Pristine Market Analysis & Watchlist 9/19

Fed Wednesday Aftermath

Team,

Fed Wednesday is in the books Team! Rather than dissect Powell’s words, let’s analyze the market reaction.

-Andrew

Fed Wednesday

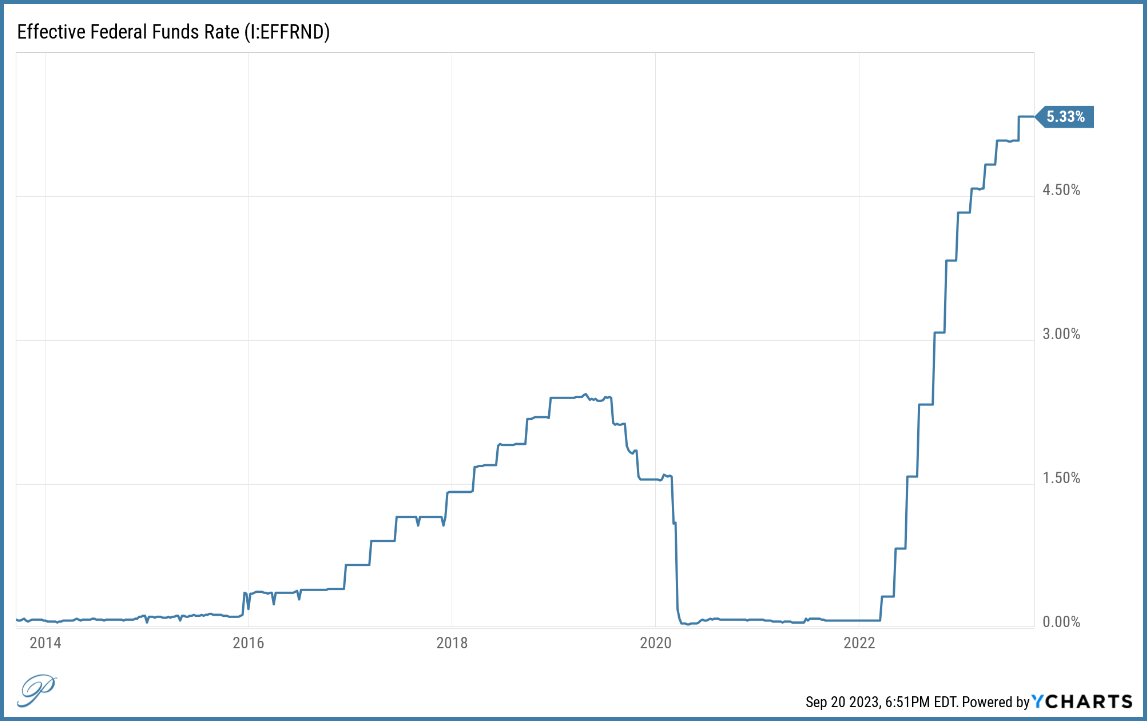

As was expected by market participants, the Fed paused at today’s meeting.

FOMC ANNOUNCEMENT -- FED LEAVES RATES UNCHANGED AS EXPECTED

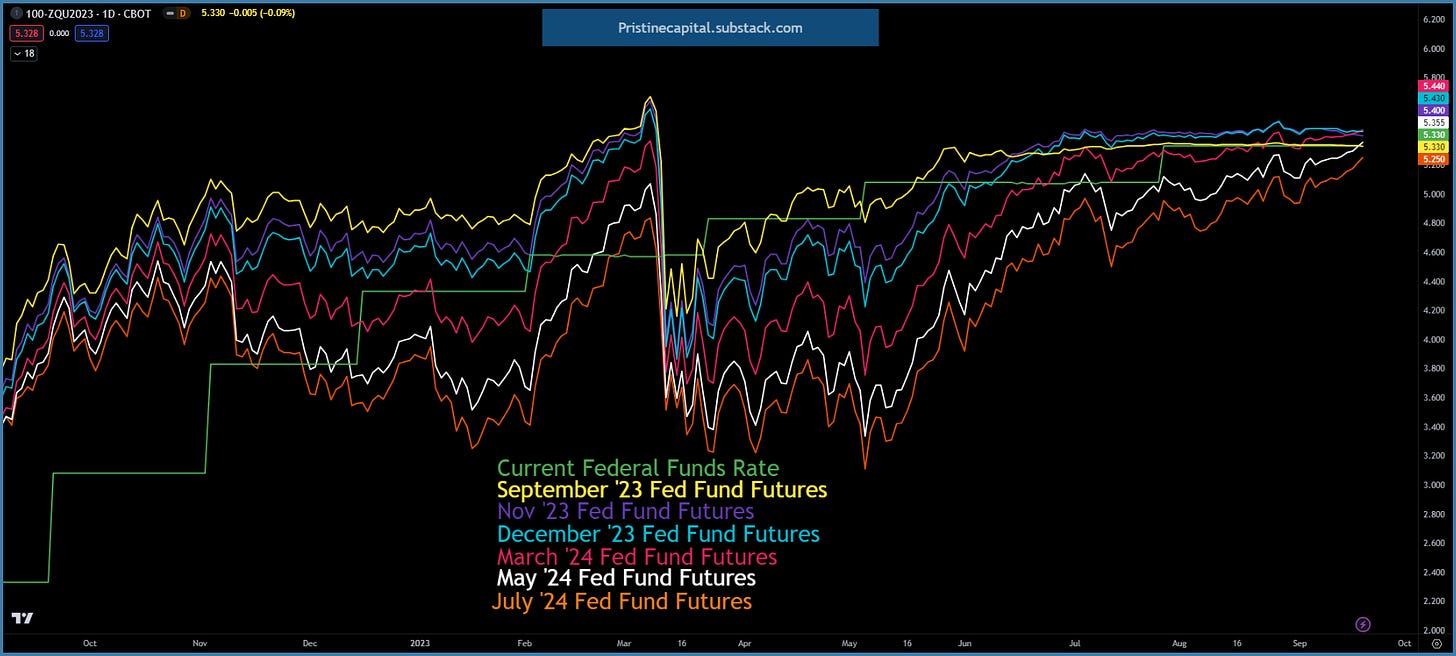

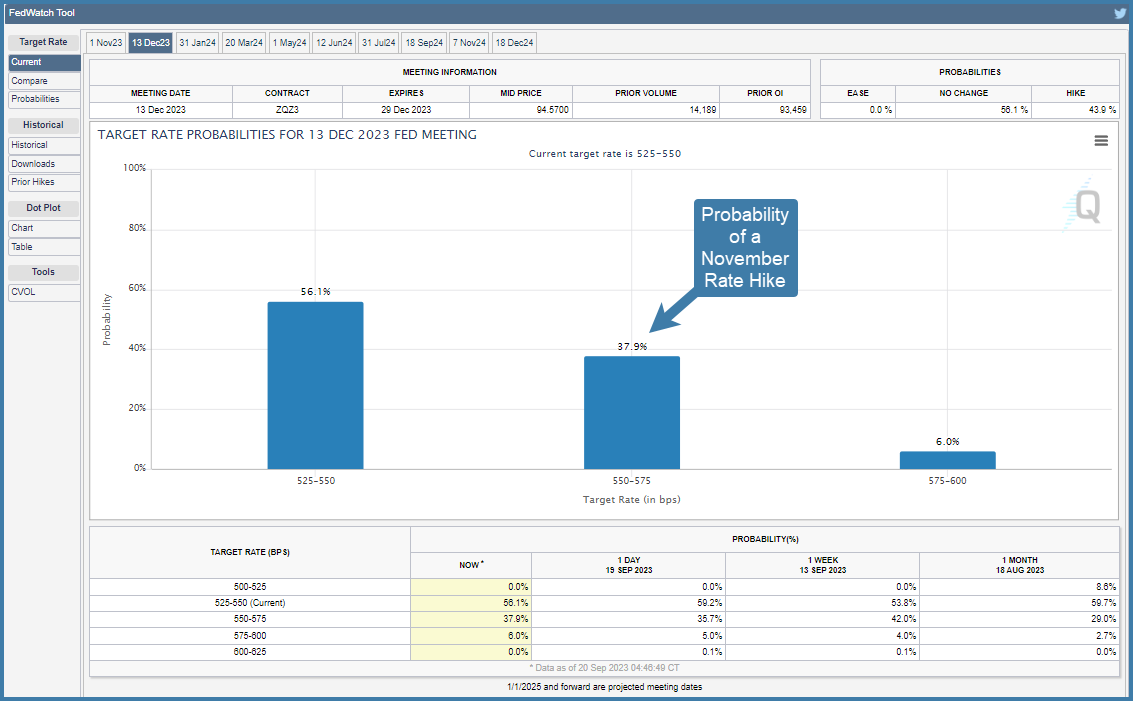

But the key for this meeting was in the expectations market participants had regarding future rate hikes and cuts. While the November Fed fund futures barely moved following Powell’s presser, the July Fed futures took a leg higher, signaling expectations for tighter fed policy for longer 👇

The probability of a November rate hike increased from 28.9% to 37.9%. The November fed meeting is LIVE.

FX Market

The dollar index put in a green candle and remains inside the white bullish trend channel. Remember, there is no raging bull market in risk assets when the dollar index is in such a strong uptrend!

Long-Term Treasuries

Long-term treasuries finished with green candles. My key takeaway here is that the short-term picture around interest rates is in flux, but the long-term picture is becoming more clear.

Equity Dashboard

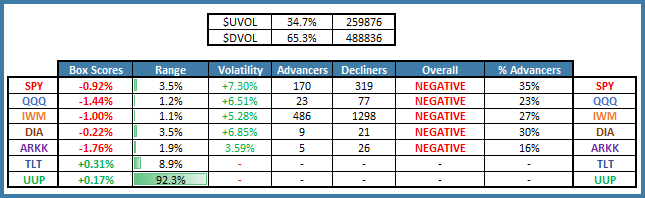

Equity indices declined, and the rate-sensitive QQQ and ARKK fell the most.

The Nasdaq QQQ outperformance vs IWM Small caps on the higher timeframes is still intact.

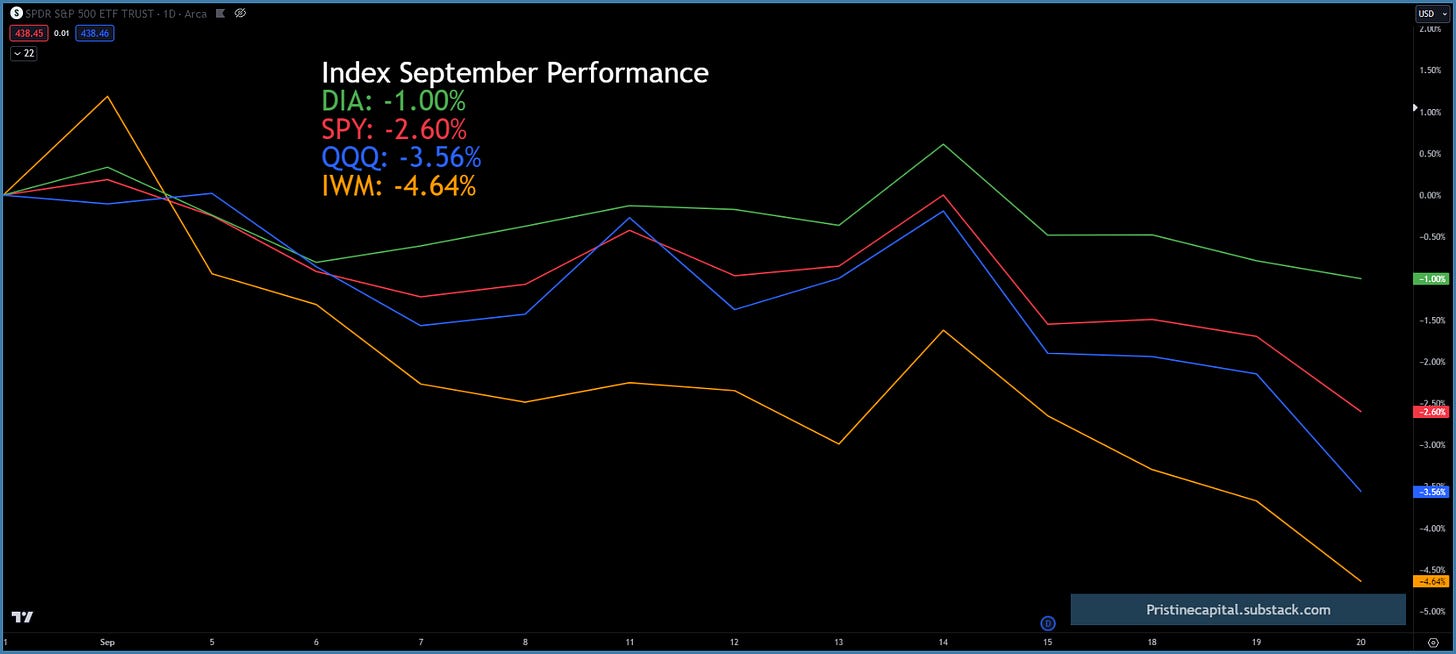

Equity Index MTD September Performance

The indices are in negative territory for the month of September.

Index Price Cycle Monitor

ES S&P 500 - Below 20 day SMA and below monthly point of control

NQ Nasdaq - Below 20 day SMA and below monthly point of control

RTY Russell 2000 - Below 200 day SMA and below monthly value area

YM Dow Jones - Below 20 day SMA and below monthly point of control

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities