Pristine Market Analysis & Watchlist

📈NVDA earnings incoming!

NVDA reports earnings after the bell 11/21

Team,

Investors have bought the rumor in NVDA, but will this stock deliver the goods on earnings? Let’s take a look at the risk/reward. HAGE🍻

-Andrew

P.S. The news channel in our community Discord is now properly pulling news headlines into the server

News/Economic Data

This OpenAI story has almost no relevance to markets, but it sure is getting a lot of attention and clicks👇

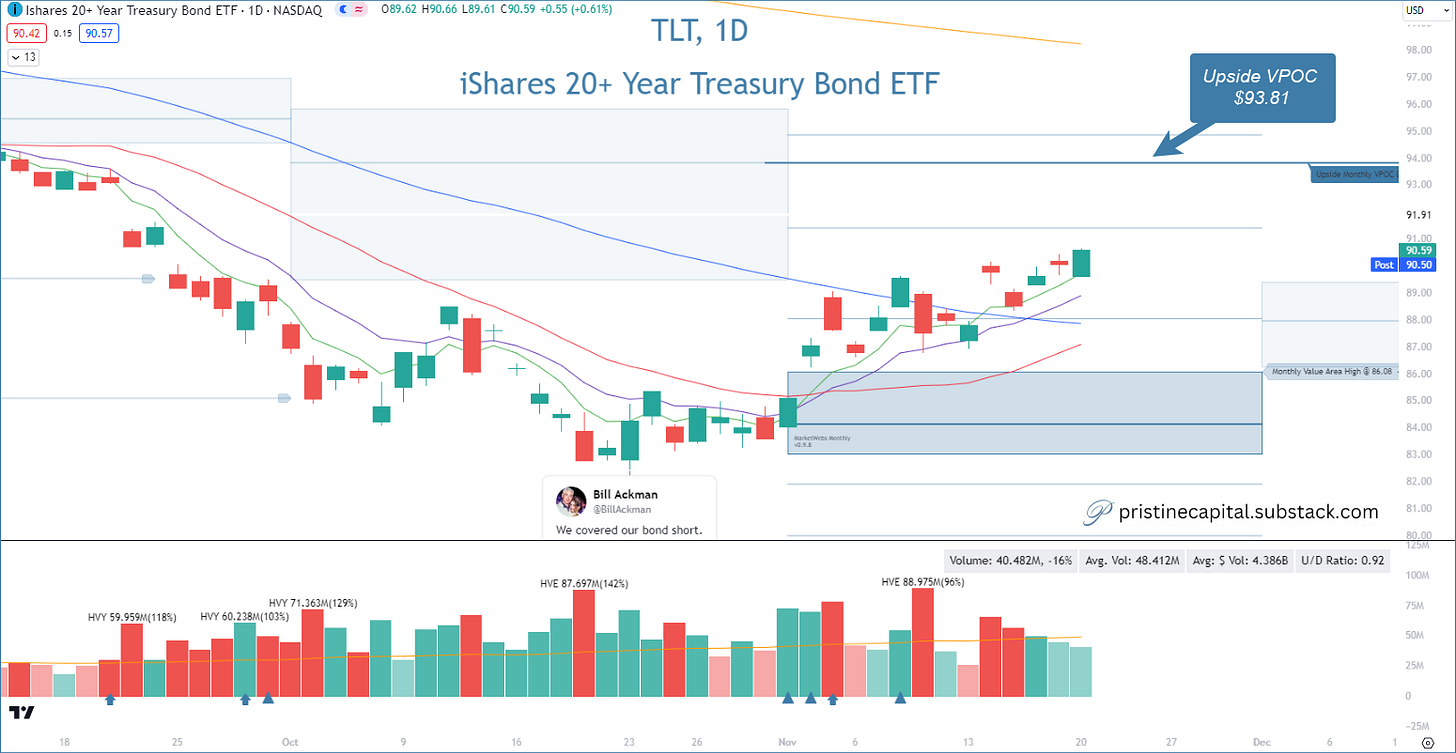

Long-Term Treasuries

Bill Ackman put the bottom in back in late November, and now this trend is hitting escape velocity. Our baseline assumption is that the TLT takes out the upside VPOC at $93.81 by year-end 👇

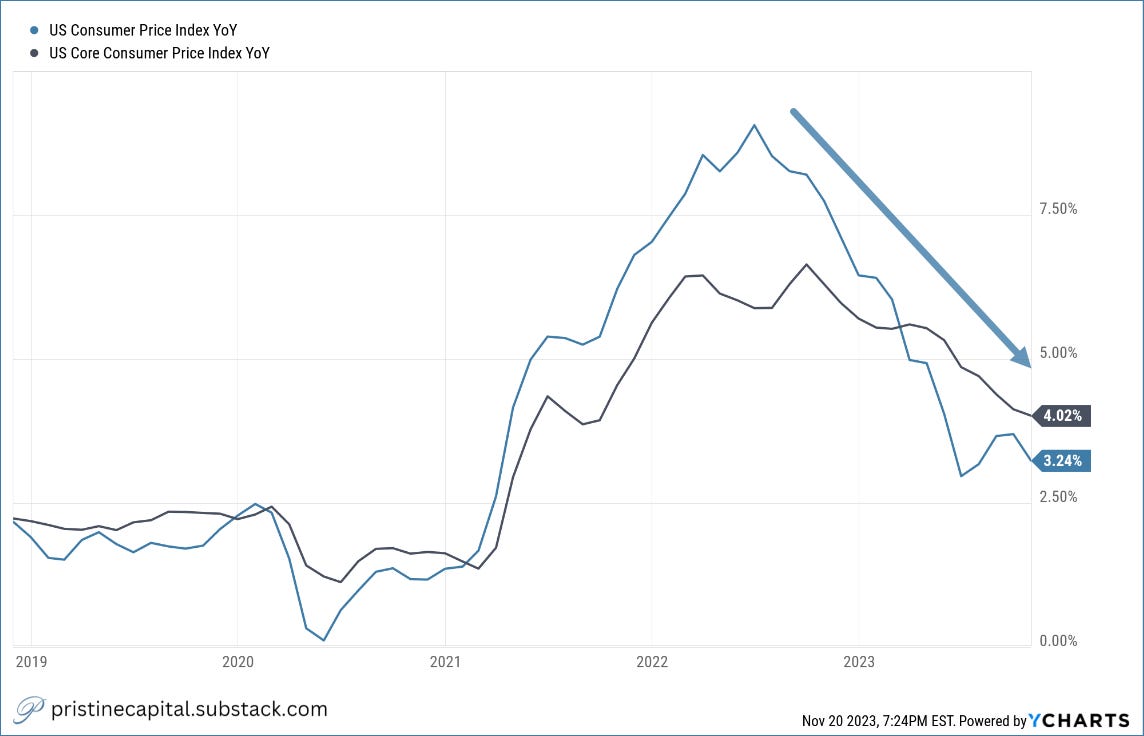

The improving trend in bonds is supported by the good ol’ fundamentals. Inflation as measured by the CPI is declining!

FX Market

The dollar index closed below the 200-day SMA. The weakening dollar trend loosens financial conditions, which is bullish for risk assets. ✅

Energy

Crude oil remains in the $70’s and in a downtrend. Does crude have to keep falling every single day to support risk assets? No. If crude oil prices start dipping into the $60’s and $50’s, that could imply that investors believe an economic Armageddon is coming . We just don’t want to see crude oil in a raging uptrend like it was in the summer and early fall 👇

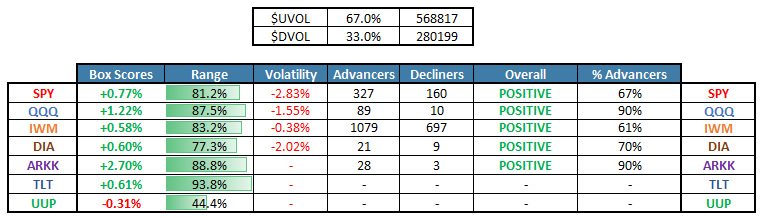

Equity Dashboard

The duration-sensitive ARKK and QQQ led in a strong tape 👇

Index Price Cycle Monitor

All green 👇

ES likely to take out the 4581.75 VPOC tomorrow ahead of NVDA earnings

YM likely to take out the 35331 VPOC tomorrow ahead of NVDA earnings

RTY appears to have the most upside, as it is only beginning to emerge from value

NQ trading out on Pluto ahead of NVDA earnings 😂

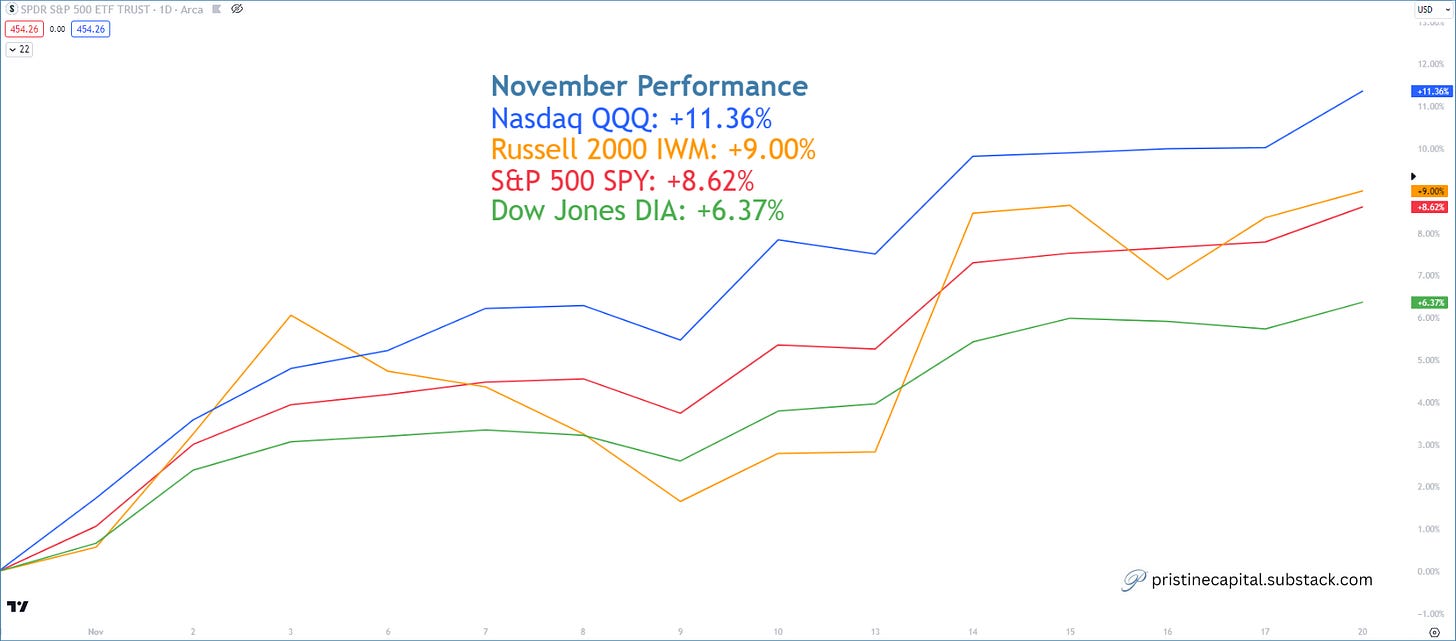

Index Performance Monthly

The price action the past few days has been choppy, but when in doubt, ZOOM OUT!

The indices have all put in a full year’s worth of returns in about two weeks 👇

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities