Pristine Market Analysis & Watchlist 6/27

Market Rips on Hot Economic Data

Team,

The market raged higher all day…but now NVDA might burst the bubble. Let’s dive in!

-Andrew

Economic Data

Today’s economic data was filled with upside surprises. Durable goods orders came in hot, home price data came in hot, and consumer confidence came in hot!

Fed Fund Futures

Fed fund futures ticked higher as the market priced higher interest rates for longer.

10Yr Treasury Futures

Sold off to the low end of the recent chop zone.

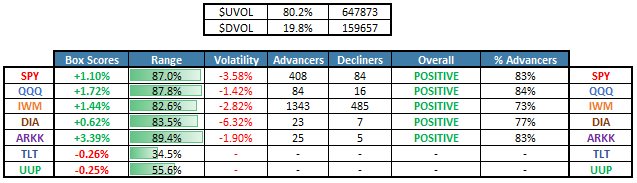

Equity Dashboard

After taking the stairs down for a few trading sessions, equities took the elevator up! Intuitively, one would think that on strong economic data, the Dow Jones and small caps would lead the market and the ‘duration sensitive’ Nasdaq would be the laggard…but the opposite was the case 😂

Into the final days of the first half, there is a lot of chasing of popular themes. Once the calendar rolls to the 2nd half, I believe there will be more true price discovery.

Index MTD June Performance

The indices are sitting on hefty gains for the month of June. This is far from a normal month. Important to not get spoiled and think that every month will be like this.

Index After Hours Price Action

The following story dropped after hours and is moving the Nasdaq

ES S&P 500 -.20% (20 SMA Bounce)

NQ Nasdaq -.45% (20 SMA Bounce)

YM Dow Jones -.04% (20 SMA Bounce)

RTY Russell 2000 -.17% (20 SMA Bounce)

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities