Pristine Market Analysis & Watchlist 8/30

More Signs of a Recession...Let's Ride!

Team,

From both a macro (ADP employment report) and micro level (CHWY earnings report), it is becoming more obvious that the economy is headed into recession! But that does not have to be a bad thing for us traders and investors! Let’s discuss 😎

-Andrew

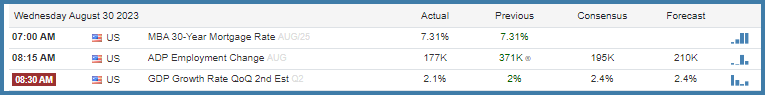

Overnight/Economic Data

Today’s session kicked off with weaker than expected ADP Employment data and Q2 GDP growth data!

As one might expect in reaction to weak data, long-term treasuries were bid, and the dollar index was sold. Remember just a week ago when investors were saying that bond yields were headed to the moon?

The slight softening in US economic data has been enough to produce a rather sharp pullback in the US dollar AKA…the dollar wrecking ball!

Equity Dashboard

So it should come as no surprise, that against a backdrop of much lighter positioning in equities, we are seeing a fantastic bounce, led by the duration sensitive ARKK and QQQ.

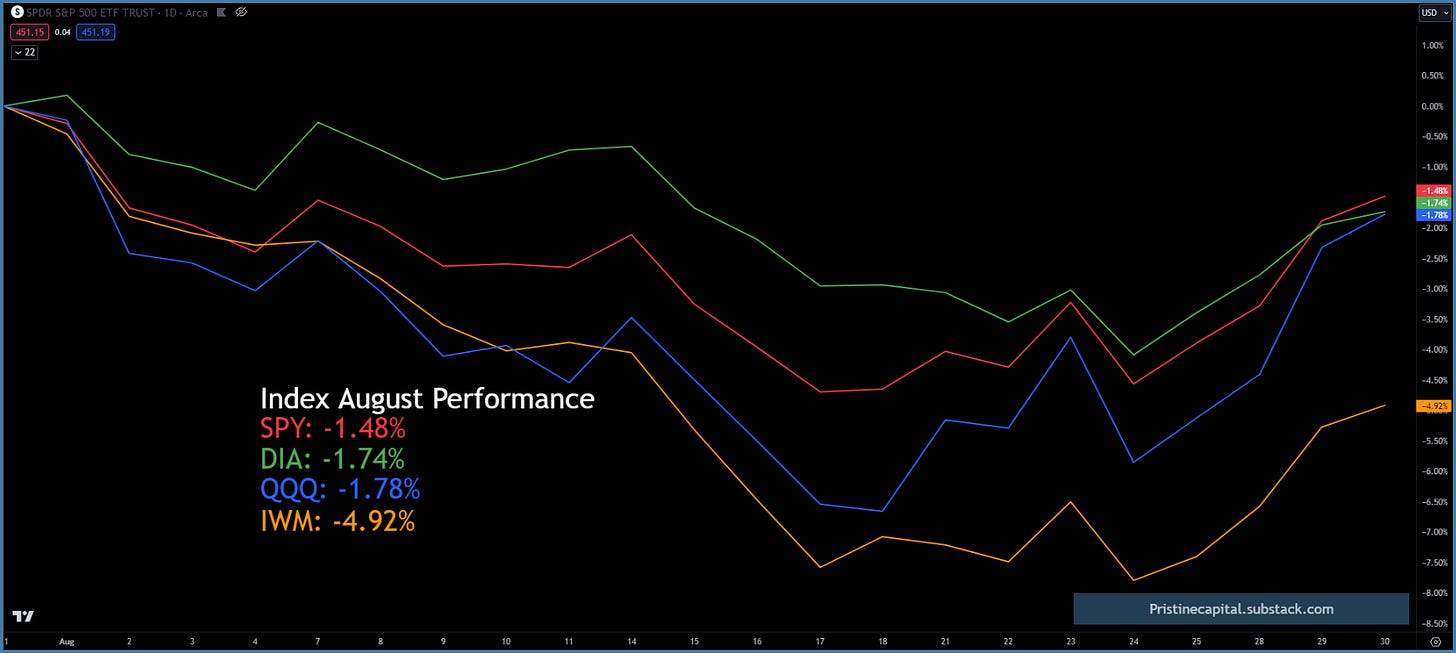

Equity Index MTD August Performance

In fact, the equity indices recouped the vast majority of their August losses over the past few sessions. Notice that the IWM small caps have not been nearly as resilient as the other indices? Another clue that the market is pricing in an economic slowdown.

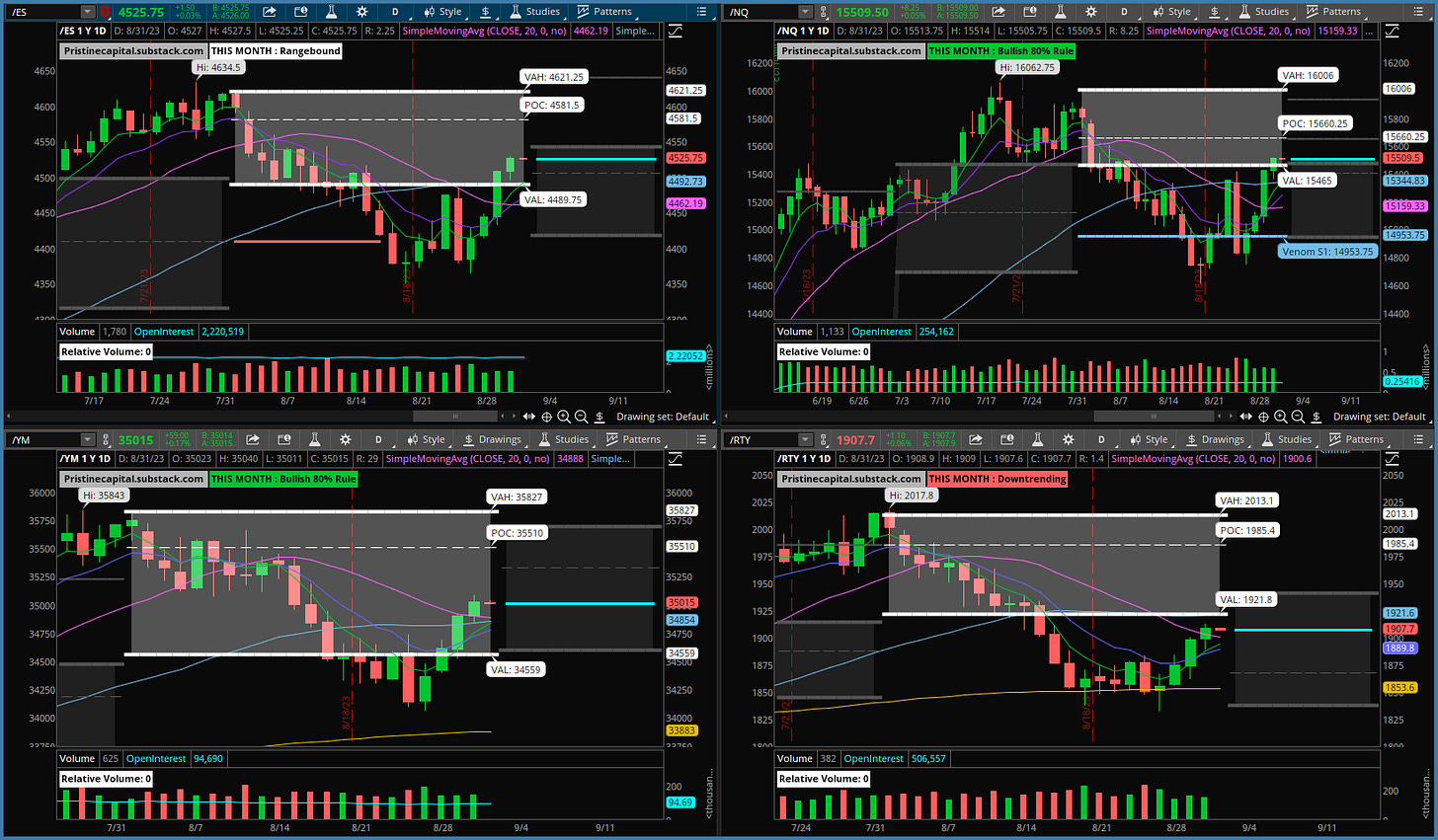

Index Price Cycle Monitor

ES S&P 500 - Above key moving averages & Inside Monthly Value Area

NQ Nasdaq - Above key moving averages & Inside Monthly Value Area

YM Dow Jones - Above key moving averages & Inside Monthly Value Area

RTY Russell 2000 - Above key moving averages & Inside Monthly Value Area

Now let’s discuss expectations for this market rally. Be sure to sign up for premium if you haven’t already 🔥

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities