Pristine Market Analysis & Watchlist 6/28

Crypto Stocks Setting Up For August

Team,

There are only two more sessions left in the first half of the year. Let’s take a look at how the market is setting up into Q3.

-Andrew

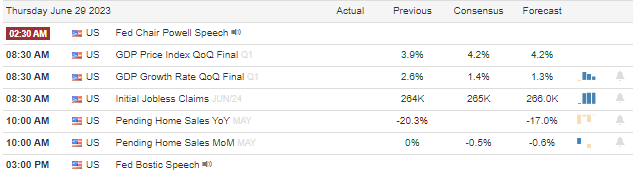

Economic Data

Quiet day on the economic front. Tomorrow we have initial jobless claims at 8:30 AM. The pattern the past few weeks has been slightly higher than expected jobless claims that catapult the markets higher.

Fed Fund Futures

December fed fund futures are now pricing one more rate hike into year end, and a slight probability of two hikes!

TLT Long-Term Treasury ETF

The volatility is contracting here, and it is slowly but surely creeping above the key moving averages. Looking for a pop higher in Q3.

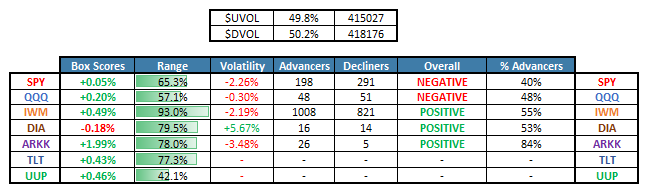

Equity Dashboard

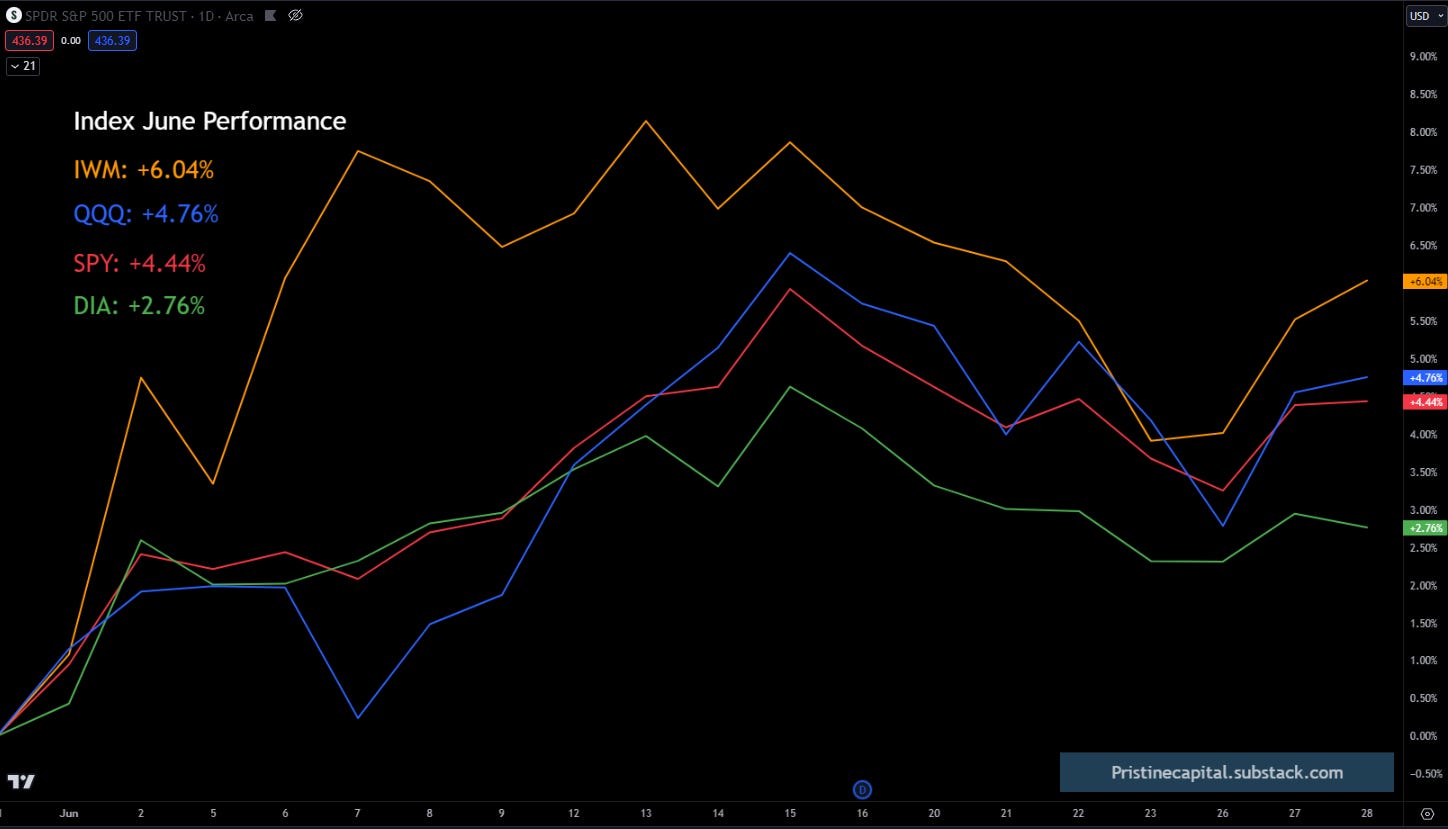

Index MTD June Performance

These monthly gains are far from normal! Don’t get used to it!

Index After Hours Price Action

The following story dropped after hours and is moving the Nasdaq

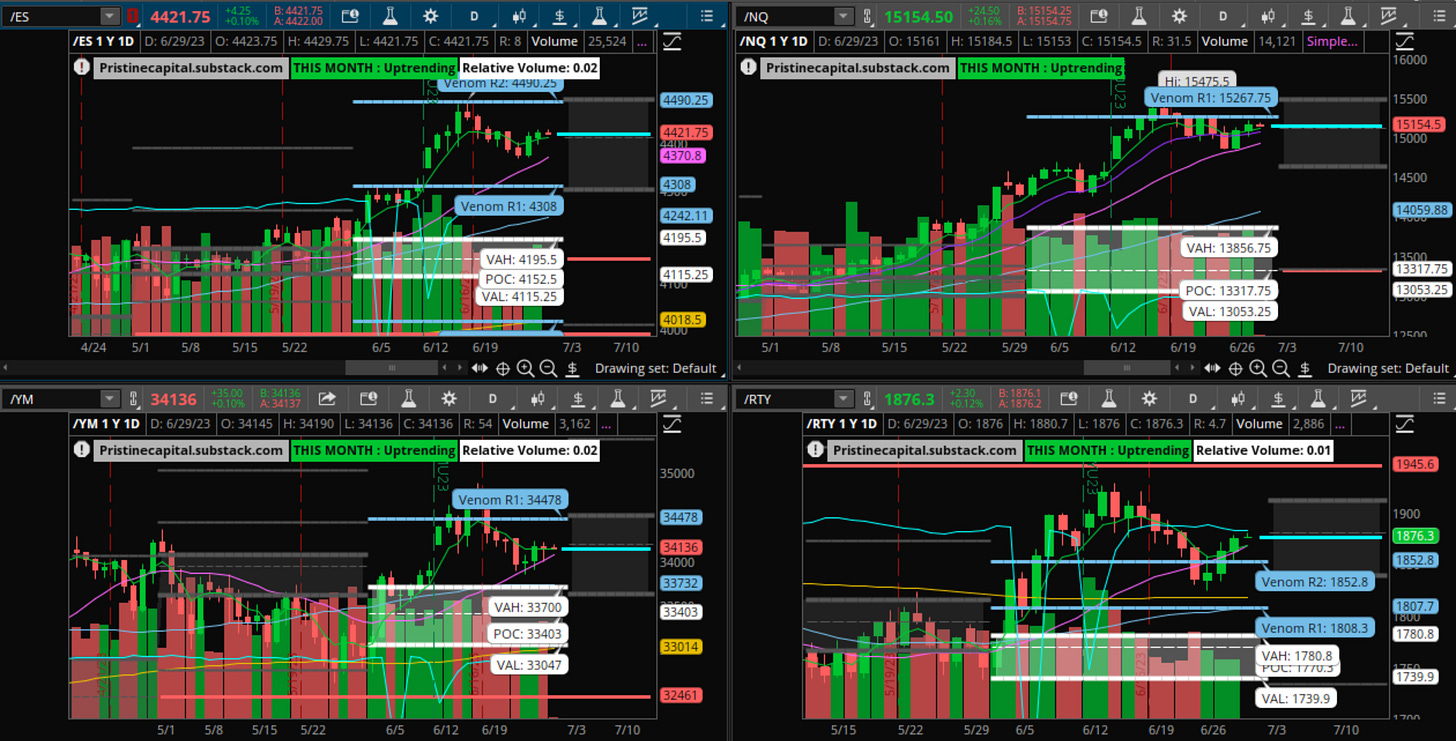

ES S&P 500 -.10% (20 SMA Bounce)

NQ Nasdaq +.16% (20 SMA Bounce)

YM Dow Jones +.10% (20 SMA Bounce)

RTY Russell 2000 +.12% (20 SMA Bounce)

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities