Pristine Market Analysis & Watchlist 6/12

VVIX Risk Model Issues Second Sell Signal of 2023

Team,

Wow! That was an…insane session. Investors must be feeling pretty good about CPI, PPI, Fed Wednesday, and quad witching. Or perhaps it is just FOMO into binary risk events! Let’s dive into the action.

-Andrew

Equity Dashboard

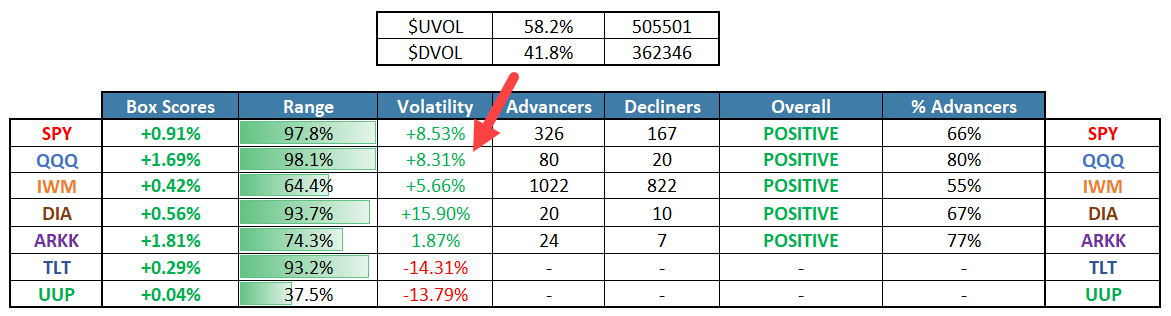

Ahead of binary events like inflation prints and FOMC meetings, the markets are typically choppy and rangebound, but the animal spirits came alive last week, and they continued to rage on throughout today’s session. Technology QQQ ARKK led today’s action, and volatility rose alongside equities. Surprisingly, only 58.2% of stocks participated in today’s rally.

TSLA put in its 12th consecutive green session…the best win streak ever recorded for the stock.

Long Nasdaq is now the consensus trade.

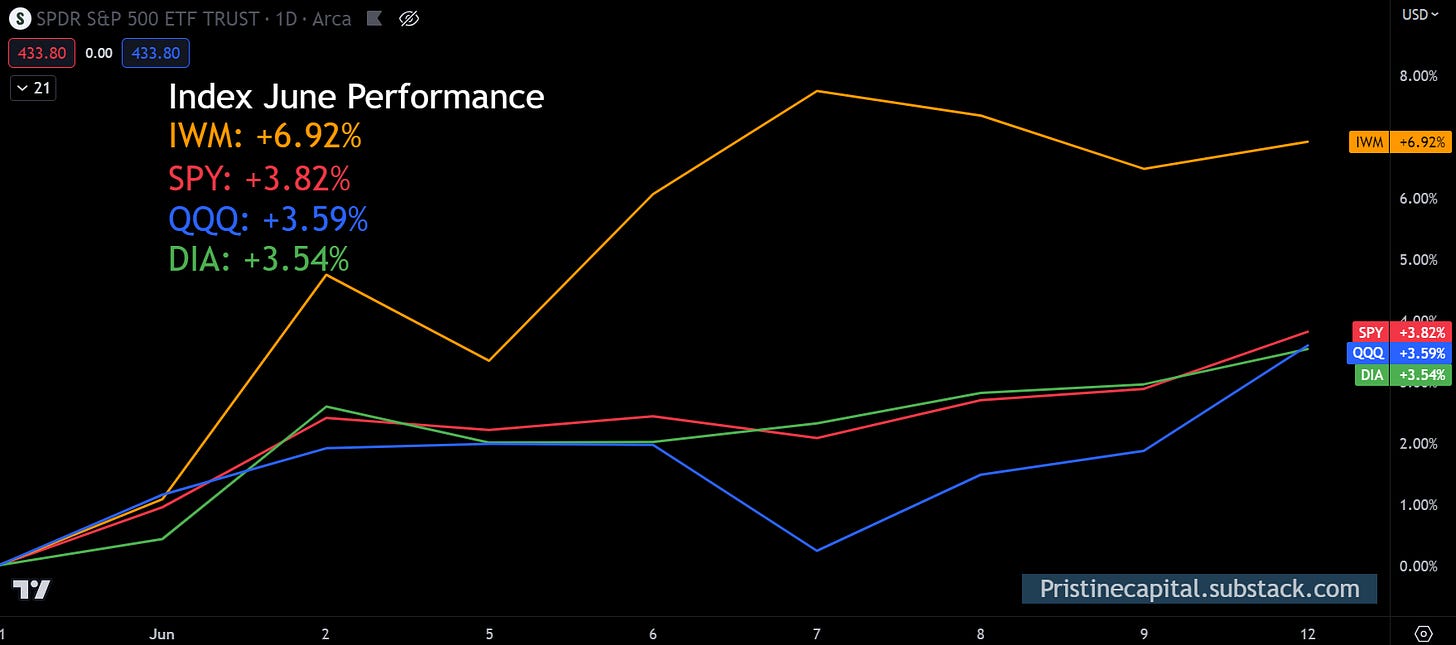

We are not even two weeks into June, and some of the indices have already put in an entire quarter’s worth of performance.

As of Friday, market makers were pricing in the following expected moves for the index ETFs heading into the Friday 6/16 options expiration. QQQ has already put in over 2/3 of its expected weekly move to the upside, and we haven’t even gotten to any of our binary events for the week yet!

So where is the risk/reward headed into CPI?

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities