Pristine Market Analysis & Watchlist 9/25

The Silver Lining Emerges!

Team,

Another day, another dollar…rally! While the market chatter is turning incredibly pessimistic as of late, we are beginning to see some encouraging signals under the surface. Let’s dive in!

-Andrew

Economic Data

No gigantic market-moving economic data releases this morning.

FX Market

The dollar index remains inside the white bullish trend channel. Remember, there is no raging bull market in risk assets when the dollar index is in such a strong uptrend!

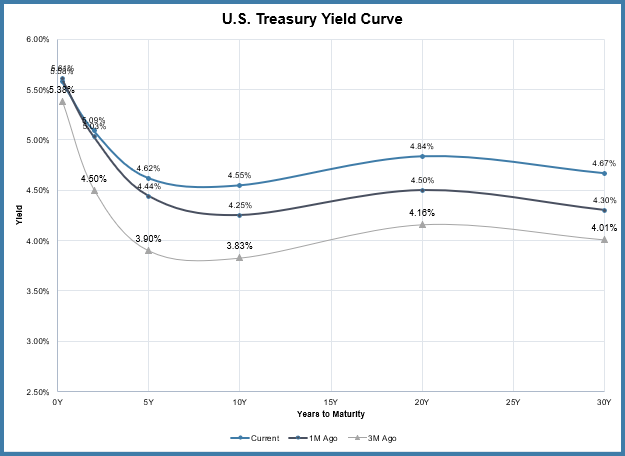

Yield Curve

The 20yr treasury yield is now 4.84%

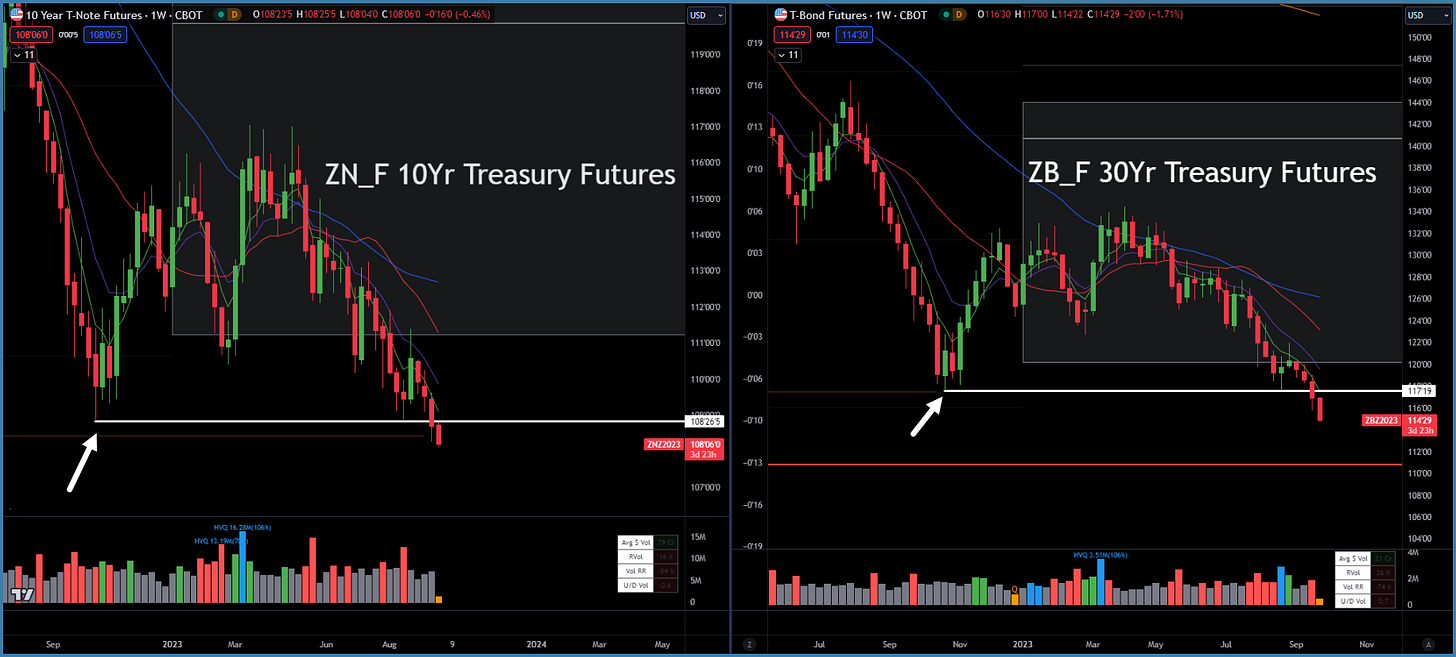

Long-term treasuries cascaded below their Fall ‘22 lows in what appeared to be a capitulatory move.

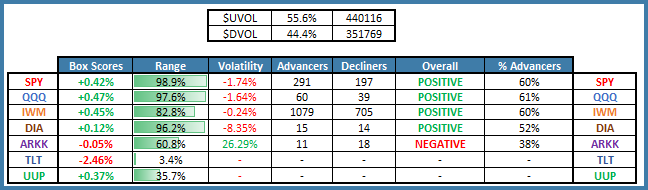

Equity Dashboard

But equities bucked the trend of bond weakness and finished positive!

Equity Index MTD September Performance

The indices are in negative territory for the month of September.

Index Price Cycle Monitor

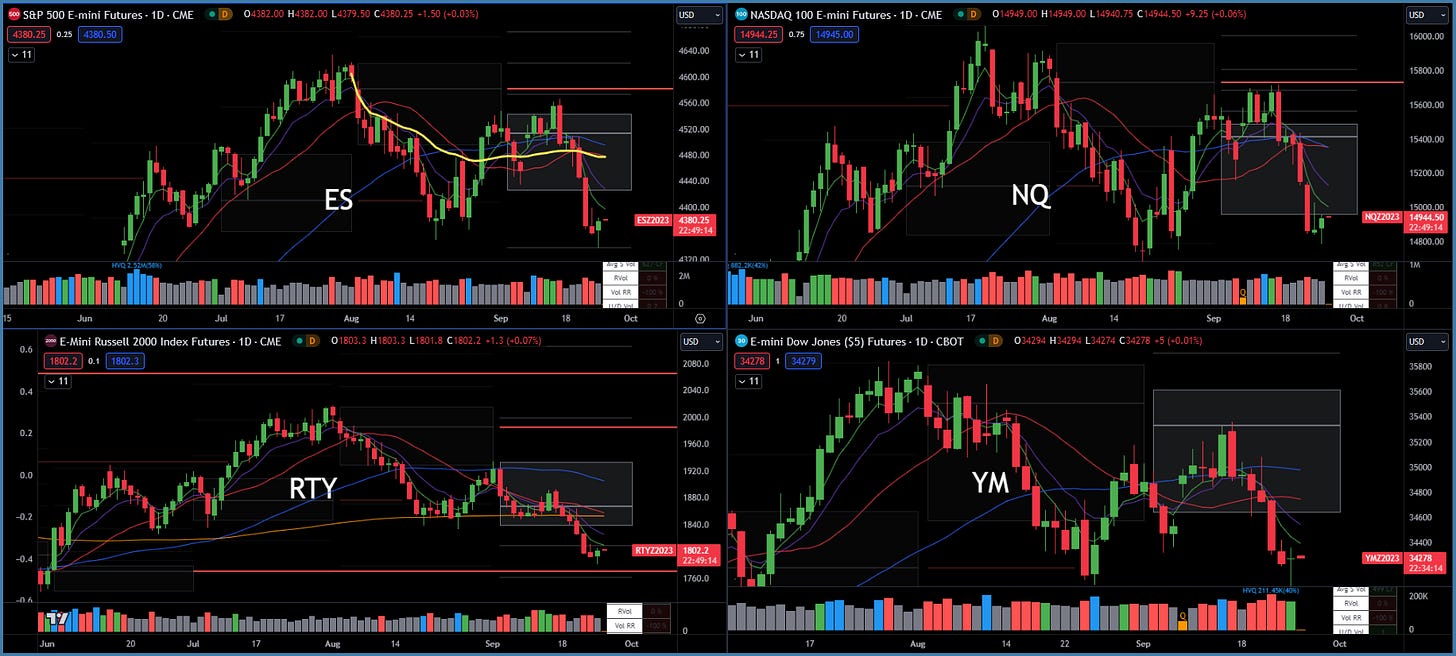

ES S&P 500 - Below key moving averages and below monthly value area

NQ Nasdaq - Below key moving averages and below monthly value area

RTY Russell 2000 - Below key moving averages and below monthly value area

YM Dow Jones - Below key moving averages and below monthly value area

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities