Pristine Market Analysis & Watchlist 3/21

Fed Meeting Incoming!

Team,

Where is the risk/reward headed into the Fed meeting? Let’s take a look Team!

-Andrew

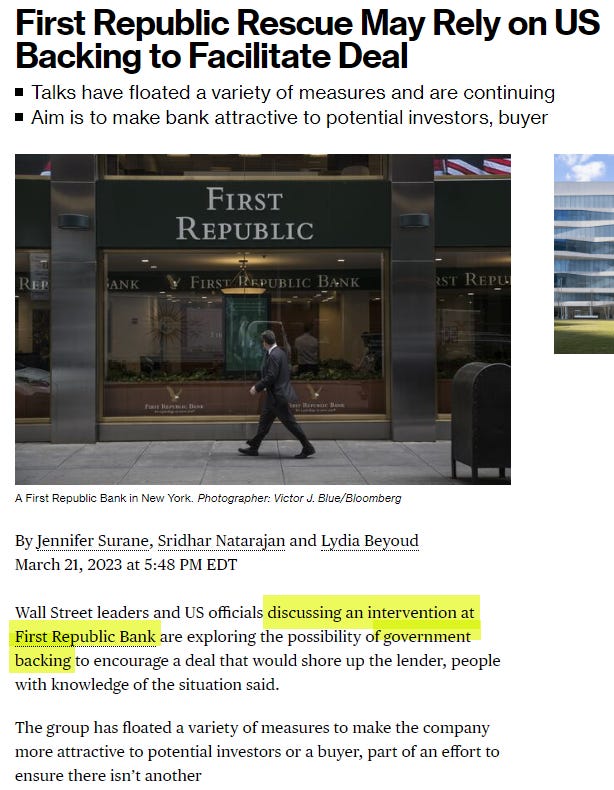

Another day, another bank massive dose of Fed intervention. Here’s the short version of what’s happened over the last few years. The fed intervened in global asset markets throughout ‘20 and ‘21 with massive liquidity programs and 0% interest rates. Those policies created high inflation. The fed intervened to solve high inflation with QT and interest rate hikes in ‘22 and ‘23. Those policies caused the global banking system to nearly collapse two weeks ago. Now the fed is intervening and attempting to save the system with…massive liquidity programs…and maybe…just maybe…pausing interest rate hikes?

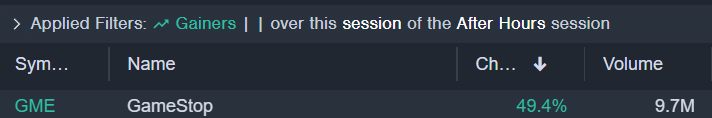

These events and resulting fed reactions have been jaw dropping to say the least. Is the fed overdoing it? Well…GME Gamestop is trading +50% in the after hours session. I’ll let you be the judge.

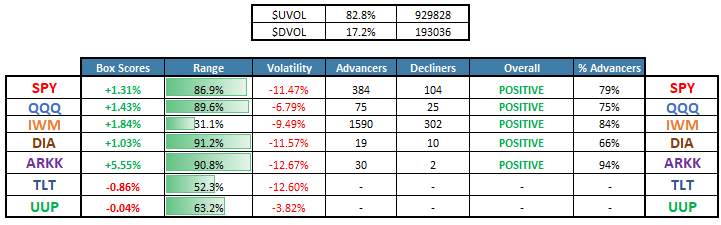

Equity Dashboard

Strong market breadth with 82.8% advancers. Volatility crushed into the Fed meeting.

ES_F S&P 500 Price Action Analysis

The S&P 500 is trading above all key moving averages, and the angle of ascent is getting steeper! We are approaching resistance at the monthly value area high ~4,058 into tomorrow’s Fed meeting.

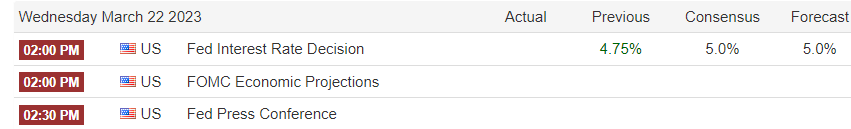

Fed Meeting

The fed will release it’s interest rate hike decision/ written statement at 2:00PM ET tomorrow and the press conference will follow shortly after at 2:30 PM ET.

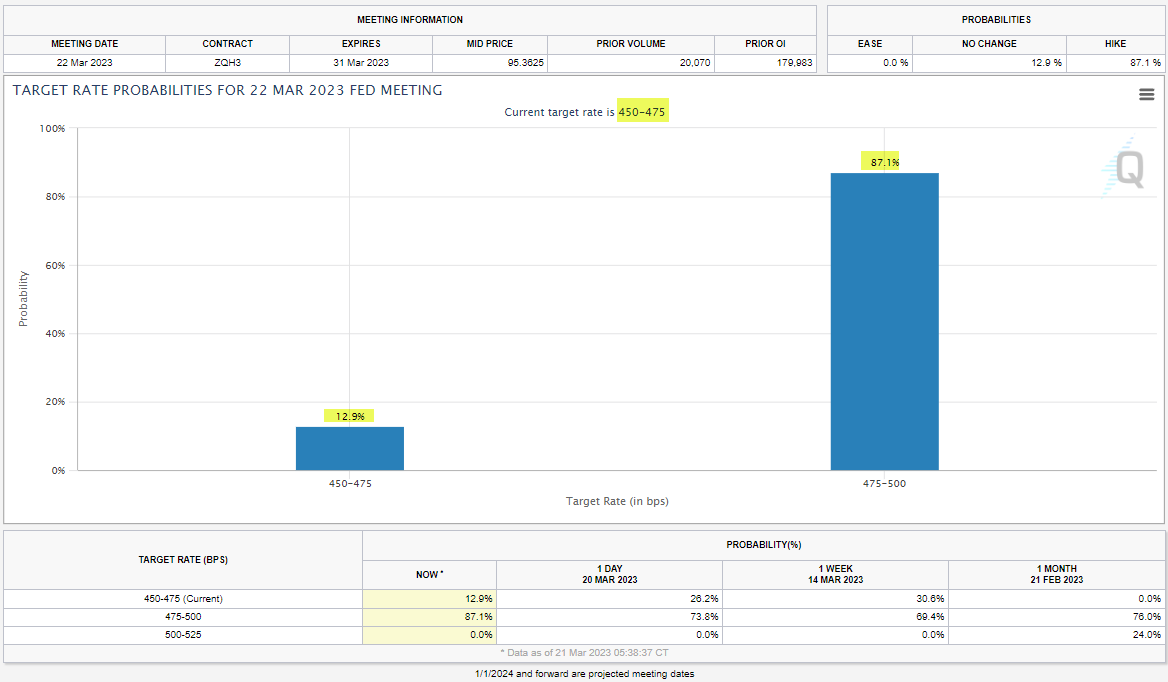

Fed fund futures are pricing in a 87.1% probability of a 25 basis point rate hike. The Fed ALWAYS does what the bond market prices, so 25 bps it is!

Markets are not going to move based on the Fed hiking 25 bps! They are going to move based on how Powell’s speech impacts probabilities of FUTURE policy moves!

I am seeing significant divergences heading into the meeting. Subscribe to premium to read tonight’s full research note!

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities