Pristine Market Analysis & Watchlist - 1/11

CPI Incoming!

Good evening everyone,

CPI is upon us. Let’s dive in and get prepared👊

-Andrew

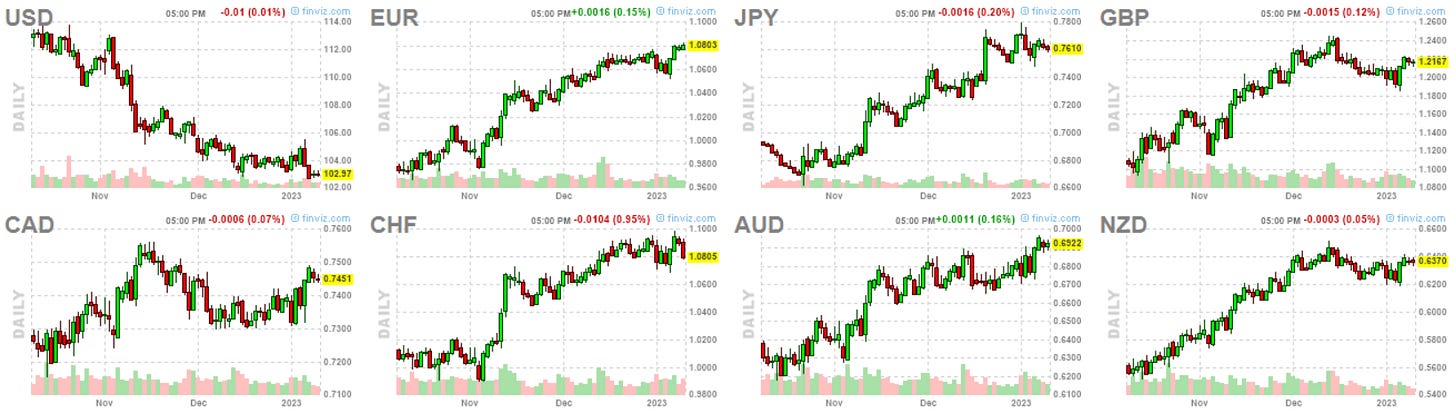

FX Market

The USD dollar index finished the session flat -.03%:

Tomorrow’s CPI print could influence market participant’s outlook for future fed rate hikes, which can in turn, lead to volatility in the FX market.

Expectations for a more hawkish fed (hot CPI) will likely result in dollar strength and vice versa for incrementally dovish expectations (Light CPI)

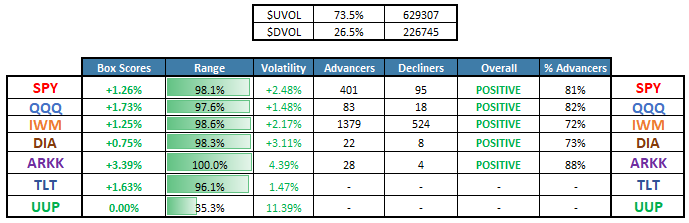

Equity Dashboard

73.5% UVOL - Strong breadth into CPI, but volatility did not confirm the strength 🚩

Finviz Heatmap

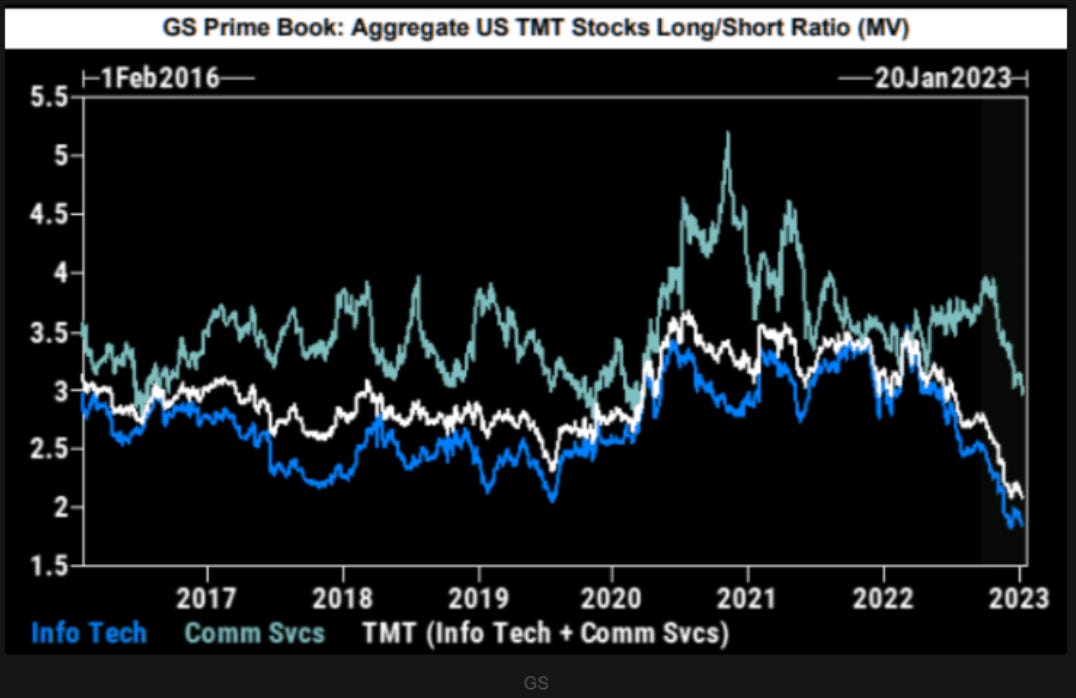

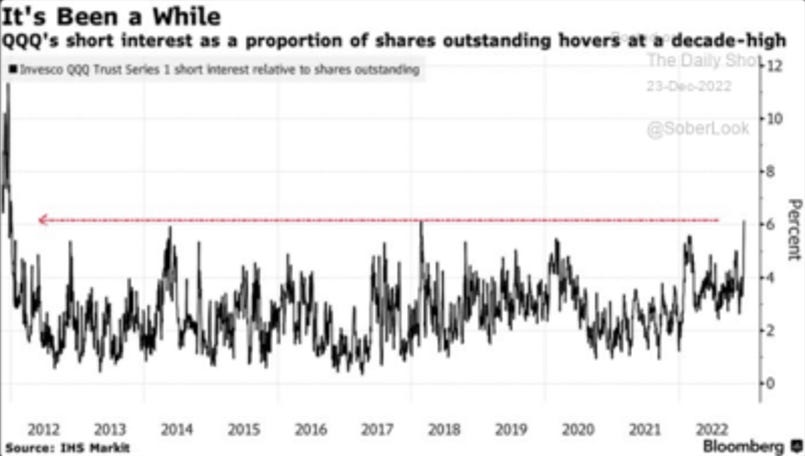

Megacap Tech led the upside today. This should come as no surprise to any of our regular readers, as we’ve discussed the record short interest in the Nasdaq QQQ, and light positioning in TMT stocks via GS’ prime brokerage desk ad nauseum:

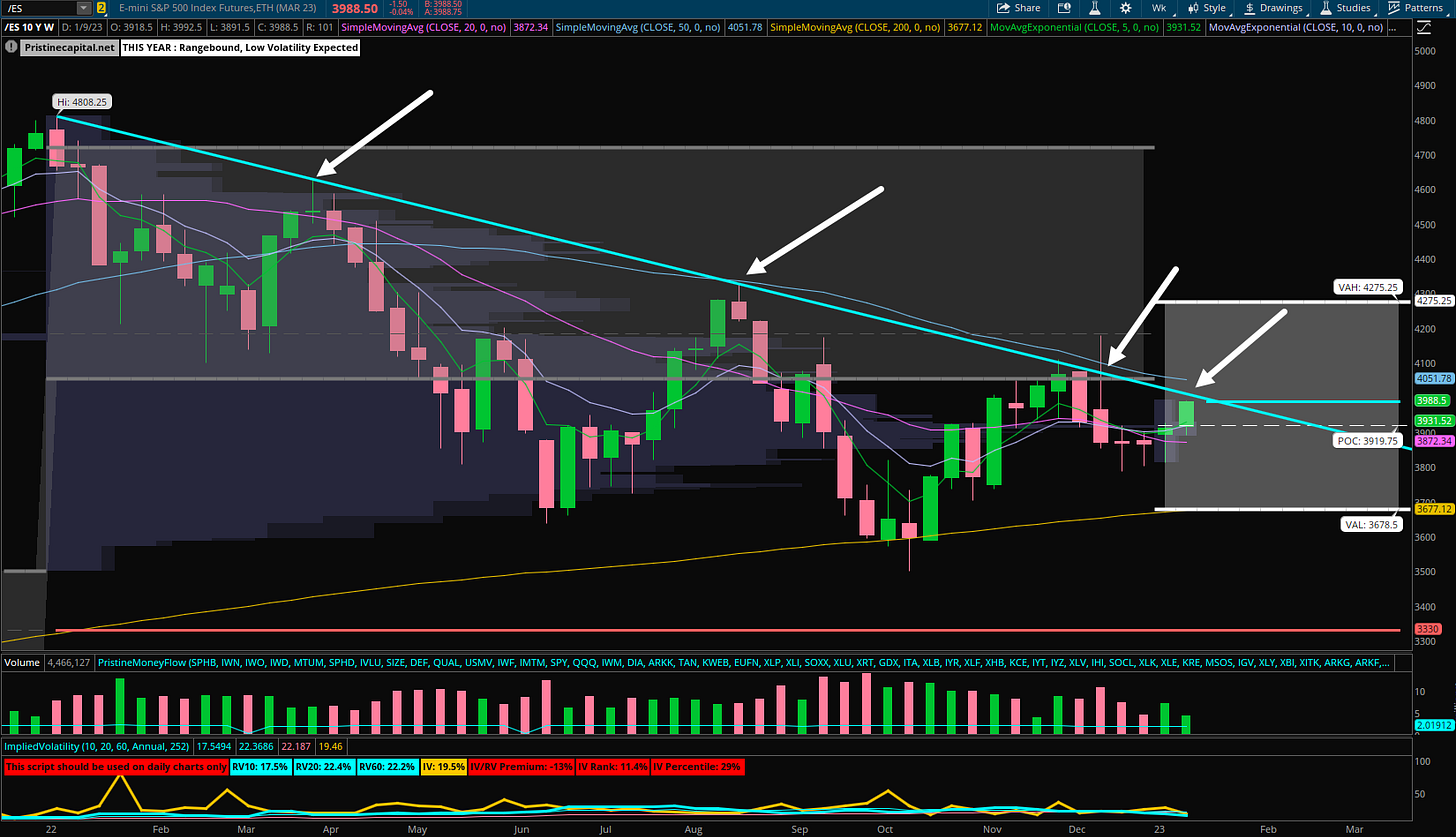

S&P 500 ES_F Price Analysis

The S&P 500 finished the session +1.26%, and within striking distance of the teal downward trendline! The last three attempts to clear it were met with selling. Could this time be different?

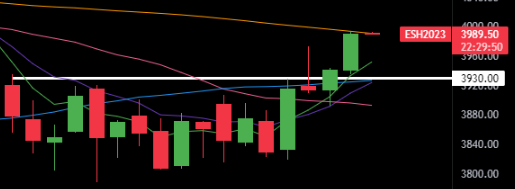

S&P 500 ES_F Broke Out of Balance!

The S&P 500 had a powerful breakout from the balance area and tagged the 200-day SMA:

Net New Highs/Lows

100 stocks made new highs today while 11 made new lows, resulting in net new highs of 89 stocks:

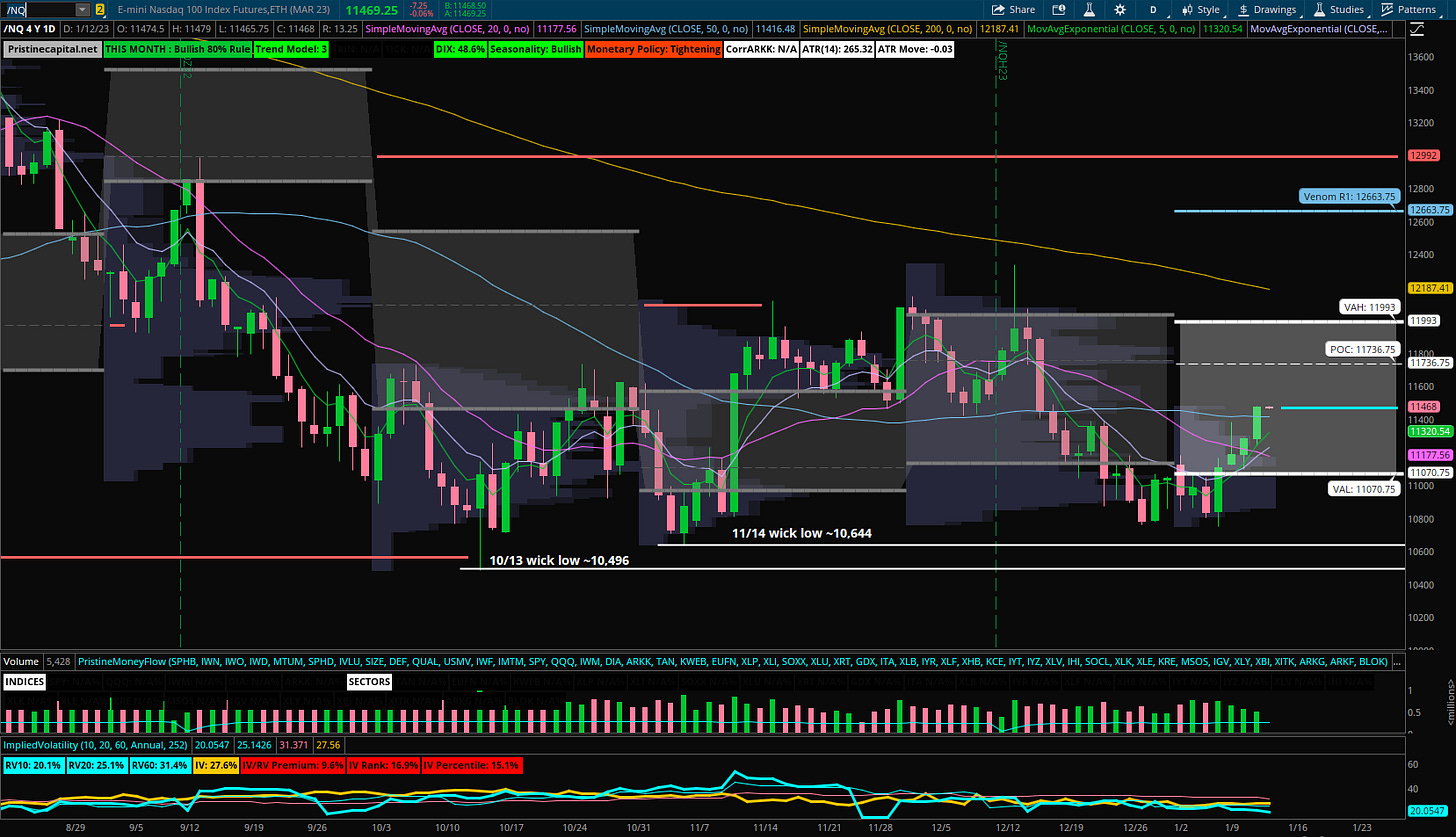

Nasdaq NQ_F Price Action Analysis

The Nasdaq finished today’s session +1.73% and above the 50-day SMA! One of our key themes heading into the new year was a catch-up trade in megacap tech, and the theme is finally getting legs. The next upside target to look for on continuation of this rally is the monthly POC of ~11,736.75:

We’ve cited the following in each nightly newsletter for the last two weeks. Tonight will be the last night we feature this data, as the technology catch-up trade is already in full swing:

Technology Hated

Coming into today’s session, we knew investors were underexposed to TMT (technology) stocks via Goldman Sachs’ prime brokerage data and the decade-high short interest in the Nasdaq QQQ ETF:

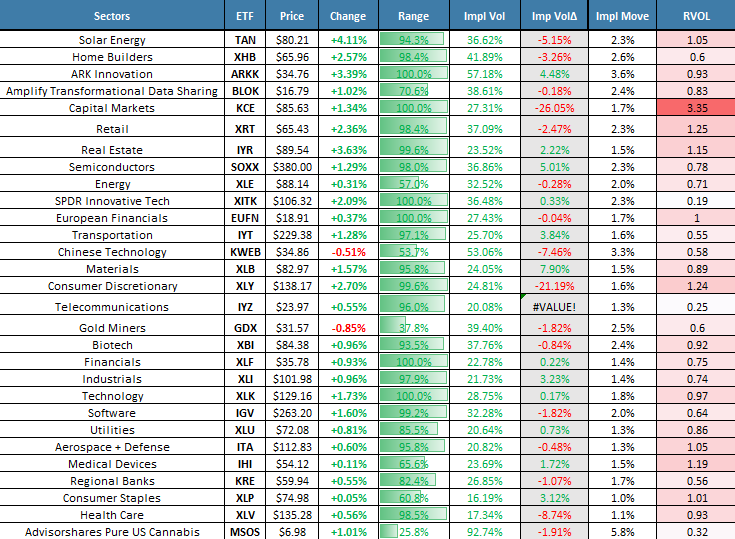

Sectors - Ranked by Momentum

Quite a changing of the guard on our momentum list! The Solar energy TAN ETF is now in our top slot, followed by the Homebuilders XHB and the ARKK innovation ETF. Investors are rotating out more defensive areas of the market like XLP Consumer Staples and XLV Healthcare and going risk-on into CPI:

CPI Incoming

The US CPI data will be released tomorrow 1/12 at 8:30 AM ET:

I recorded a CPI preview video earlier today with everything you need to know ahead of this key piece of economic data. Check it out here 👇

Key Takeaways

The market ripped higher into CPI!

The technology catch-up trade is well underway

Tomorrow’s CPI could change everything

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan post-CPI

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities