Pristine Market Analysis & Watchlist - 1/25

Earnings Season Volatility

Good evening everyone,

Four more trading sessions in January, and five more till the Feb 1st Fed meeting. Stay disciplined!

-Andrew

Microsoftageddon

Our story begins with yesterday’s MSFT earnings report. The company put up +2% YoY sales growth and -6% EPS growth, and mentioned that its Azure cloud business growth was decelerating!

The stock traded down as much as ~5% intraday, but found buyers and finished down only -.59%:

I have to assume based on this price action that the earnings deceleration is priced in! This presents a problem for market bears that thought Q4 earnings slowdowns would take the market down.

S&P 500 ES_F Price Analysis

Pay close attention here. As much as it may seem like the market is overbought, the market has been rangebound for the past three months, and can move sharply when it breaks out of range (think of a coiled spring). Given that we are trading above the current monthly value area high 4,010.75, I have to give the edge to the bulls for a move up to 4100. If that scenario were to unfold, I’d imagine that almost every market bear would capitulate:

Equity Dashboard

What originally appeared to be a market pullback turned into a consolidation ✔️

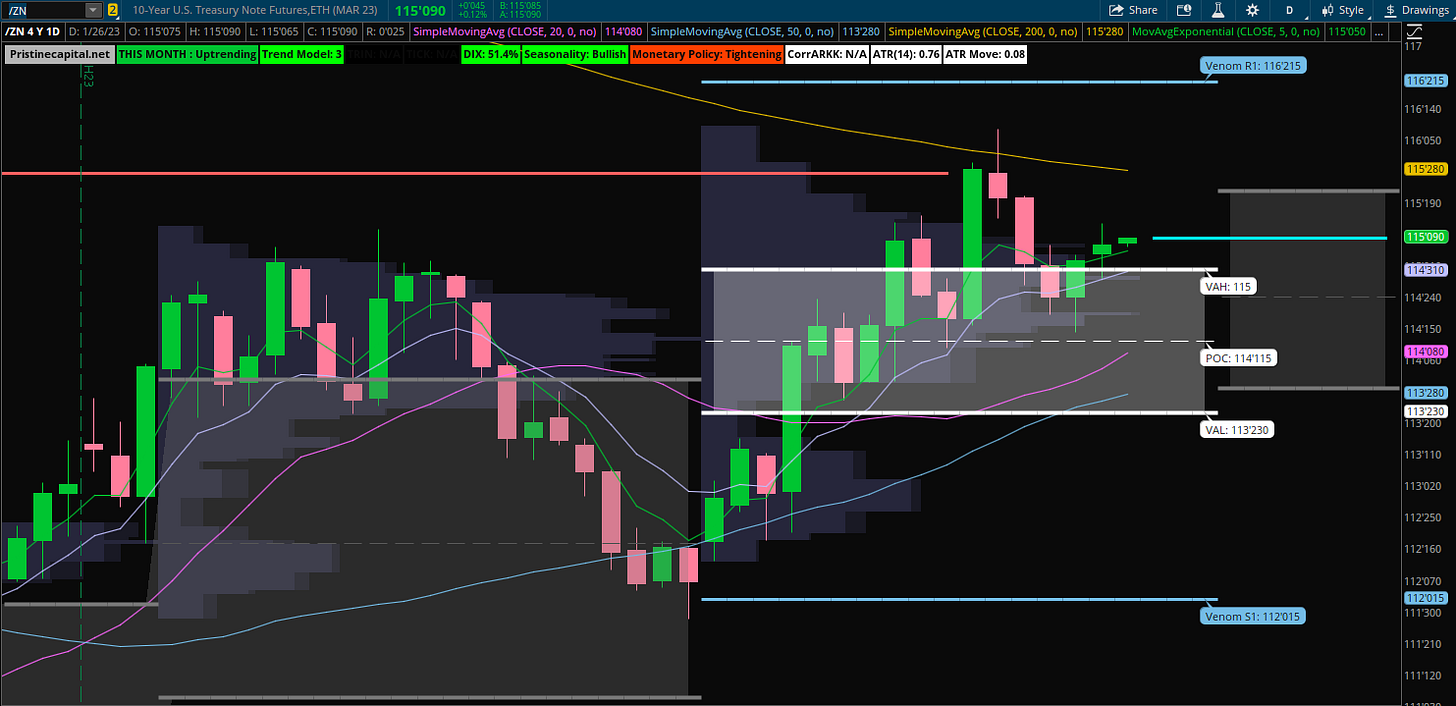

ZN_F 10yr Treasury Futures

Bonds are benefiting from the weak earnings and economic data, and are breaking out alongside equities:

Finviz Heatmap

Today’s heatmap was about as mixed as it gets. We still have plenty of companies that have yet to report their quarterly earnings. For now we play musical chairs:

Nasdaq NQ_F Price Action Analysis

Today’s candle screams shakeout! If sellers were not able to hold price below the monthly POC on weak MSFT earnings, I don’t see why we can’t run higher and test the 200-day SMA and monthly VAH 12,074.25 in the short-term:

Sectors - Ranked by Momentum

BLOK GDX ARKK KWEB momentum leaders

XRT retail was today’s top performer

Earnings on Tap

I am covering all of these reports and reactions in Discord

Key Takeaways

The market is shrugging off weak earnings

The S&P 500 is a coiled spring, and could break higher any day

Keep searching for low-risk entry points in high momentum areas of the market and stocks that report better than expected numbers

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities