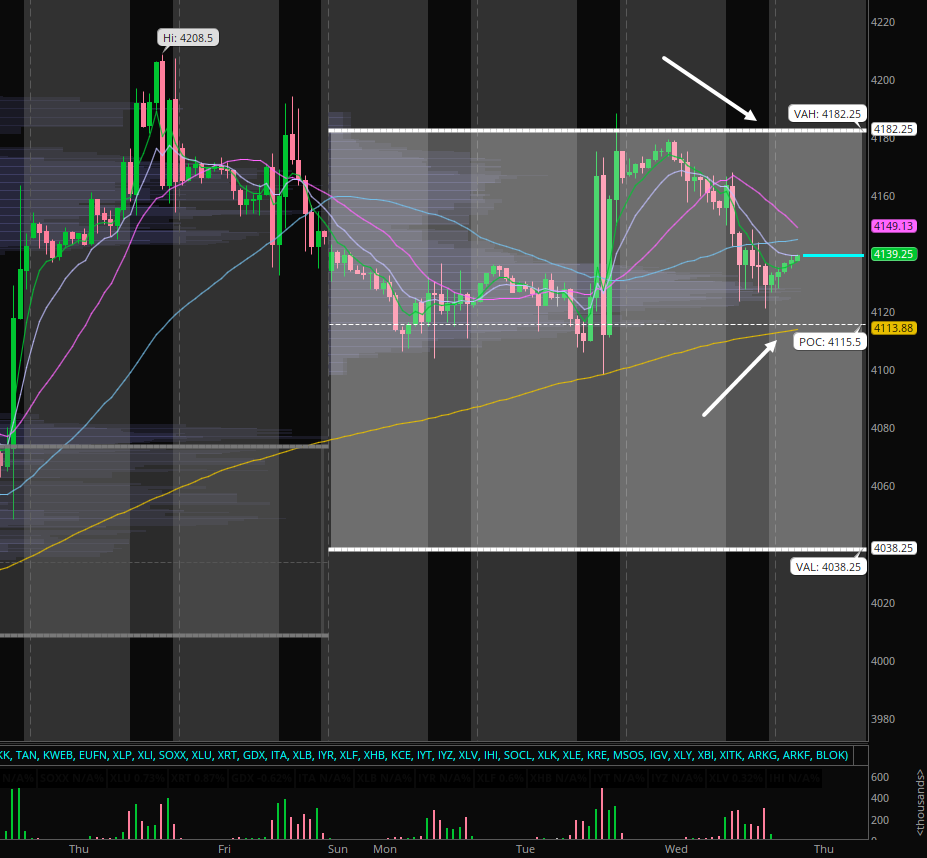

S&P 500 ES_F Price Analysis

The S&P 500 continues to bounce around between the weekly value area high ~4,182.25 and the weekly POC 4,115.5. I am going to resist the urge to add trades until we decisively move out of this range:

Beware the Jaws!

The divergence between the 10yr US treasury yield and the Nasdaq shrank today, but it still has a ways to go before the jaws shut!

Sectors - Ranked by Momentum

Red across the board on our sector map. Defensive areas of the market like ITA aerospace & defense and XLV healthcare showed relative strength

Earnings on Tap

We are covering all of the following reports and earnings reactions in Discord

Okay, now on to the VVIX and spike and Carl Icahn’s new position

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities