Pristine Market Analysis & Watchlist 5/1

Entering the Eye of the Storm

Team,

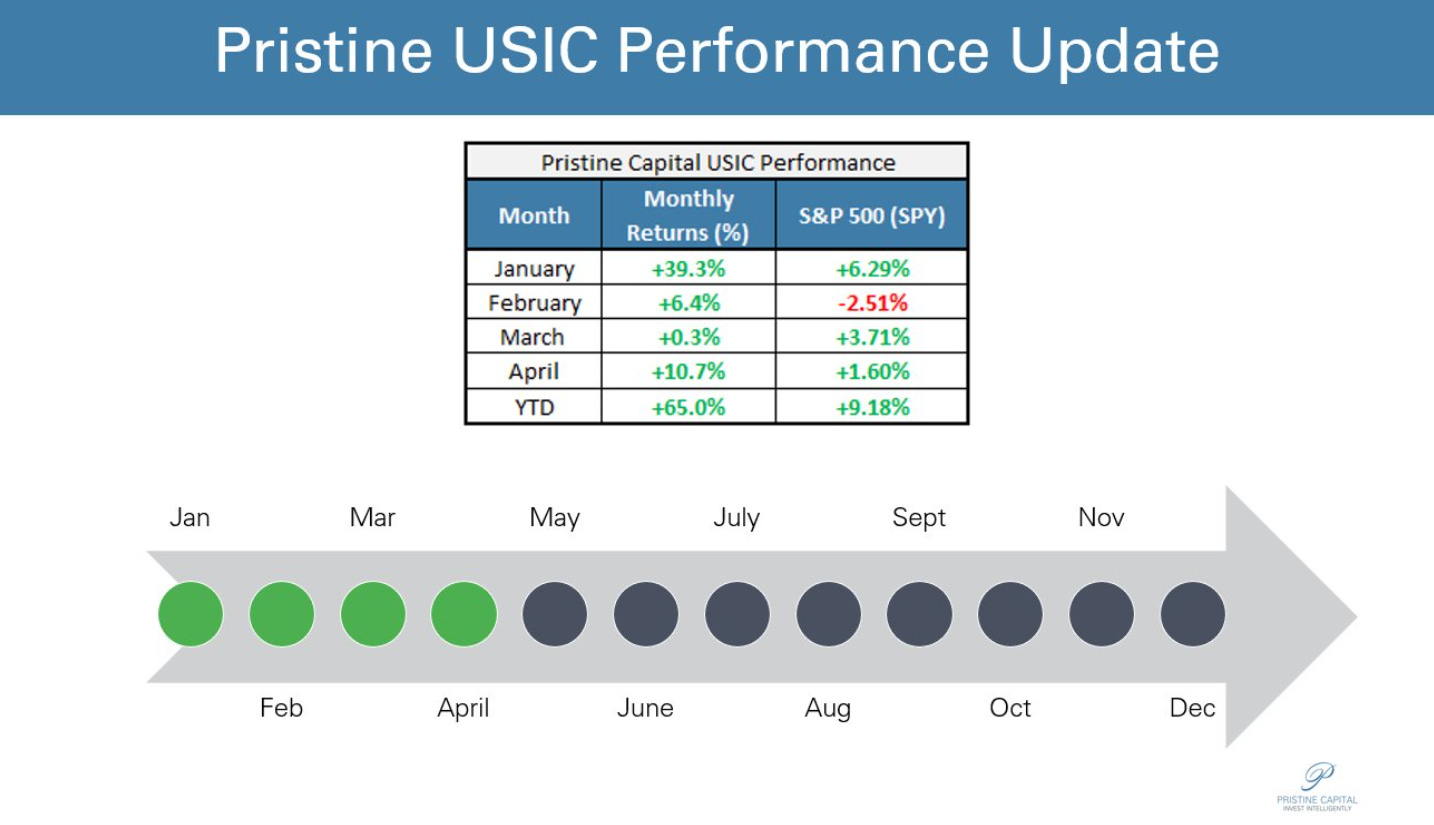

The trading year is flying by! I am proud of the work we’ve put in thus far this year. We said 2023 was going to be our year, and we meant it! 👊

With this said, May could be our most challenging month yet! Let’s keep putting one foot in front of the other, and focus on clean trading process.

-Andrew

Economic Data

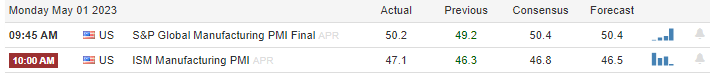

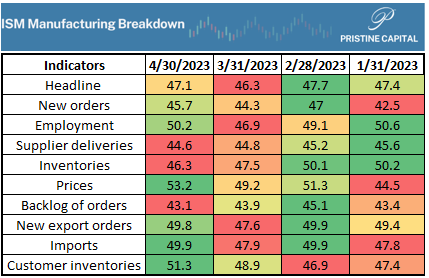

Today’s session kicked off with another sub-50 (contracting) ISM manufacturing data point, but one that came in above the average analyst estimate:

The underlying component of the ISM that accelerated the most was…prices paid 🤯

Treasury Selloff

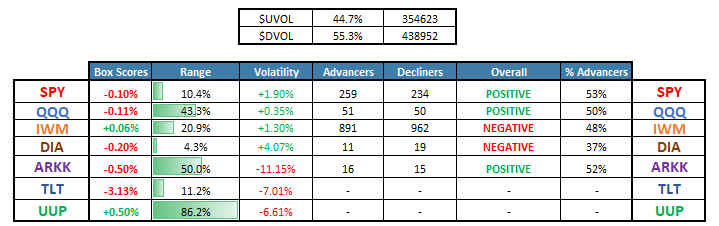

From this point on, a treasury bloodbath ensued! The TLT long-term treasury ETF put in a -2.11 ATR (average true range) move, and filled the gap from when the banking crisis first kicked off in March☟

Equity Dashboard

Equities were once again more resilient than bonds, but breadth weakened throughout the session, and the dollar index advanced.

MSFT and META had powerful trending moves after reporting earnings last week. NVDA has yet to report earnings , but the stock broke out of consolidation and led the market…into the fed meeting. This is the definition of a stock ‘getting ahead of itself’. This is a good tell for how market participants are perceiving the market.

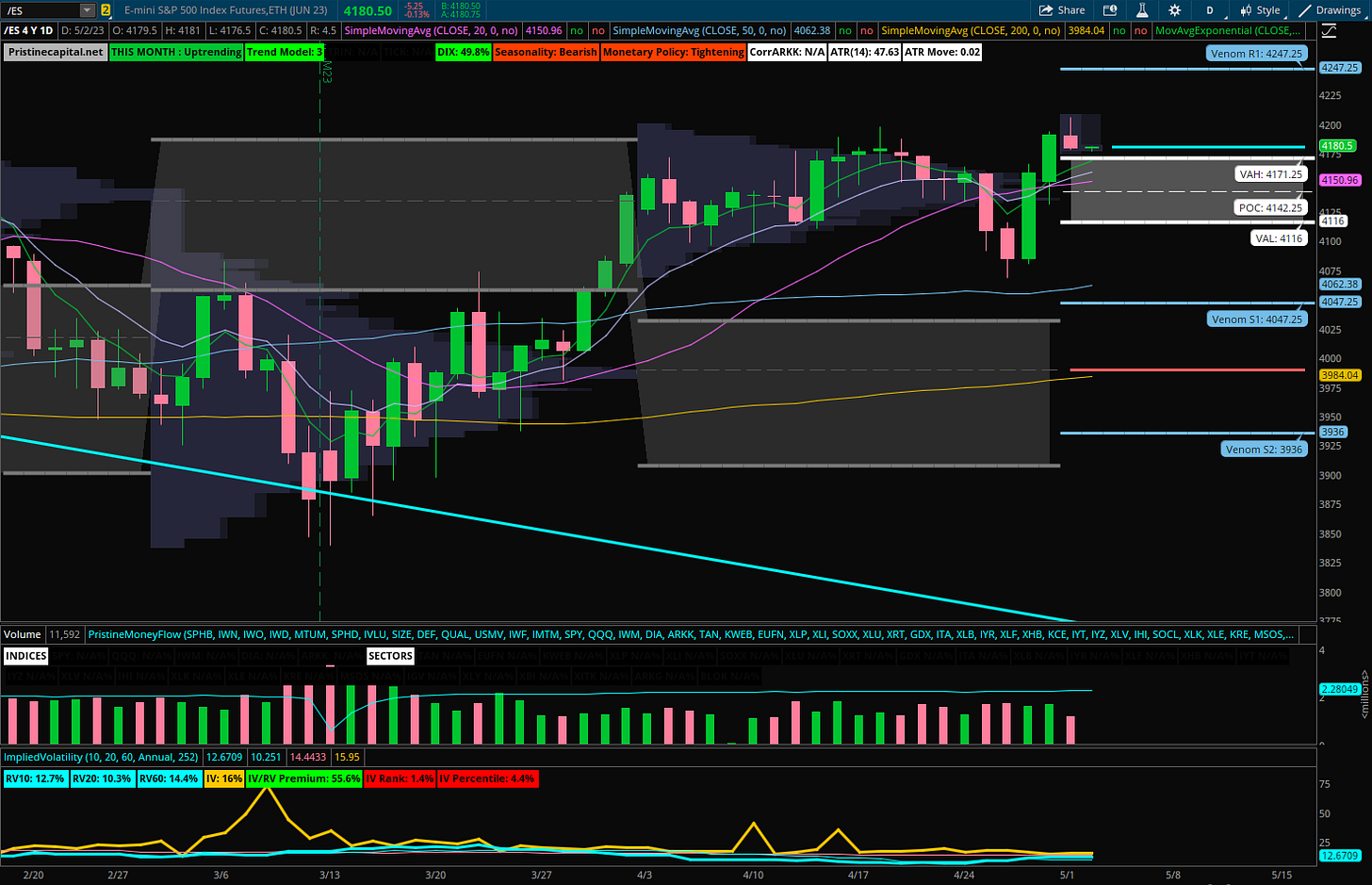

ES_F S&P 500 Price Action Analysis

The S&P 500 reversed gains into the close and finished on the lows, but it finished above the brand new monthly value area for May.

Let’s dig a bit deeper under the hood and analyze the risk/reward into the Fed meeting. If you haven’t upgraded your membership yet, what are you waiting for?

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities